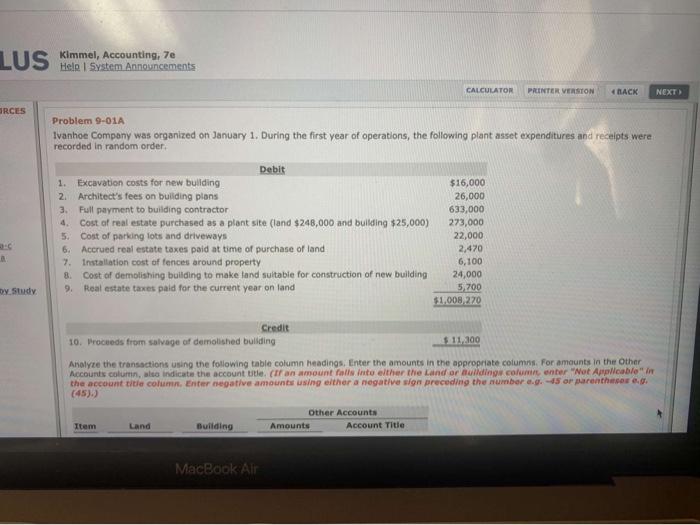

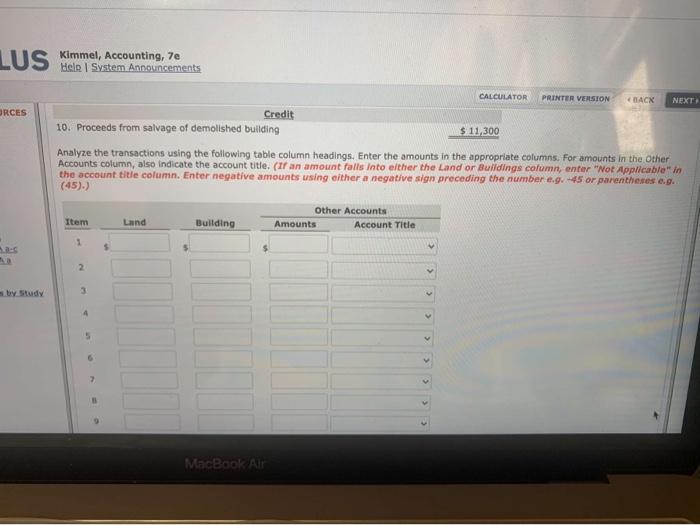

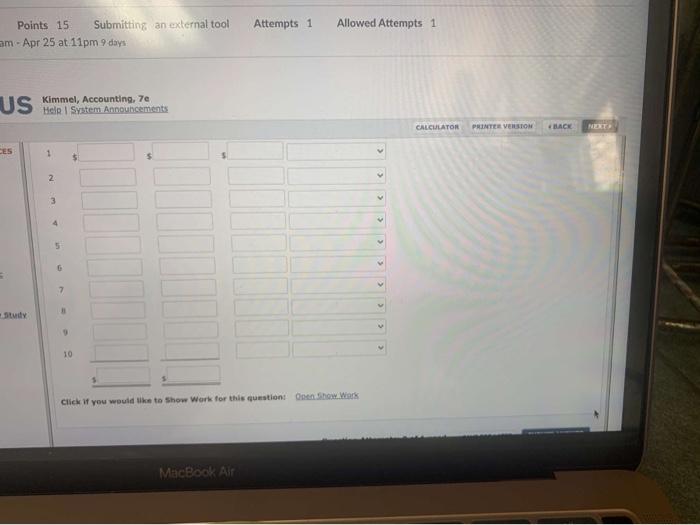

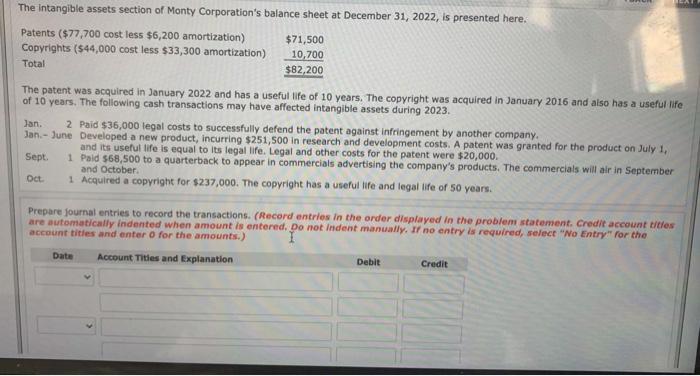

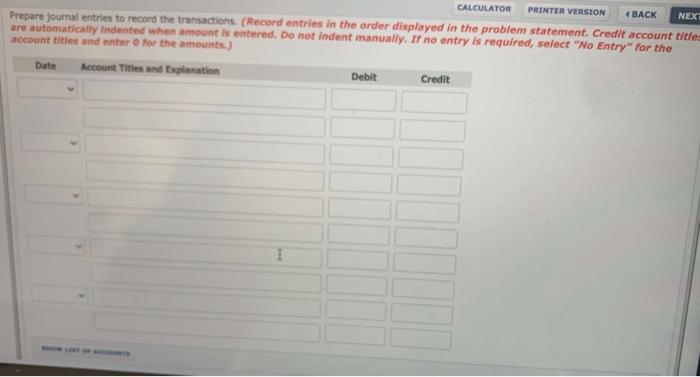

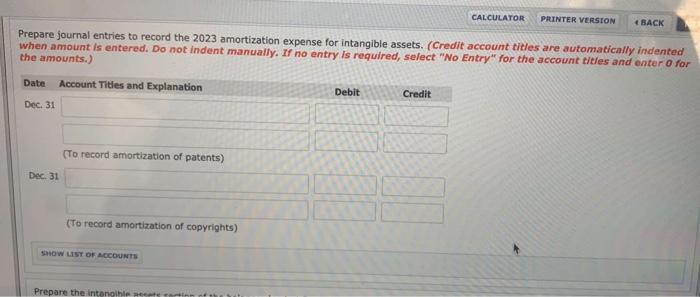

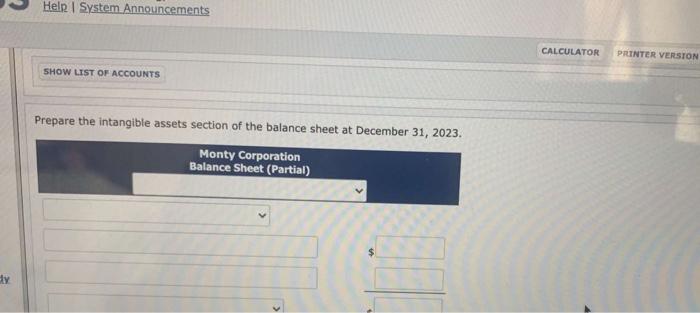

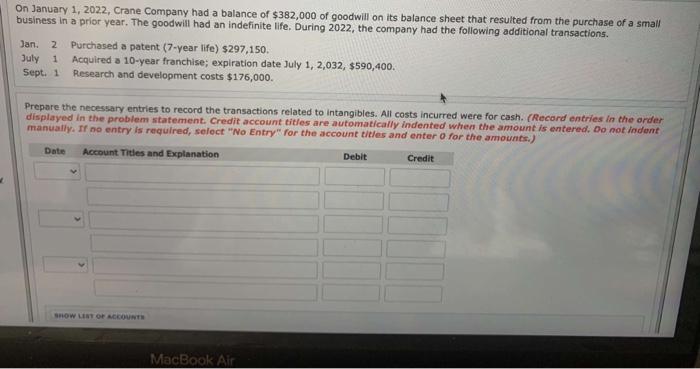

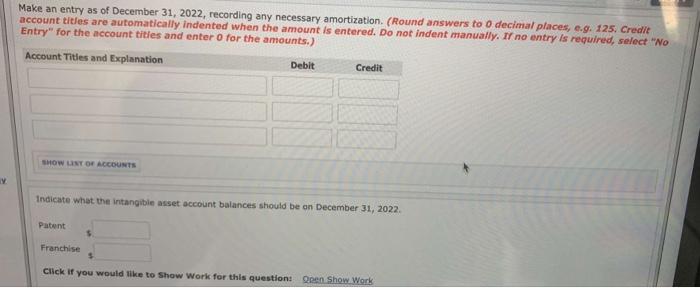

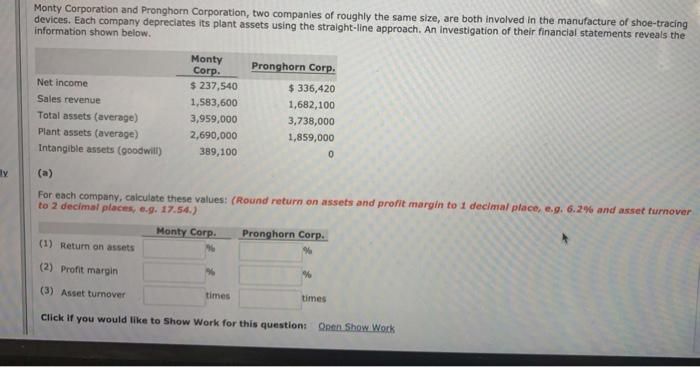

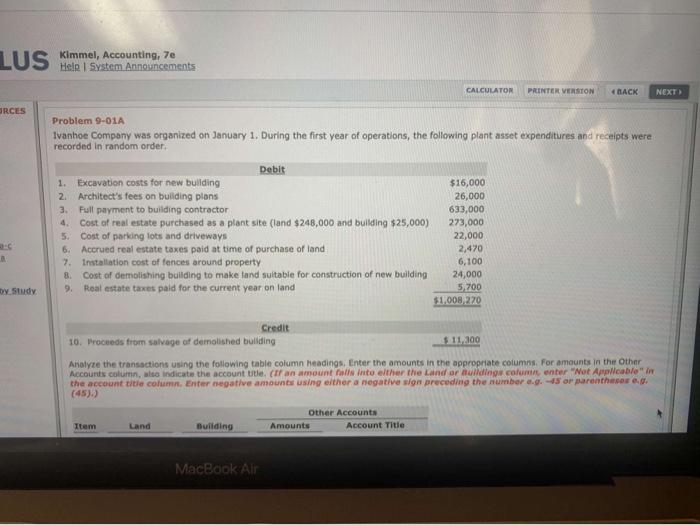

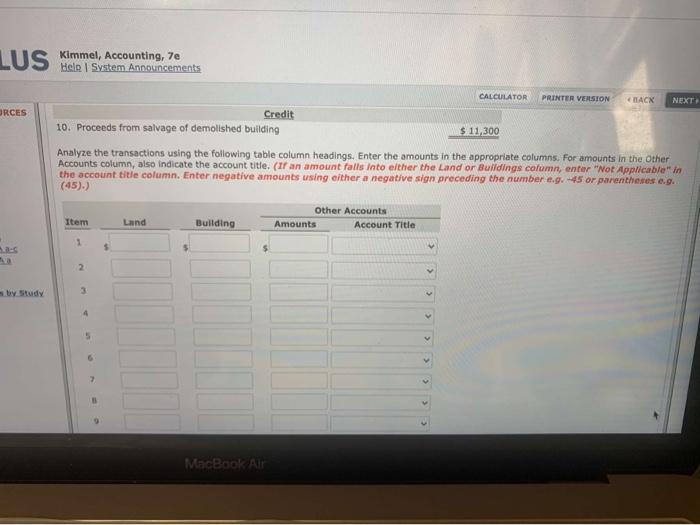

LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSTON 4 NEXT SRCES Problem 9-01A Ivanhoe Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. 1. Debit Excavation costs for new building $16,000 2. Architect's fees on building plans 26,000 3. Full payment to building contractor 633,000 4. Cost of real estate purchased as a plant site (land $248,000 and building $25,000) 273,000 5. Cost of parking lots and driveways 22,000 6. Accrued real estate taxes paid at time of purchase of land 2,470 7. Installation cost of fences around property 6,100 8 Cost of demolishing building to make land suitable for construction of new building 24,000 9. Real estate taxes paid for the current year on land 5700 $1.008.220 by Study Credit 10. Proceeds from salvage of demolished bulliding $11.300 Analyze the transactions using the following table column Headings, Enter the amounts in the appropriate columns For amounts in the Other Accounts column, als indicate the account title. (If an amount falls into either the Land or Building columinenter "Not Applicable the account title column. Enter negative amounts using either a negative sign preceding the number w.g.-15 or parenthesse.. (45).) Other Accounts Item Land Building Amounts Account Title MacBook Air LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSION HACK NEXT ORCES Credit 10. Proceeds from salvage of demolished building $ 11,300 Analyze the transactions using the following table column headings. Enter the amounts in the appropriate columns. For amounts in the Other Accounts column, also indicate the account title. (If an amount falls into alter the Land or Buildings column, enter "Not Applicable" in the account title column. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.. (45).) Other Accounts Item Land Building Amounts Account Title 1 2 by Study 3 4 v MacBook Air Attempts 1 Allowed Attempts 1 Points 15 Submitting an external tool am - Apr 25 at 11pm 9 days US Kimmel, Accounting, 70 Help System Announcements CALCULATOR PRINTEE VERSTOM BLACK NET CES 1 2 3 5 6 7 Study 10 Click if you would like to show Work for this questions on Show Work MacBook Air The