Answered step by step

Verified Expert Solution

Question

1 Approved Answer

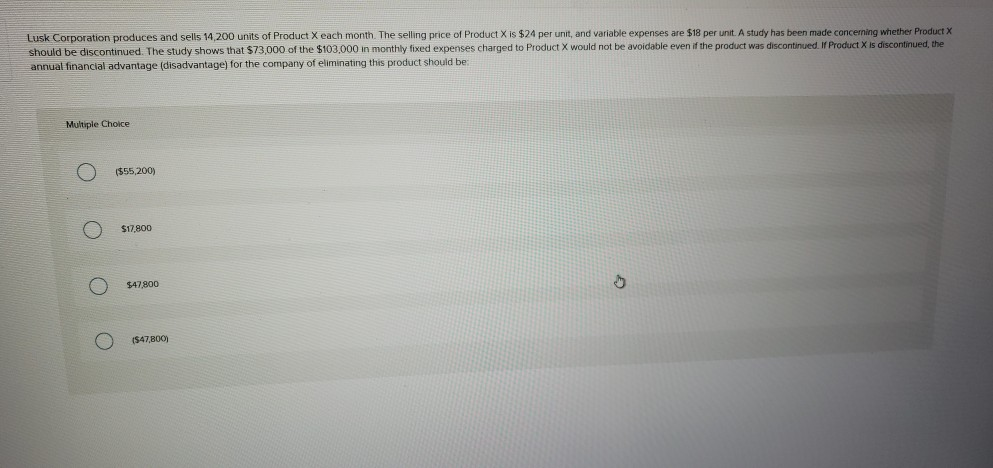

Lusk Corporation produces and sells 14,200 units of Product X each month. The selling pric annual financial advantage (disadvantage) for the company of eliminating this

