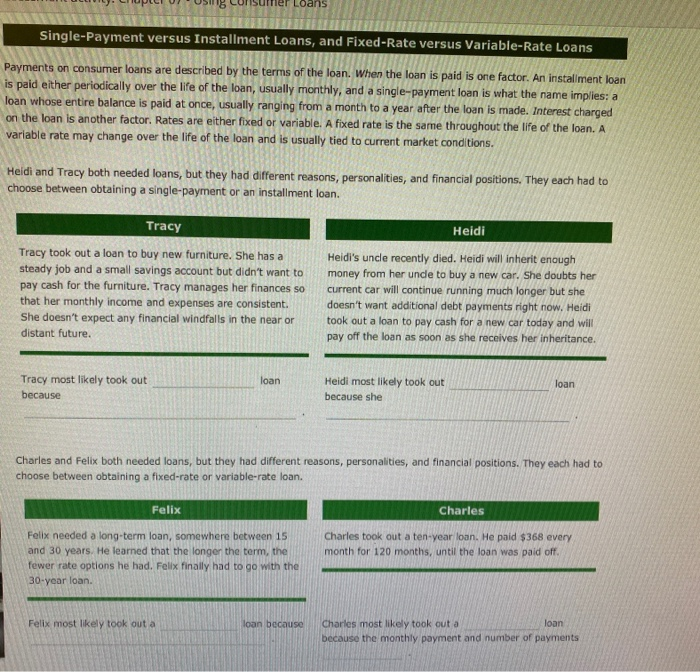

Lusunler Loans Single-Payment versus Installment Loans, and Fixed-Rate versus Variable-Rate Loans Payments on consumer loans are described by the terms of the loan. When the loan is paid is one factor. An installment loan is paid either periodically over the life of the loan, usually monthly, and a single-payment loan is what the name implies: a loan whose entire balance is paid at once, usually ranging from a month to a year after the loan is made. Interest charged on the loan is another factor Rates are either fixed or variable. A fixed rate is the same throughout the life of the loan. A variable rate may change over the life of the loan and is usually tied to current market conditions. Heidi and Tracy both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a single-payment or an installment loan. Tracy Heidi Tracy took out a loan to buy new furniture. She has a steady job and a small savings account but didn't want to pay cash for the furniture. Tracy manages her finances so that her monthly income and expenses are consistent. She doesn't expect any financial windfalls in the near or distant future. Heidi's uncle recently died. Heidi will inherit enough money from her unde to buy a new car. She doubts her current car will continue running much longer but she doesn't want additional debt payments right now. Heidi took out a loan to pay cash for a new car today and will pay off the loan as soon as she receives her Inheritance. oan loan Tracy most likely took out because Heidi most likely took out because she Charles and Felix both needed loans, but they had different reasons, personalities, and financial positions. They each had to choose between obtaining a fixed-rate or variable-rate loan. Felix Charles Charles took out a ten-year loan. He paid $368 every month for 120 months, until the loan was paid off. Felix needed a long-term loan, somewhere between 15 and 30 years. He learned that the longer the term, the fewer rate options he had. Felix finally had to go with the 30-year loan. Felix most likely took out a loan because Charles most likely took out a loan because the monthly payment and number of payments