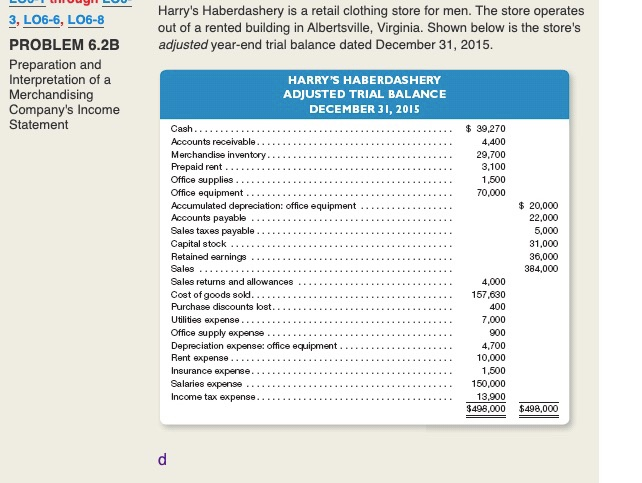

LUULUU LOU Harry's Haberdashery is a retail clothing store for men. The store operates out of a rented building in Albertsville, Virginia. Shown below is the store's adjusted year-end trial balance dated December 31, 2015. 3, LO6-6, L06-8 PROBLEM 6.2B Preparation and Interpretation of a Merchandising Company's Income Statement HARRY'S HABERDASHERY ADJUSTED TRIAL BALANCE DECEMBER 31, 2015 $ 39,270 4,400 29,700 3,100 1,500 70,000 Cash...... Accounts receivable..... Merchandise inventory.... Prepaid rent. Office supplies... Office equipment ............... Accumulated depreciation office equipment Accounts payable ....... Sales taxes payable. Capital stock .... Retained earnings ...... Sales ... Sales returns and allowances Cost of goods sold. Purchase discounts lost... Utilities expense......... Office supply expense........ Depreciation expense: office equipment. Rent expense.......... Insurance expense... Salaries expense ......... Income tax expense.......... $ 20,000 22.000 5,000 31,000 36,000 384,000 4,000 157,630 400 7,000 900 4,700 10,000 1,500 150,000 13,900 $498,000 $498,000 Instructions a. Prepare an income statement for Harry's Haberdashery dated December 31, 2015. b. Compute the store's gross profit margin as a percentage of net sales. c. Do the store's customers seem to be satisfied with their purchases? Defend your answer. d. Explain how you can tell that the business records inventory purchases net of any purchase discounts. e. The store reports sales taxes payable of $5,000 in its adjusted trial balance. Explain why it does not report any sales taxes expense. f. What is meant by the term "operating cycle" and which accounts in the trial balance comprise Harry's Haberdashery's operating cycle? Other Data 1. Supplies on hand at December 31, 2015, total $1,000. 2. The studio pays rent quarterly (every three months). The last payment was made November 1, 2015. The next payment will be made early in February 2016 3. Studio equipment is being depreciated over 120 months (10 years). 4. On October 1, 2015, the studio borrowed $24,000 by signing a 12- month, 12 percent note payable. The entire amount, plus interest, is due on September 30, 2016. 5. At December 31, 2015, $3,000 of previously unearned client fees had been earned. 6. Accrued, but unrecorded and uncollected client fees earned total $690 at December 31, 2015. 7. Accrued, but unrecorded and unpaid salary expense totals $750 at December 31, 2015. 8. Accrued income taxes expense for the entire year ending December 31, 2015, total $7,000. The full amount is due early in 2016. Instructions a. Prepare the necessary adjusting journal entries on December 31, 2015. Prepare also an adjusted trial balance dated December 31, 2015. b. From the adjusted trial balance prepared in part a, prepare an income statement and statement of retained earnings for the year ended December 31, 2015. Also prepare the company's balance sheet dated December 31, 2015. c. Prepare the necessary year-end closing entries. d. Prepare an after-closing trial balance. e. Has the studio's monthly rent remained the same throughout the year? If not, has it gone up or down? Explain