intangible assets section of Monty Corporation's balance sheet at December 31, 2022, is presented here. Patents ($77,700 cost less $6,200 amortization) $71,500 Copyrights ($44,000 cost less $33,300 amortization) 10.700 Total $82,200 The patent was acquired in January 2022 and has a useful life of 10 years. The copyright was acquired in January 2016 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Jan. 2 Paid $36,000 legal costs to successfully defend the patent against Infringement by another company. Jan. - June Developed a new product, incurring $251,500 in research and development costs. A patent was granted for the product on July 1, and its useful life is equal to its legal life. Legal and other costs for the patent were $20,000. Sept 1 Paid $68,500 to a quarterback to appear in commercials advertising the company's products. The commercials will air in September and October Oct. 1 Acquired a copyright for $237,000. The copyright has a useful life and legal life of 50 years. Prepare journal entries to record the transactions. (Record entries in the order displayed in the problem statement Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) I Date Account Tities and Explanation Debit Credit BACK CALCULATOR PRINTER VERSION NEXT Prepare journal entries to record the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter for the amounts.) Date Account Tities and Explanation Debit Credit 1 CALCULATOR PRINTER VERSION 4 BACK Prepare journal entries to record the 2023 amortization expense for intangible assets. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Dec. 31 Date (To record amortization of patents) Dec 31 (To record amortization of copyrights) SHOW LIST OF ACCOUNTS Prepare the intangible in the Help System Announcements CALCULATOR PRINTER VERSION SHOW LIST OF ACCOUNTS Prepare the intangible assets section of the balance sheet at December 31, 2023. Monty Corporation Balance Sheet (Partial) Hly On January 1, 2022, Crane Company had a balance of $382,000 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $297,150. July 1 Acquired a 10-year franchise; expiration date July 1, 2,032, $590,400. Sept. 1 Research and development costs $175,000. Prepare the necessary entries to record the transactions related to intangibles. All costs incurred were for cash. