Question

Two power plants are currently emitting 8,000 tons of pollution each (for a total of 16,000 tons) in City A. Marginal pollution reduction costs for

Two power plants are currently emitting 8,000 tons of pollution each (for a total of 16,000 tons) in City A. Marginal pollution reduction costs for Plant 1 are given by MCR1 = 0.02 Q1 and for Plant 2 by MCR2 = 0.03 Q2, where Q represents the number of tons of pollution reduction.

(1) Suppose a regulation is implemented that requires each plant to reduce its pollution by 5,000 tons.

What will be each plant’s pollution reduction costs?

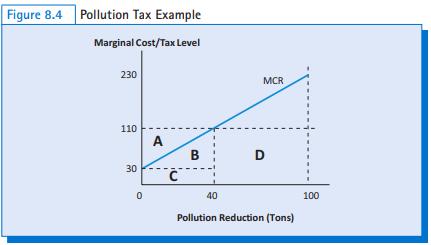

Hint: Draw two graphs (one for each firm), similar to Figure 8.4.

(2)

Suppose, instead of the regulation in Question (1), that a pollution tax of $120 per ton of pollution emitted is implemented.

a. How much will Plant 1 now pay in the pollution reduction costs (not including taxes)?

b. How much will Plant 2 pay in the pollution reduction costs (not including taxes)?

c. How much will be the total pollution reduction costs (not including taxes) for the two plants together? How much will be the tax payment for the two plants together?

d. Compare the total pollution reduction costs estimated in Question (c) to the total reduction costs by the regulation from Question (1). Which policy is economically efficient? Why?

(3)

Finally, suppose a tradable permit system is instituted in which permits for emissions of 6,000 tons of pollution are freely issued, that is, 3,000 permits to each plant.

a. What are the pollution reduction costs to each plant without trading?

Hint: Draw a graph similar to Figure 8.6 on page 186, showing 10,000 tons of total pollution reduction.

b. With trading, explain which plant will sell permits and how many permits the firm will sell.

Hint: Use the graph you drew in Question (a).

c. Assuming all permits sell for the same price, calculate each plant’s net costs after trading, considering their pollution reduction costs and the costs (or revenue) from trading permits.

d. Calculate the total pollution control (or reduction) costs for the two plants together.

Figure 8.4 Pollution Tax Example Marginal Cost/Tax Level 230 MCR 110 A 30 40 100 Pollution Reduction (Tons)

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

For plant 1 MCR 1 002Q For reducing pollution by 5000 tons MCR 1 002 x 5000 MCR 1 100 Thus the pollution reduction costs for plant 1 would be 051005000 250000 Thus for Firm 1 a graph would be For plan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started