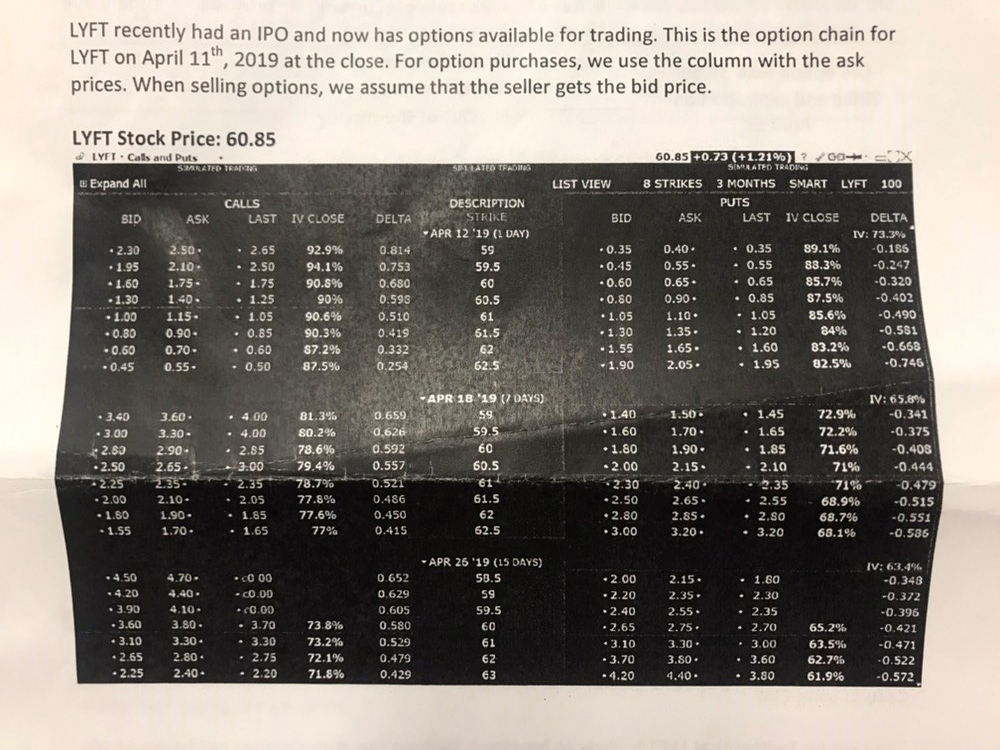

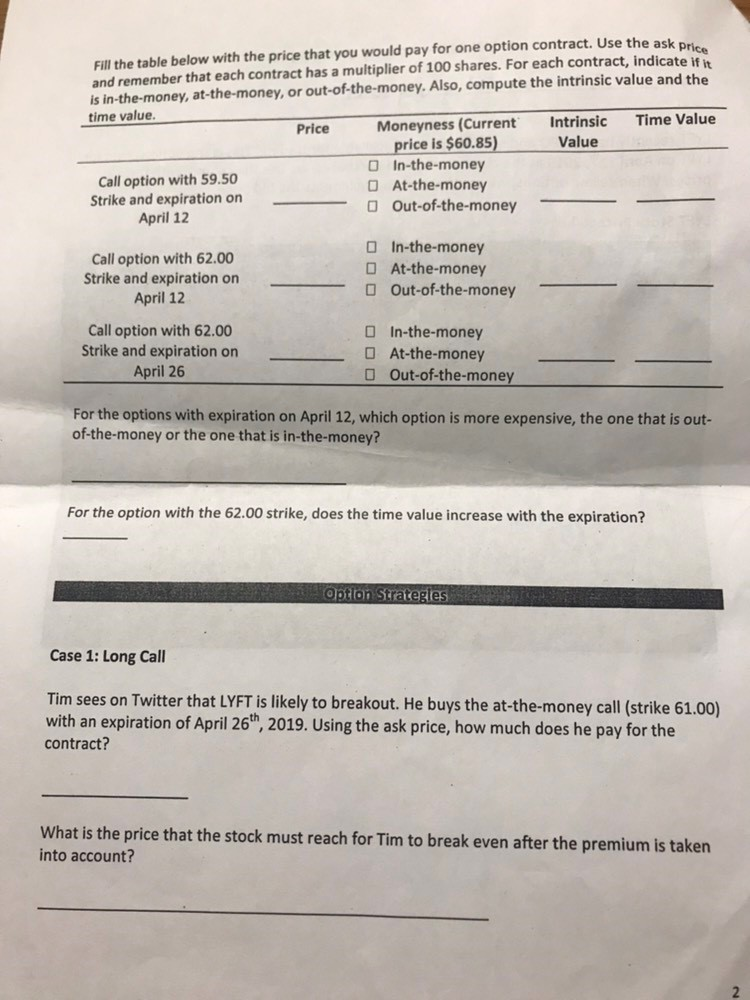

