Question

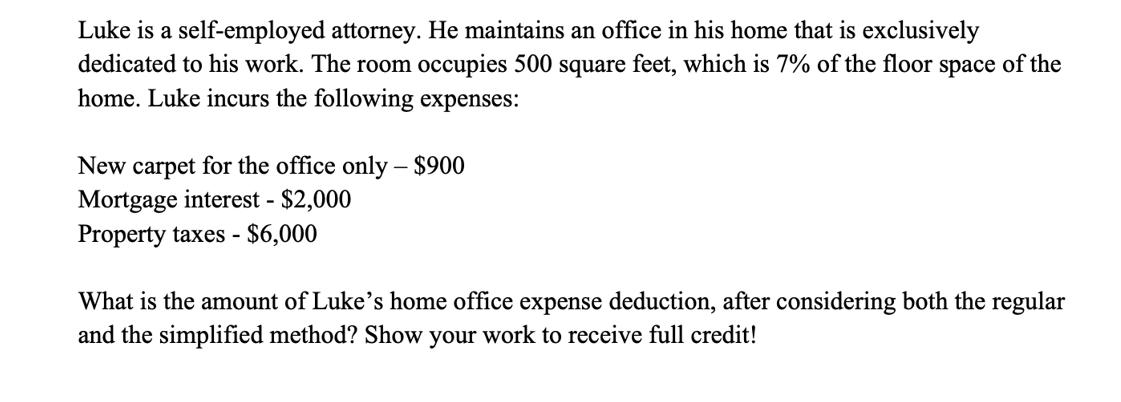

Luke is a self-employed attorney. He maintains an office in his home that is exclusively dedicated to his work. The room occupies 500 square

Luke is a self-employed attorney. He maintains an office in his home that is exclusively dedicated to his work. The room occupies 500 square feet, which is 7% of the floor space of the home. Luke incurs the following expenses: New carpet for the office only - $900 Mortgage interest - $2,000 Property taxes - $6,000 What is the amount of Luke's home office expense deduction, after considering both the regular and the simplified method? Show your work to receive full credit!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Lukes home office expense deduction we need to consider both the regular method and the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation For Decision Makers 2019

Authors: Shirley Dennis Escoffier, Karen A. Fortin

9th Edition

1119497280, 978-1-119-4972, 1119497221, 9781119497226, 978-1119497288

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App