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Snow LIST OF ACCOUNT MacBook Air Make an entry as of December 31, 2022, recording any necessary amortization (Round answers to o decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LNT OF ACCOUNTS Indicate what the intangible asset account balances should be on December 31, 2022 Patent Franchise Click if you would like to show Work for this questionDen Show Work Monty Corporation and Pronghorn Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. Net income Sales revenue Total assets (average) Plant assets (average) Intangible assets (goodwill) Monty Corp. $ 237,540 1,583,600 3,959,000 2,690,000 389,100 Pronghorn Corp. $336,420 1,682,100 3,738,000 1,859,000 0 ly (a) For each company, calculate these values: (Round return on assets and profit margin to I decimal place, c.9. 6.2% and asset turnover to 2 decimal places, e.g. 17.54.) Monty Corp. Pronghorn Corp. (1) Return on assets (2) Profit margin 96 % (3) Asset turnover times times Click if you would like to Show Work for this question: Open Show Work LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSTON 4 NEXT SRCES Problem 9-01A Ivanhoe Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. 1. Debit Excavation costs for new building $16,000 2. Architect's fees on building plans 26,000 3. Full payment to building contractor 633,000 4. Cost of real estate purchased as a plant site (land $248,000 and building $25,000) 273,000 5. Cost of parking lots and driveways 22,000 6. Accrued real estate taxes paid at time of purchase of land 2,470 7. Installation cost of fences around property 6,100 8 Cost of demolishing building to make land suitable for construction of new building 24,000 9. Real estate taxes paid for the current year on land 5700 $1.008.220 by Study Credit 10. Proceeds from salvage of demolished bulliding $11.300 Analyze the transactions using the following table column Headings, Enter the amounts in the appropriate columns For amounts in the Other Accounts column, als indicate the account title. (If an amount falls into either the Land or Building columinenter "Not Applicable the account title column. Enter negative amounts using either a negative sign preceding the number w.g.-15 or parenthesse.. (45).) Other Accounts Item Land Building Amounts Account Title MacBook Air LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSION HACK NEXT ORCES Credit 10. Proceeds from salvage of demolished building $ 11,300 Analyze the transactions using the following table column headings. Enter the amounts in the appropriate columns. For amounts in the Other Accounts column, also indicate the account title. (If an amount falls into alter the Land or Buildings column, enter "Not Applicable" in the account title column. