Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ly Test 5 - Lyryx Learning Inc - Google Chrome lifa 1.lyryx.com/quiz-servlets/QuizServlet?cid=11048 Question 5 [10 points] On January 1, 2015 partners Ryan Player, Judith Grimm

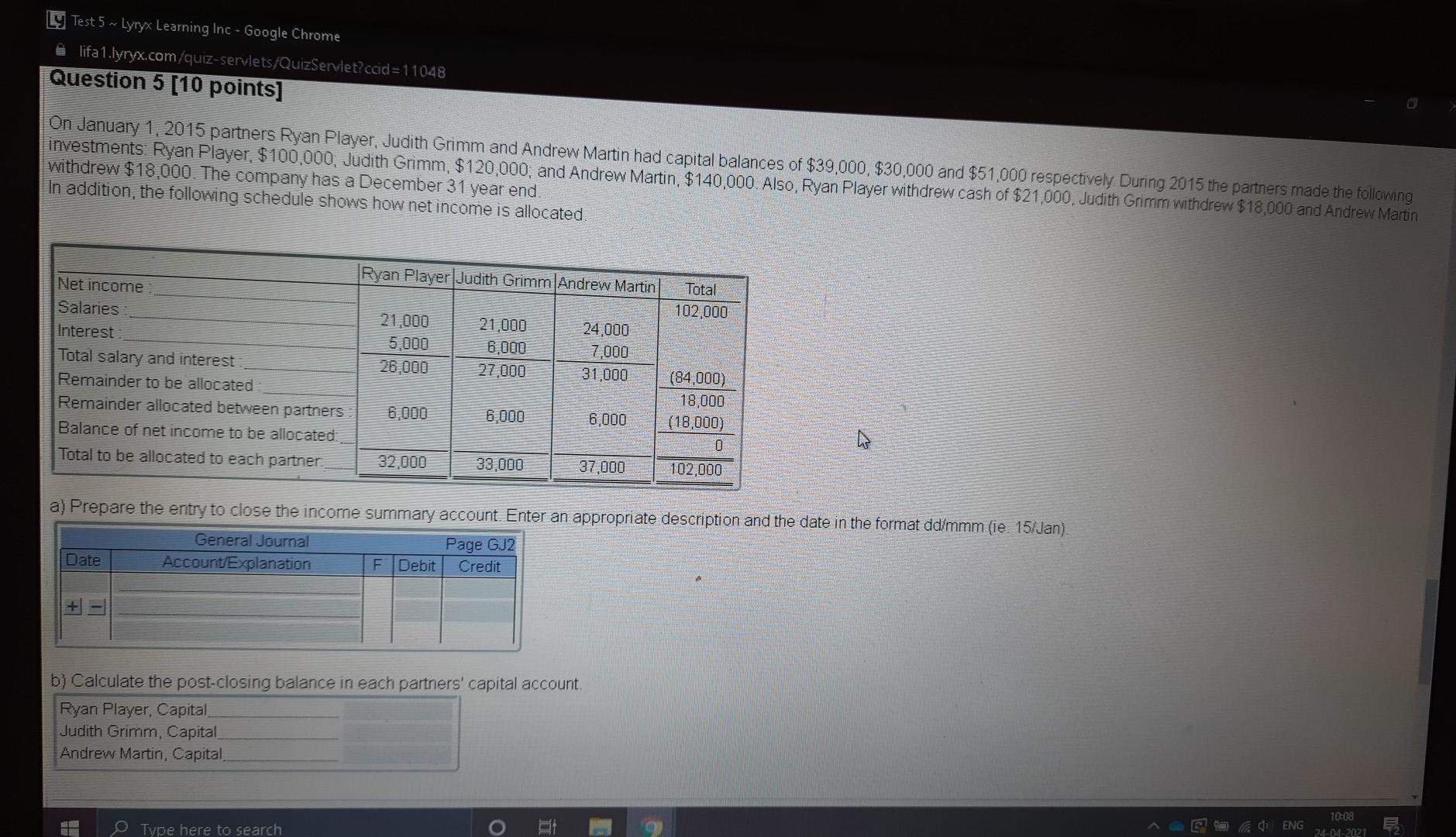

Ly Test 5 - Lyryx Learning Inc - Google Chrome lifa 1.lyryx.com/quiz-servlets/QuizServlet?cid=11048 Question 5 [10 points] On January 1, 2015 partners Ryan Player, Judith Grimm and Andrew Martin had capital balances of $39,000, $30,000 and $51,000 respectively. During 2015 the partners made the following investments Ryan Player, $100,000, Judith Grimm, $120,000, and Andrew Martin, $140,000. Also, Ryan Player withdrew cash of $21,000, Judith Grimm withdrew $18,000 and Andrew Martin withdrew $18,000. The company has a December 31 year end. In addition, the following schedule shows how net income is allocated Total 102,000 Ryan Player Judith Grimm Andrew Martin Net income Salaries 21,000 21,000 24,000 Interest 5,000 6,000 7,000 Total salary and interest 26,000 27,000 31,000 Remainder to be allocated Remainder allocated between partners 6.000 6,000 6,000 Balance of net income to be allocated: Total to be allocated to each partner 32,000 33,000 37,000 (84,000) 18,000 (18,000) 0 102,000 a) Prepare the entry to close the income summary account. Enter an appropriate description and the date in the format dd/mmm (ie. 15/Jan) General Journal Page GJ2 Date Account Explanation F Debit Credit b) Calculate the post-closing balance in each partners' capital account. Ryan Player, Capital Judith Grimm, Capital Andrew Martin, Capital Type here to search Med ENG 10:08 24-04-2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started