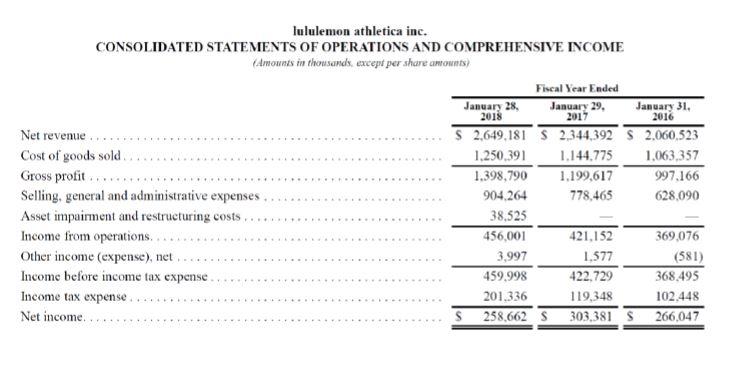

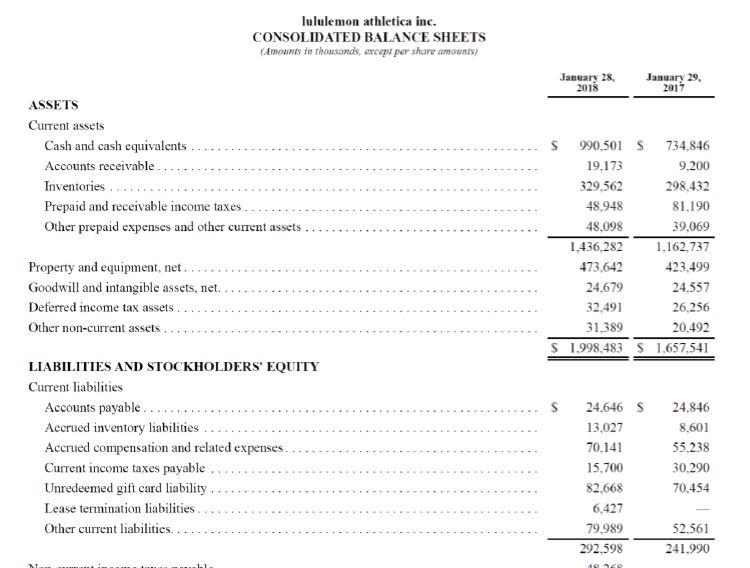

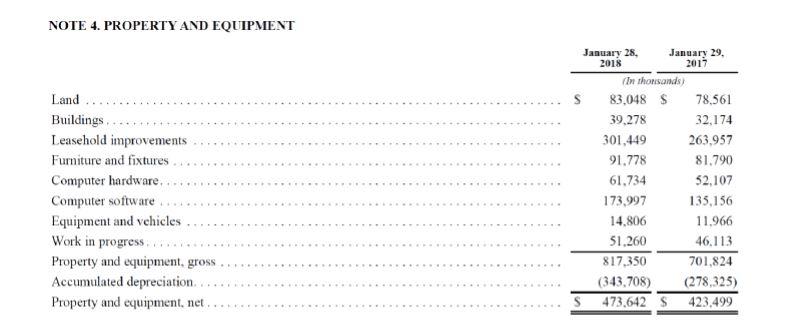

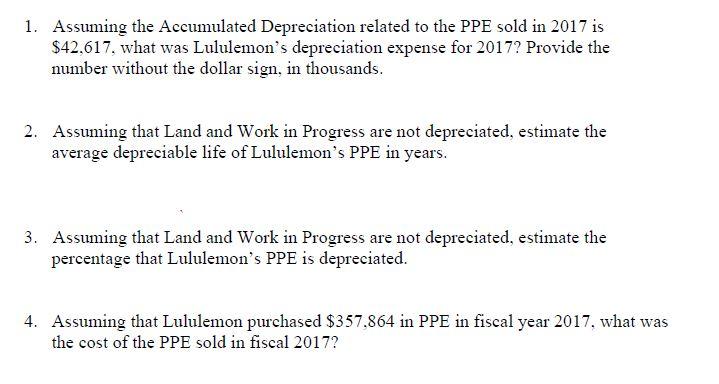

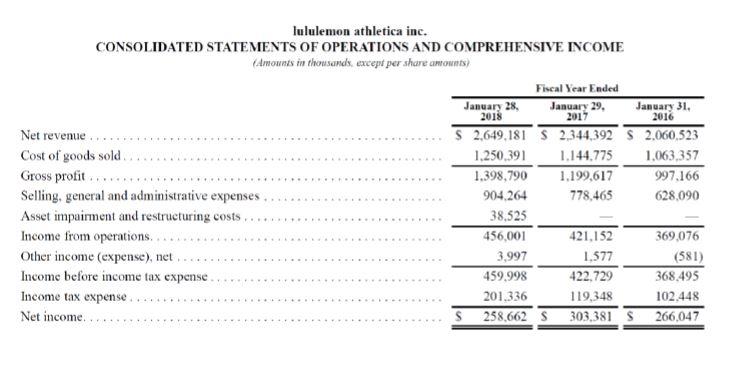

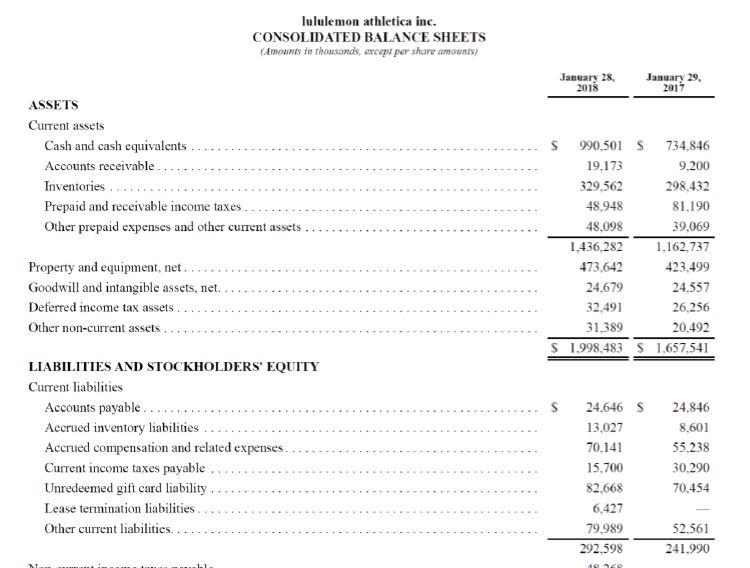

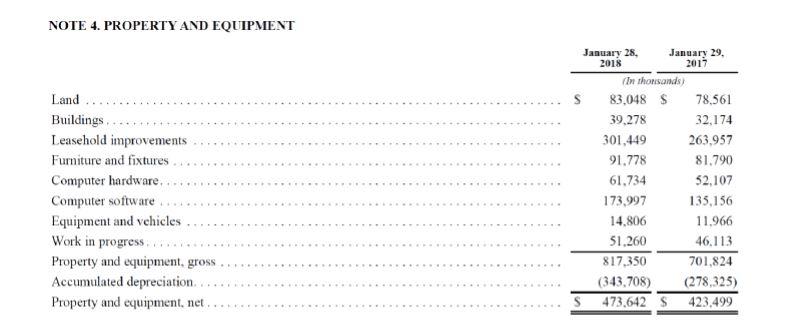

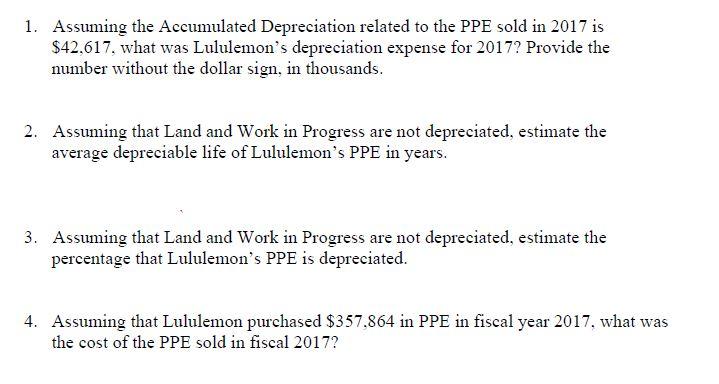

lululemon athletica inc. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Amounts in thousands, except per share camounts Fiscal Year Ended January 28, January 29, January 31, 2018 2017 2016 Net revenue $ 2,649.181 S 2,344,392 S 2.060,523 Cost of goods sold 1.250.391 1.144.775 1.063,357 Gross profit 1.398,790 1.199,617 997.166 Selling, general and administrative expenses 904.264 778,465 628,090 Asset impairment and restructuring costs..... 38,525 Income from operations. 456,001 421.152 369,076 Other income (expense), net 3,997 1,577 (581) Income before income tax expense 459.998 422,729 368.495 Income tax expense 201,336 119,348 102.448 Net income. S 258,662 s 303,381 S 266,047 lululemon athletica inc. CONSOLIDATED BALANCE SHEETS (Amounts in thousands, except per share amounts) January 29, January 28, 2018 2017 ASSETS Current assets Cash and cash equivalents Accounts receivable Inventories Prepaid and receivable income taxes. Other prepaid expenses and other current assets $ 990,501 S 734,846 19,173 9.200 329,562 298.432 48,948 81.190 48,098 39,069 1,436,282 1,162,737 473,642 423,499 24,679 24.557 32.491 26.256 31,389 20,492 S 1.998,483 S 1.657.541 Property and