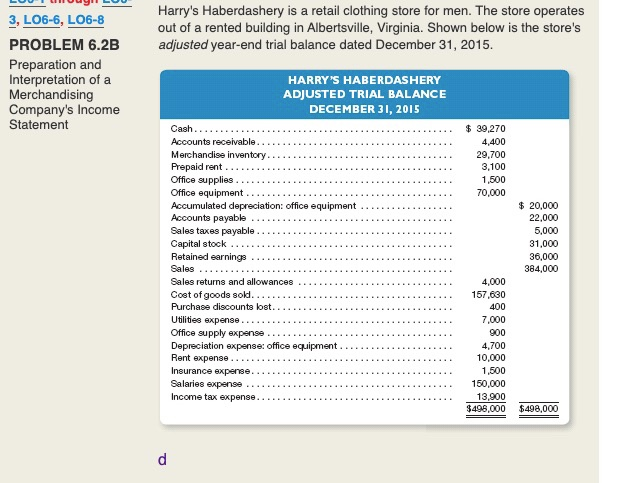

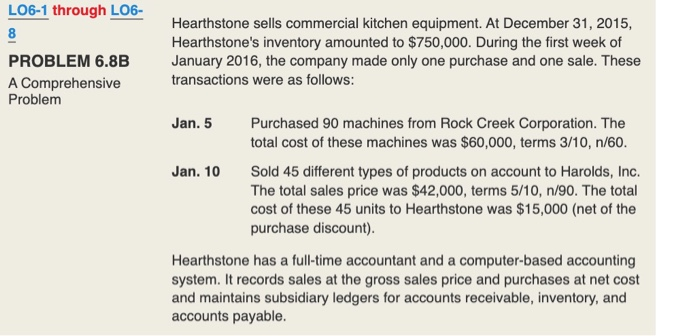

LUULUU LOU Harry's Haberdashery is a retail clothing store for men. The store operates out of a rented building in Albertsville, Virginia. Shown below is the store's adjusted year-end trial balance dated December 31, 2015. 3, LO6-6, L06-8 PROBLEM 6.2B Preparation and Interpretation of a Merchandising Company's Income Statement HARRY'S HABERDASHERY ADJUSTED TRIAL BALANCE DECEMBER 31, 2015 $ 39,270 4,400 29,700 3,100 1,500 70,000 Cash...... Accounts receivable..... Merchandise inventory.... Prepaid rent. Office supplies... Office equipment ............... Accumulated depreciation office equipment Accounts payable ....... Sales taxes payable. Capital stock .... Retained earnings ...... Sales ... Sales returns and allowances Cost of goods sold. Purchase discounts lost... Utilities expense......... Office supply expense........ Depreciation expense: office equipment. Rent expense.......... Insurance expense... Salaries expense ......... Income tax expense.......... $ 20,000 22.000 5,000 31,000 36,000 384,000 4,000 157,630 400 7,000 900 4,700 10,000 1,500 150,000 13,900 $498,000 $498,000 LO6-1 through L06- PROBLEM 6.8B A Comprehensive Problem Hearthstone sells commercial kitchen equipment. At December 31, 2015, Hearthstone's inventory amounted to $750,000. During the first week of January 2016, the company made only one purchase and one sale. These transactions were as follows: Jan. 5 Purchased 90 machines from Rock Creek Corporation. The total cost of these machines was $60,000, terms 3/10, n/60. Jan. 10 Sold 45 different types of products on account to Harolds, Inc. The total sales price was $42,000, terms 5/10, n/90. The total cost of these 45 units to Hearthstone was $15,000 (net of the purchase discount). Hearthstone has a full-time accountant and a computer-based accounting system. It records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts receivable, inventory, and accounts payable. LUULUU LOU Harry's Haberdashery is a retail clothing store for men. The store operates out of a rented building in Albertsville, Virginia. Shown below is the store's adjusted year-end trial balance dated December 31, 2015. 3, LO6-6, L06-8 PROBLEM 6.2B Preparation and Interpretation of a Merchandising Company's Income Statement HARRY'S HABERDASHERY ADJUSTED TRIAL BALANCE DECEMBER 31, 2015 $ 39,270 4,400 29,700 3,100 1,500 70,000 Cash...... Accounts receivable..... Merchandise inventory.... Prepaid rent. Office supplies... Office equipment ............... Accumulated depreciation office equipment Accounts payable ....... Sales taxes payable. Capital stock .... Retained earnings ...... Sales ... Sales returns and allowances Cost of goods sold. Purchase discounts lost... Utilities expense......... Office supply expense........ Depreciation expense: office equipment. Rent expense.......... Insurance expense... Salaries expense ......... Income tax expense.......... $ 20,000 22.000 5,000 31,000 36,000 384,000 4,000 157,630 400 7,000 900 4,700 10,000 1,500 150,000 13,900 $498,000 $498,000 LO6-1 through L06- PROBLEM 6.8B A Comprehensive Problem Hearthstone sells commercial kitchen equipment. At December 31, 2015, Hearthstone's inventory amounted to $750,000. During the first week of January 2016, the company made only one purchase and one sale. These transactions were as follows: Jan. 5 Purchased 90 machines from Rock Creek Corporation. The total cost of these machines was $60,000, terms 3/10, n/60. Jan. 10 Sold 45 different types of products on account to Harolds, Inc. The total sales price was $42,000, terms 5/10, n/90. The total cost of these 45 units to Hearthstone was $15,000 (net of the purchase discount). Hearthstone has a full-time accountant and a computer-based accounting system. It records sales at the gross sales price and purchases at net cost and maintains subsidiary ledgers for accounts receivable, inventory, and accounts payable