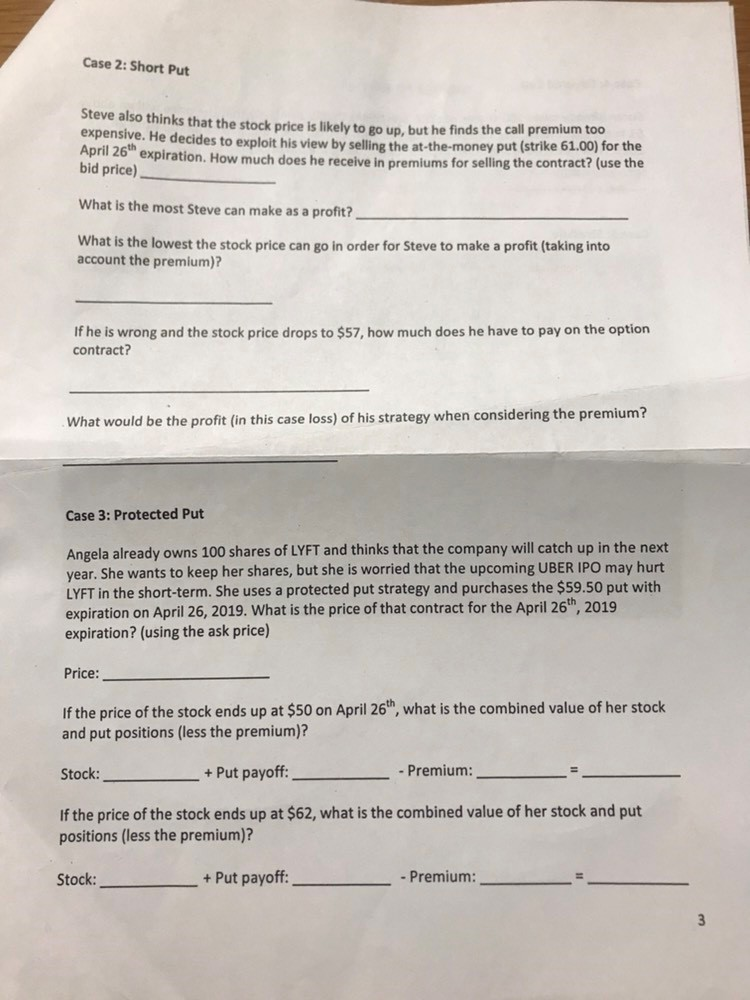