equipment, net. Goodwill and intangible assets, net. Deferred income tax assets Other non-current assets $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable.. Accrued inventory liabilities Accrued compensation and related expenses. Current income taxes payable Unredeemed gift card liability. Lease termination liabilities Other current liabilities.. 24,646 13.027 70.141 15,700 82.668 6,427 79.989 292,598 24.846 8,601 55.238 30.290 70,454 52.561 241.990 1969 NOTE 4. PROPERTY AND EQUIPMENT Land Buildings Leasehold improvements Furniture and fixtures Computer hardware Computer software Equipment and vehicles Work in progress Property and equipment, gross... Accumulated depreciation Property and equipment, net January 28, January 29, 2018 2017 In thonsands S 83,048 $ 78.561 39.278 32,174 301.449 263.957 91.778 81.790 61,734 52,107 173.997 135,156 14.806 11,966 51.260 46,113 817,350 701,824 (343.708) (278,325) 473.642 $ 423,499 1. Assuming the Accumulated Depreciation related to the PPE sold in 2017 is $42,617, what was Lululemon's depreciation expense for 2017? Provide the number without the dollar sign, in thousands. 2. Assuming that Land and Work in Progress are not depreciated, estimate the average depreciable life of Lululemon's PPE in years. 3. Assuming that Land and Work in Progress are not depreciated, estimate the percentage that Lululemon's PPE is depreciated. 4. Assuming that Lululemon purchased $357.864 in PPE in fiscal year 2017, what was the cost of the PPE sold in fiscal 2017