Answered step by step

Verified Expert Solution

Question

1 Approved Answer

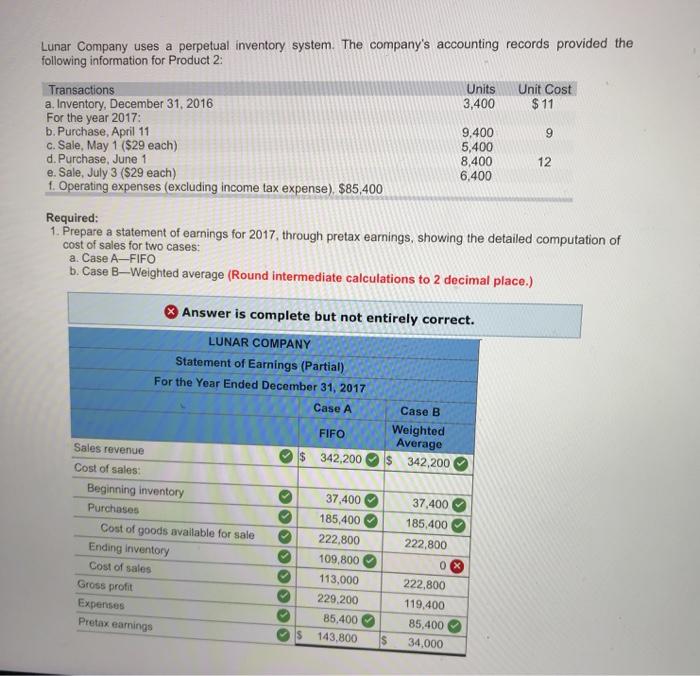

Lunar Company uses a perpetual inventory system. The company's accounting records provided the following information for Product 2: Transactions a. Inventory, December 31, 2016

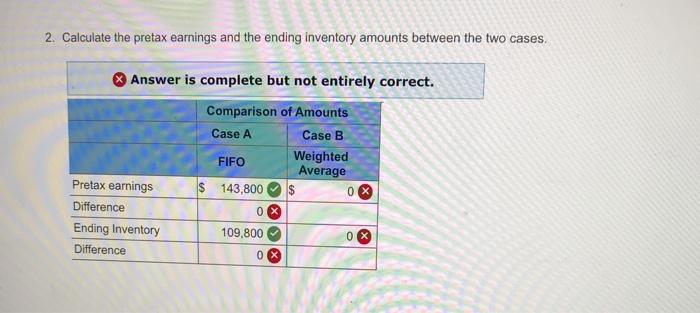

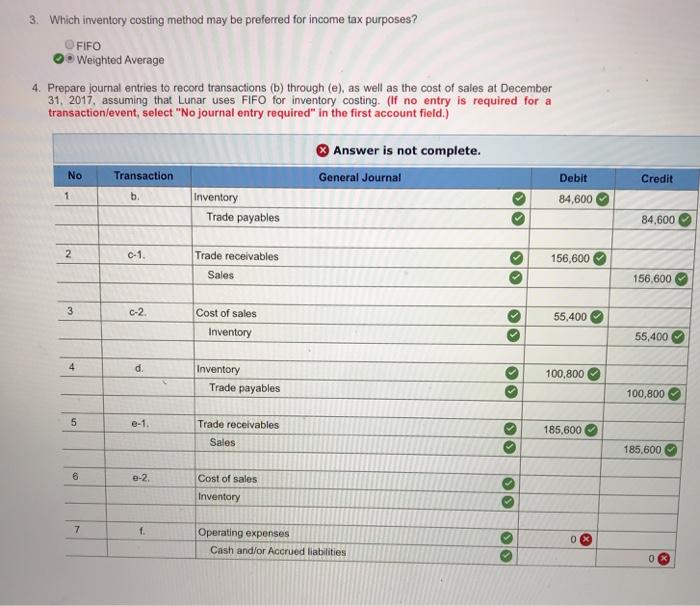

Lunar Company uses a perpetual inventory system. The company's accounting records provided the following information for Product 2: Transactions a. Inventory, December 31, 2016 For the year 2017: b. Purchase, April 11 c. Sale, May 1 ($29 each) d. Purchase, June 1 e. Sale, July 3 ($29 each) 1. Operating expenses (excluding income tax expense). $85,400 Sales revenue Cost of sales: a. Case A-FIFO b. Case B-Weighted average (Round intermediate calculations to 2 decimal place.) Beginning inventory Purchases Required: Prepare a statement of earnings for 2017, through pretax earnings, showing the detailed computation of cost of sales for two cases: Cost of goods available for sale Ending inventory Cost of sales Gross profit Expenses Pretax earnings Answer is complete but not entirely correct. LUNAR COMPANY Statement of Earnings (Partial) For the Year Ended December 31, 2017 Case A FIFO $ 342,200 37,400 185,400 222,800 109,800 113,000 229,200 85,400 $ 143,800 Case B Weighted Average $ 342,200 $ Units 3,400 9,400 5,400 8,400 6,400 37,400 185,400 222,800 0x 222,800 119,400 85,400 34,000 Unit Cost $11 9 12 2. Calculate the pretax earnings and the ending inventory amounts between the two cases. Answer is complete but not entirely correct. Comparison of Amounts Case A Case B Weighted Average Pretax earnings Difference Ending Inventory Difference FIFO $ 143,800 0 109,800 0 $ 0x 0x 3. Which inventory costing method may be preferred for income tax purposes? FIFO Weighted Average 4. Prepare journal entries to record transactions (b) through (e), as well as the cost of sales at December 31, 2017, assuming that Lunar uses FIFO for inventory costing. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No 1 2 3 4 5 6 7 Transaction b. C-1. c-2. d. e-1. e-2. f. Inventory Trade payables Trade receivables Sales Cost of sales Inventory Inventory Trade payables Trade receivables Sales Cost of sales Inventory Answer is not complete. General Journal Operating expenses Cash and/or Accrued liabilities 33 Debit 84,600 156,600 55,400 100,800 185,600 0 Credit 84,600 156,600 55,400 100,800 185,600 0x

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Question Computation of Ending Inventory under Weighted Average 1 COGS on May 1 Cost per unit 340011 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started