Question

Luxury jewelry retailer tiffany & co posted first quarter earnings that substantially beat analysts' estimates. Operational earnings more than doubled to 48 cents a

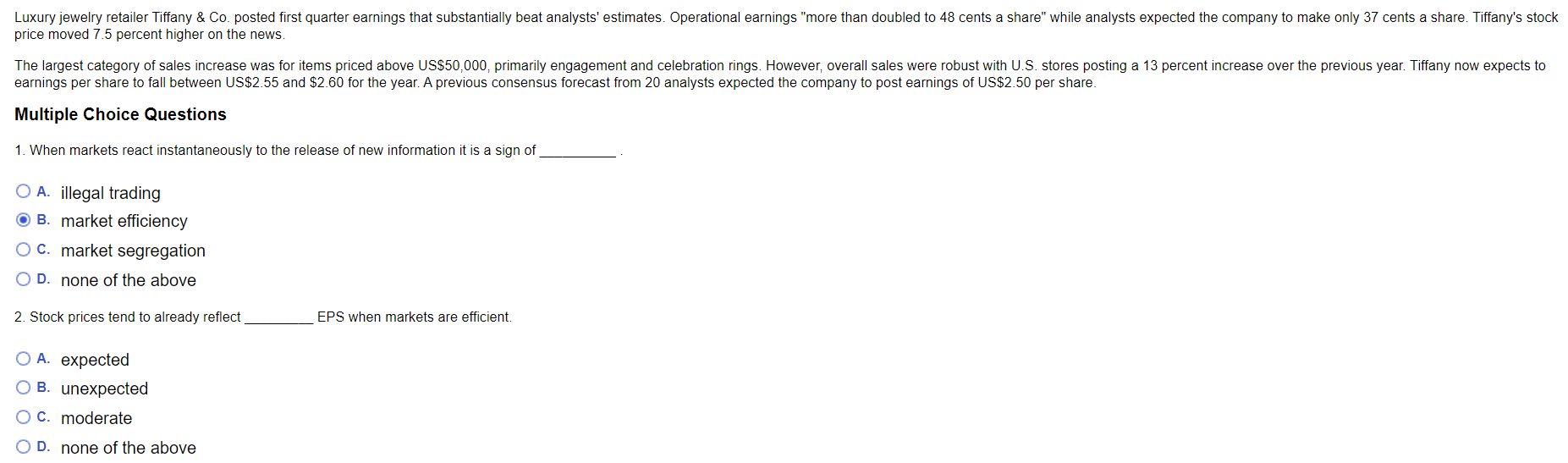

Luxury jewelry retailer tiffany & co posted first quarter earnings that substantially beat analysts' estimates. Operational earnings " more than doubled to 48 cents a share" while analysts expected the company to make only 37 cents a share. tiffany's stock price moved 7.5 percent higher on the news.

The largest category of sales increase was for items priced above US$50,000, primarily engagement and celebration rings. However, overall sales were robust with U.S. stores posting a 13 percent increase over the previous year. tiffany now expects to earnings per share to fall between US$2.55 and $2.60 for the year. A previous consensus forecast from 20 analysts expected the company to post earnings of US$2.50 per share.

1. when markets react instantaneously to the release of new information it is a sign of

a. illegal trading

b. market efficiency

c. market segregation

d none of the above

2. Stock prices tend to already reflect _______ EPS when markets are efficient

a. expected

b. unexpected

c. moderate

d none of the above

Luxury jewelry retailer Tiffany & Co. posted first quarter earnings that substantially beat analysts' estimates. Operational earnings "more than doubled to 48 cents a share" while analysts expected the company to make only 37 cents a share. Tiffany's stock price moved 7.5 percent higher on the news. The largest category of sales increase was for items priced above US$50,000, primarily engagement and celebration rings. However, overall sales were robust with U.S. stores posting a 13 percent increase over the previous year. Tiffany now expects to earnings per share to fall between US$2.55 and $2.60 for the year. A previous consensus forecast from 20 analysts expected the company to post earnings of US$2.50 per share. Multiple Choice Questions 1. When markets react instantaneously to the release of new information it is a sign of O A. illegal trading O B. market efficiency OC. market segregation OD. none of the above 2. Stock prices tend to already reflect EPS when markets are efficient. O A. expected OB. unexpected C. moderate OD. none of the above 3. If earnings are released that are 20 cents below expectations the price of a stock will very likely O A. decrease OB. increase O C. remain the same OD. increase and then decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started