Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Luxury Iron Company began august with 60 units of iron inventory that cost $25 each. durimg august, the company completed the following inventory transactions(shown in

Luxury Iron Company began august with 60 units of iron inventory that cost $25 each. durimg august, the company completed the following inventory transactions(shown in the data table)

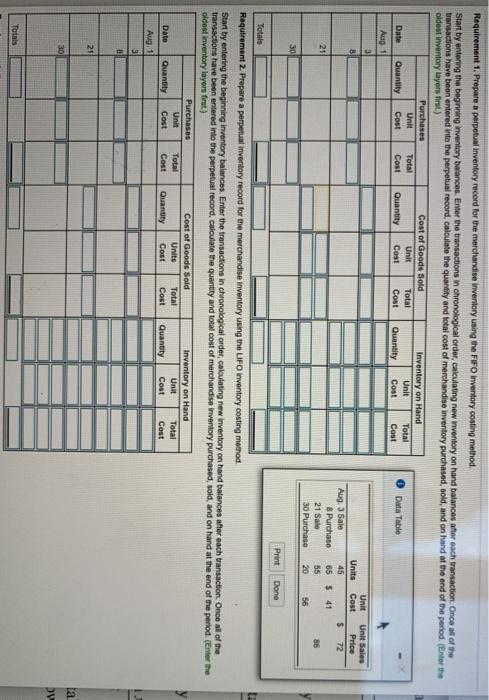

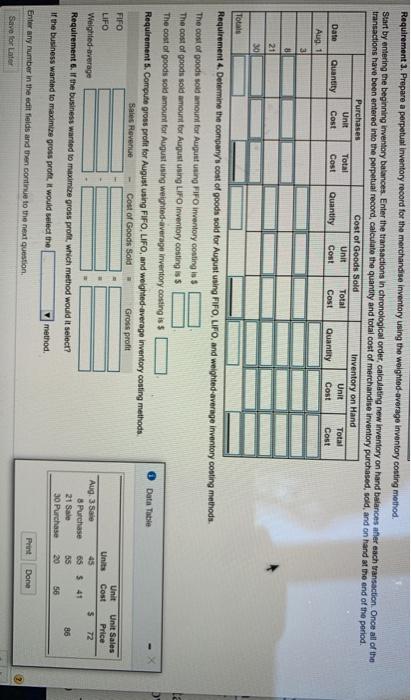

Requirement 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO Inventory costing method Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Enter the oldest inventory layers first) Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Data Table Quantity Cost Cost Aug 1 3 Unit Unit Sales Units Price Aug 3 Sale 45 $ 72 8Purchase 65 $ 41 25 21 Sale 55 30 Purchase 20 56 30 Print Done Cost 86 Totals Requirement 2. Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first) Purchases Cost of Goods Sold Inventory on Hand Unit Total Units Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Aug. 1 3 8 21 ta 301 DV Totals Requirement 3. Prepare a perpetual inventory record for the merchandise inventory using the weighted average Inventory costing method. Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. Purchases Cost of Goods Sold Inventory on Hand Unit Total Unit Total Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Aug 1 3 8 21 30 Totals Requirement 4. Determine the company's cost of goods sold for August using FIFO, LIFO, and weighted average Inventory costing methods Data Table The cost of goods sold amount for August using FIFO inventory costing is 5 The cost of goods sold amount for August using LIFO inventory costing is $ The cost of goods sold amount for August using weighted average inventory costing is 5 Requirements. Compute gross profit for August using FIFO, LIFO, and weighted average inventory costing methods Sales Revenue Cost of Goods Sold Gross profit FIFO LIFO Weighted-average Requirements. If the business wanted to maximize gross profit, which method would it select? Unit Cost Units Unit Sales Price 5 72 Aug 3 Sale 8Purchase 21 Sale 30 Purchase $41 55 20 86 if the business wanted to maximize gross profit. It would select the 56 method Print Done Enter any number in the edit fields and then continue to the next question Save for later Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started