Answered step by step

Verified Expert Solution

Question

1 Approved Answer

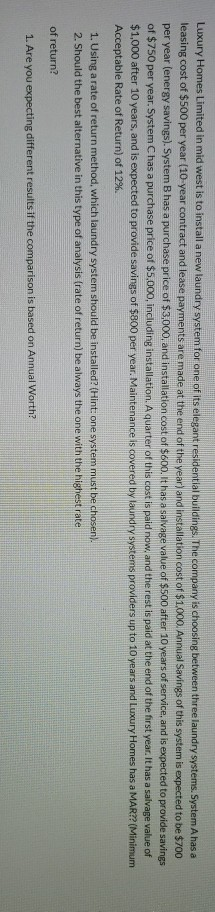

Luxury Homes Limited in mid west is to install a new laundry system for one of its elegant residential buildings. The company is choosing between

Luxury Homes Limited in mid west is to install a new laundry system for one of its elegant residential buildings. The company is choosing between three laundry systems. System A has a leasing cost of $500 per year (10-year contract and lease payments are made at the end of the year) and installation cost of $1.000. Annual Savings of this system is expected to be $700 per year (energy savings). System B has a purchase price of $3,000, and installation cost of $600. It has a salvage value of $500 after 10 years of service, and is expected to provide savings of $750 per year. System Chas a purchase price of $5,000, including installation. A quarter of this cost is paid now, and the rest is paid at the end of the first year. It has a salvage value of $1,000 after 10 years, and is expected to provide savings of $800 per year. Maintenance is covered by laundry systems providers up to 10 years and Luxury Homes has a MAR?? (Minimum Acceptable Rate of Return) of 12%. 1. Using a rate of return method, which laundry system should be installed? (Hint: one system must be chosen), 2. Should the best alternative in this type of analysis (rate of return) be always the one with the highest rate of return? 1. Are you expecting different results if the comparison is based on Annual Worth? Luxury Homes Limited in mid west is to install a new laundry system for one of its elegant residential buildings. The company is choosing between three laundry systems. System A has a leasing cost of $500 per year (10-year contract and lease payments are made at the end of the year) and installation cost of $1.000. Annual Savings of this system is expected to be $700 per year (energy savings). System B has a purchase price of $3,000, and installation cost of $600. It has a salvage value of $500 after 10 years of service, and is expected to provide savings of $750 per year. System Chas a purchase price of $5,000, including installation. A quarter of this cost is paid now, and the rest is paid at the end of the first year. It has a salvage value of $1,000 after 10 years, and is expected to provide savings of $800 per year. Maintenance is covered by laundry systems providers up to 10 years and Luxury Homes has a MAR?? (Minimum Acceptable Rate of Return) of 12%. 1. Using a rate of return method, which laundry system should be installed? (Hint: one system must be chosen), 2. Should the best alternative in this type of analysis (rate of return) be always the one with the highest rate of return? 1. Are you expecting different results if the comparison is based on Annual Worth

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started