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.. (45).) Other Accounts Item Land Building Amounts Account Title 1 2 by Study 3 4 v MacBook Air Attempts 1 Allowed Attempts 1 Points 15 Submitting an external tool am - Apr 25 at 11pm 9 days US Kimmel, Accounting, 70 Help System Announcements CALCULATOR PRINTEE VERSTOM BLACK NET CES 1 2 3 5 6 7 Study 10 Click if you would like to show Work for this questions on Show Work MacBook Air LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSTON 4 NEXT SRCES Problem 9-01A Ivanhoe Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. 1. Debit Excavation costs for new building $16,000 2. Architect's fees on building plans 26,000 3. Full payment to building contractor 633,000 4. Cost of real estate purchased as a plant site (land $248,000 and building $25,000) 273,000 5. Cost of parking lots and driveways 22,000 6. Accrued real estate taxes paid at time of purchase of land 2,470 7. Installation cost of fences around property 6,100 8 Cost of demolishing building to make land suitable for construction of new building 24,000 9. Real estate taxes paid for the current year on land 5700 $1.008.220 by Study Credit 10. Proceeds from salvage of demolished bulliding $11.300 Analyze the transactions using the following table column Headings, Enter the amounts in the appropriate columns For amounts in the Other Accounts column, als indicate the account title. (If an amount falls into either the Land or Building columinenter "Not Applicable the account title column. Enter negative amounts using either a negative sign preceding the number w.g.-15 or parenthesse.. (45).) Other Accounts Item Land Building Amounts Account Title MacBook Air LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSION HACK NEXT ORCES Credit 10. Proceeds from salvage of demolished building $ 11,300 Analyze the transactions using the following table column headings. Enter the amounts in the appropriate columns. For amounts in the Other Accounts column, also indicate the account title. (If an amount falls into alter the Land or Buildings column, enter "Not Applicable" in the account title column. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.. (45).) Other Accounts Item Land Building Amounts Account Title 1 2 by Study 3 4 v MacBook Air Attempts 1 Allowed Attempts 1 Points 15 Submitting an external tool am - Apr 25 at 11pm 9 days US Kimmel, Accounting, 70 Help System Announcements CALCULATOR PRINTEE VERSTOM BLACK NET CES 1 2 3 5 6 7 Study 10 Click if you would like to show Work for this questions on Show Work MacBook Air The intangible assets section of Monty Corporation's balance sheet at December 31, 2022, is presented here. Patents ($77,700 cost less $6,200 amortization) $71,500 Copyrights ($44,000 cost less $33,300 amortization) 10.700 Total $82,200 The patent was acquired in January 2022 and has a useful life of 10 