Question

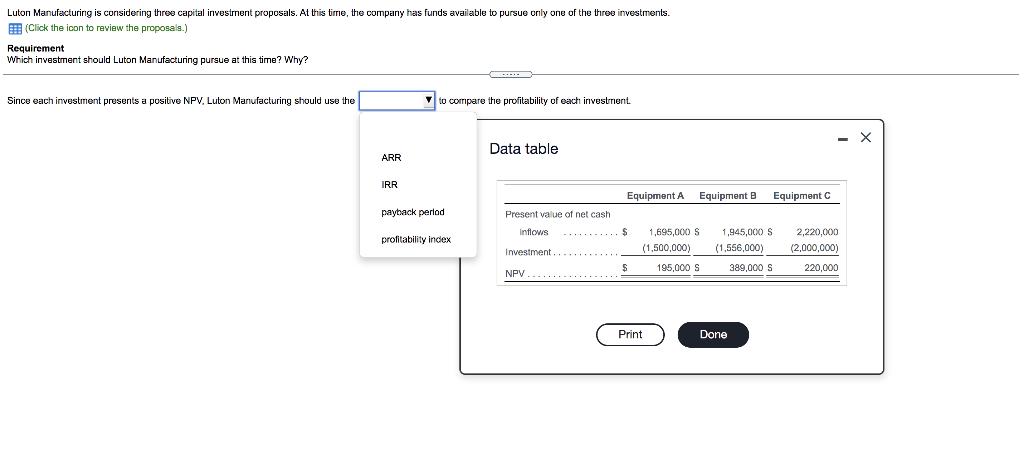

Luton Manufacturing is considering three capital investment proposals. At this tirme, the company has funds available to pursue only one of the three investments.

Luton Manufacturing is considering three capital investment proposals. At this tirme, the company has funds available to pursue only one of the three investments. E (Click the icon to review the proposals.) Requirement Which investment should Luton Manufacturing pursue at this time? Why? Since each investment presents a positive NPV, Luton Manufacturing should use the to cormpare the profitability of oach investnent - X Data table ARR IRR Equipment A Equipment B Equipment C payback perlod Present value of net cash inflows 1,695,000 S 1,945,000 S 2,220,000 profitability index (1,500,000) (1,556,000) (2,000,000) Investment 195,000 S 389,000 S 220,000 NPV Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Equipment Project Profitablity Index A 104 B 11...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Karen W. Braun, Wendy M. Tietz

5th edition

134128524, 978-0134128528

Students also viewed these Marketing questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App