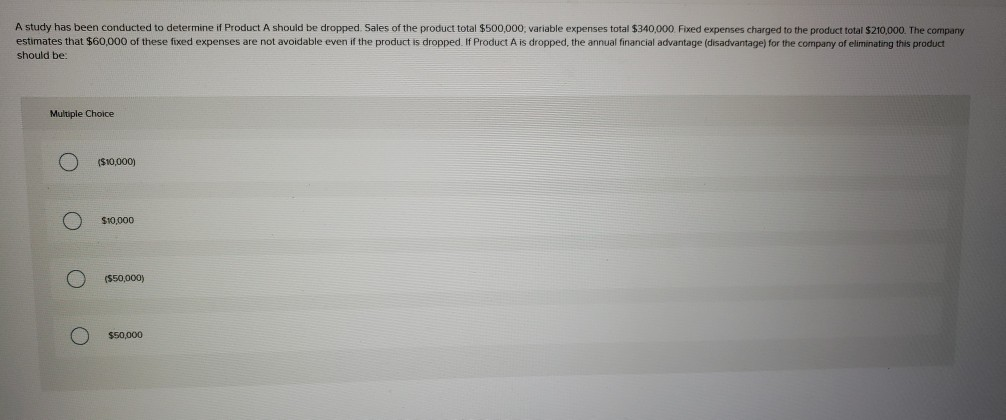

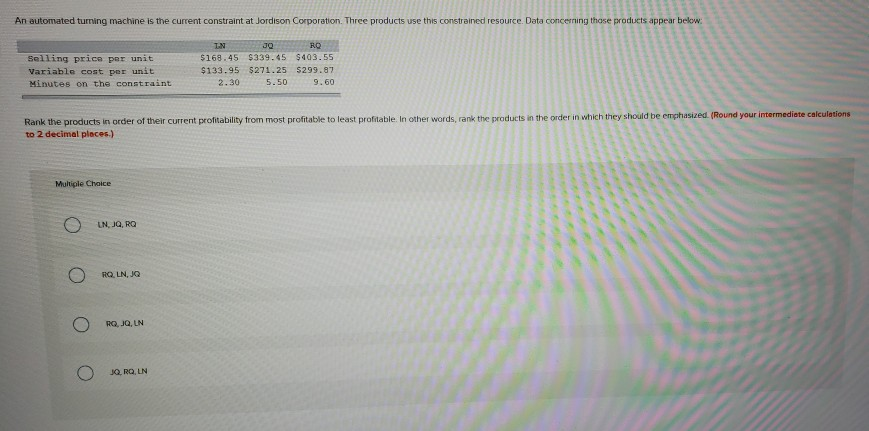

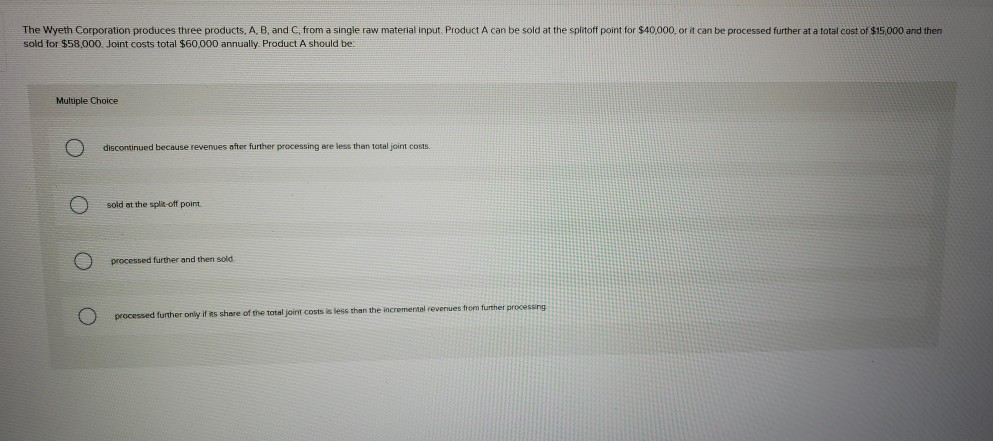

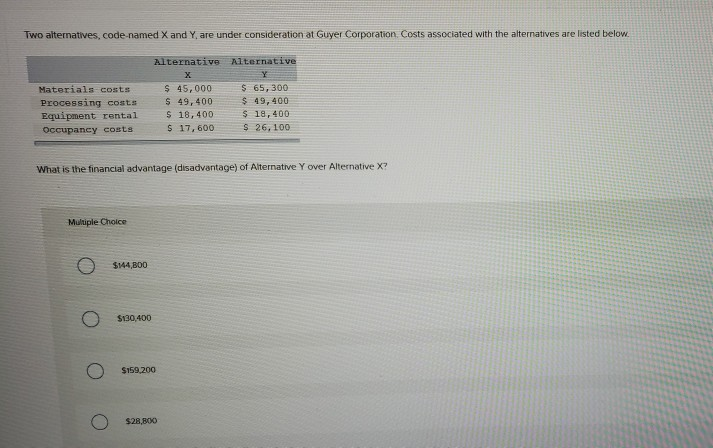

Lusk Corporation produces and sells 14,200 units of Product X each month. The selling pric annual financial advantage (disadvantage) for the company of eliminating this product should be: e o ProductX is $24 per unit and variable expenses are $18 per unit A study has been made conce ng het er Product X Multiple Choice $55,200) $17,800 $47,800 ($47,800) A study has been conducted to determine if Product A should be dropped. Sales of the product total $500,000, variable expenses total $340,000. Fixed expenses charged to the product total $210,000. The company estimates that $60,000 of these fixed expenses are not avoidable even if the product is dropped. If Product A is dropped, the annual financial advantage (disadvantage) for the company of eliminating this product should be: Multiple Choice $10,000) $10,000 $50,000) $50,000 An automated turning machine is the current constraint at Jordison Corporation. Three products use this constrained resource. Data concerning those products appear below Salling price per unit Variable cost per unit Minutes on the constraint 168.45 $339.4S $403.55 $133.95 $271.25 $299.87 2.30 5.509.60 Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be empha to 2 decimal places.) sized (Round your intermediete calculations Multiple Choice LN, JQ, RO RQ, LN, JQ RQ, JQ, LN The Wyeth Corporation produces three products, A, B, and C, from a single raw material input. Product A can be sold at the splitoff point for $40,000, or it can be processed further at a total cost of $15,000 and then sold for $58,000. Joint costs total $60,000 annually. Product A should be: Multiple Choice discontinued because revenues after further processing are less than total joint costs sold at the split-off point processed further and then sold processed further only if ks share of the total joint costs is less than the incrementel revenues from further Two alternatives, code-named X and Y, are under consideration at Guyer Corporation. Costs associated with the alternatives are listed below ternative Alternative Materials costs Processing costs S 49,400 Equipment rental 18,400 $ 65,300 49,400 18,400 S 45,000 Ocupaney costs 17,600 26,100 What is the financial advantage (disadvantage) of Alternative Y over Alternative X? Multiple Choice $144,800 $130,400 $159,200 $28,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started