years. The copyright was acquired in January 2016 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Jan. 2 Paid $36,000 legal costs to successfully defend the patent against Infringement by another company. Jan. - June Developed a new product, incurring $251,500 in research and development costs. A patent was granted for the product on July 1, and its useful life is equal to its legal life. Legal and other costs for the patent were $20,000. Sept 1 Paid $68,500 to a quarterback to appear in commercials advertising the company's products. The commercials will air in September and October Oct. 1 Acquired a copyright for $237,000. The copyright has a useful life and legal life of 50 years. Prepare journal entries to record the transactions. (Record entries in the order displayed in the problem statement Credit account titles are automatically indented when amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) I Date Account Tities and Explanation Debit Credit BACK CALCULATOR PRINTER VERSION NEXT Prepare journal entries to record the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter for the amounts.) Date Account Tities and Explanation Debit Credit 1 CALCULATOR PRINTER VERSION 4 BACK Prepare journal entries to record the 2023 amortization expense for intangible assets. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Dec. 31 Date (To record amortization of patents) Dec 31 (To record amortization of copyrights) SHOW LIST OF ACCOUNTS Prepare the intangible in the Help System Announcements CALCULATOR PRINTER VERSION SHOW LIST OF ACCOUNTS Prepare the intangible assets section of the balance sheet at December 31, 2023. Monty Corporation Balance Sheet (Partial) Hly On January 1, 2022, Crane Company had a balance of $382,000 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $297,150. July 1 Acquired a 10-year franchise; expiration date July 1, 2,032, $590,400. Sept. 1 Research and development costs $175,000. Prepare the necessary entries to record the transactions related to intangibles. All costs incurred were for cash. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Snow LIST OF ACCOUNT MacBook Air Make an entry as of December 31, 2022, recording any necessary amortization (Round answers to o decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit SHOW LNT OF ACCOUNTS Indicate what the intangible asset account balances should be on December 31, 2022 Patent Franchise Click if you would like to show Work for this questionDen Show Work Monty Corporation and Pronghorn Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. Net income Sales revenue Total assets (average) Plant assets (average) Intangible assets (goodwill) Monty Corp. $ 237,540 1,583,600 3,959,000 2,690,000 389,100 Pronghorn Corp. $336,420 1,682,100 3,738,000 1,859,000 0 ly (a) For each company, calculate these values: (Round return on assets and profit margin to I decimal place, c.9. 6.2% and asset turnover to 2 decimal places, e.g. 17.54.) Monty Corp. Pronghorn Corp. (1) Return on assets (2) Profit margin 96 % (3) Asset turnover times times Click if you would like to Show Work for this question: Open Show Work LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSTON 4 NEXT SRCES Problem 9-01A Ivanhoe Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. 1. Debit Excavation costs for new building $16,000 2. Architect's fees on building plans 26,000 3. Full payment to building contractor 633,000 4. Cost of real estate purchased as a plant site (land $248,000 and building $25,000) 273,000 5. Cost of parking lots and driveways 22,000 6. Accrued real estate taxes paid at time of purchase of land 2,470 7. Installation cost of fences around property 6,100 8 Cost of demolishing building to make land suitable for construction of new building 24,000 9. Real estate taxes paid for the current year on land 5700 $1.008.220 by Study Credit 10. Proceeds from salvage of demolished bulliding $11.300 Analyze the transactions using the following table column Headings, Enter the amounts in the appropriate columns For amounts in the Other Accounts column, als indicate the account title. (If an amount falls into either the Land or Building columinenter "Not Applicable the account title column. Enter negative amounts using either a negative sign preceding the number w.g.-15 or parenthesse.. (45).) Other Accounts Item Land Building Amounts Account Title MacBook Air LUS Kimmel, Accounting, 7e Help System Announcements CALCULATOR PRINTER VERSION HACK NEXT ORCES Credit 10. Proceeds from salvage of demolished building $ 11,300 Analyze the transactions using the following table column headings. Enter the amounts in the appropriate columns. For amounts in the Other Accounts column, also indicate the account title. (If an amount falls into alter the Land or Buildings column, enter "Not Applicable" in the account title column. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.. (45).) Other Accounts Item Land Building Amounts Account Title 1 2 by Study 3 4 v MacBook Air Attempts 1 Allowed Attempts 1 Points 15 Submitting an external tool am - Apr 25 at 11pm 9 days US Kimmel, Accounting, 70 Help System Announcements CALCULATOR PRINTEE VERSTOM BLACK NET CES 1 2 3 5 6 7 Study 10 Click if you would like to show Work for this questions on Show Work MacBook Air