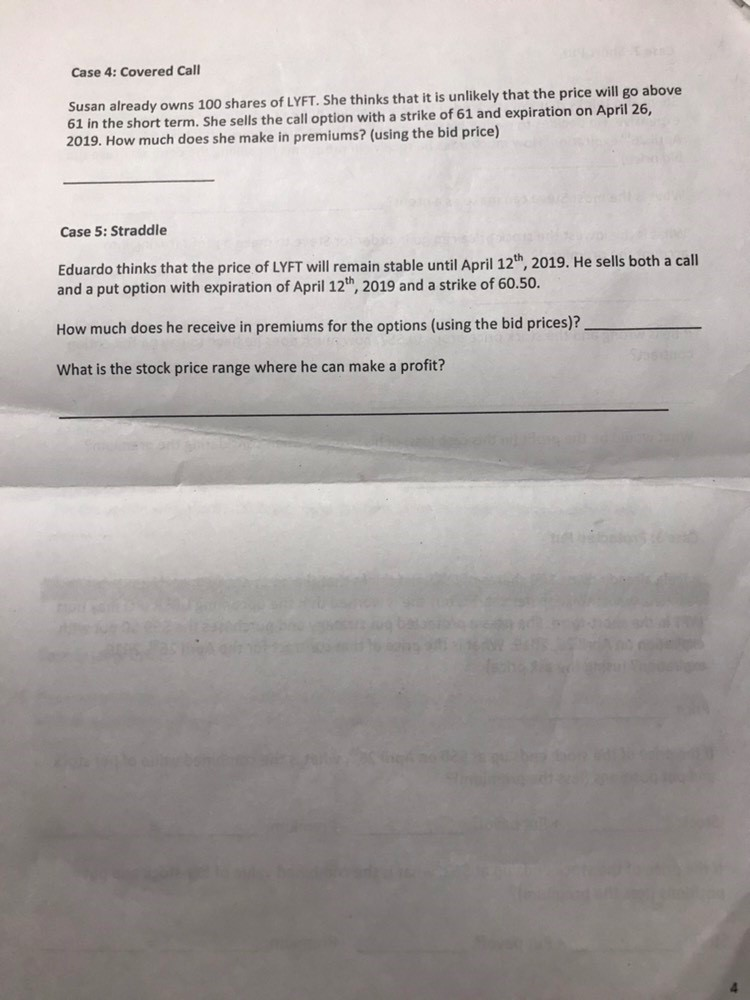

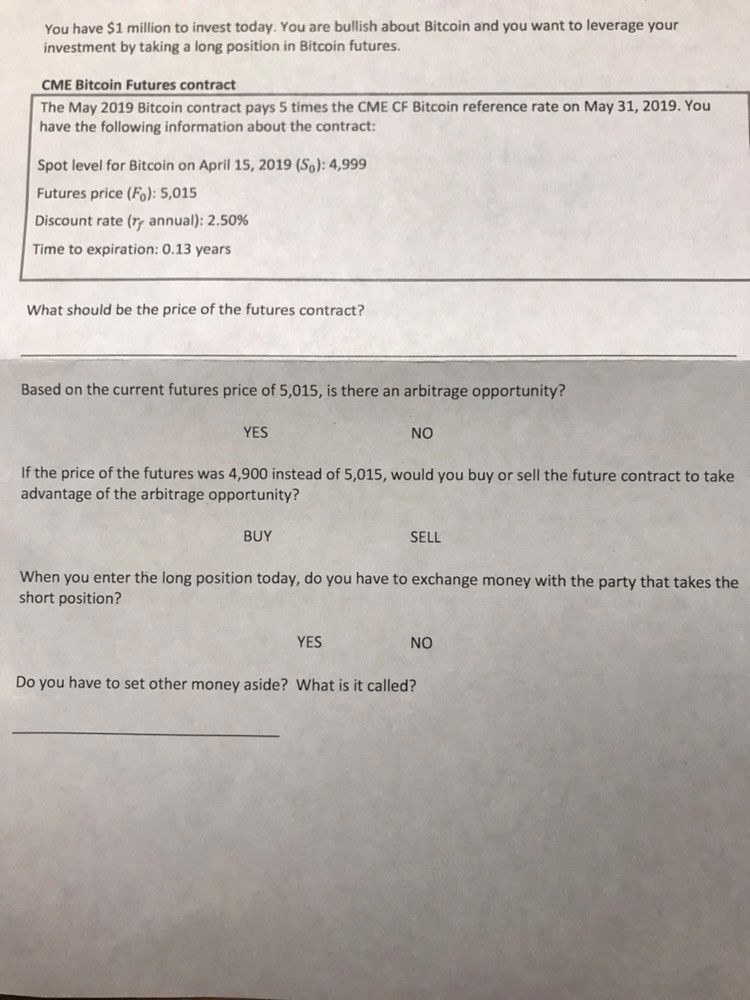

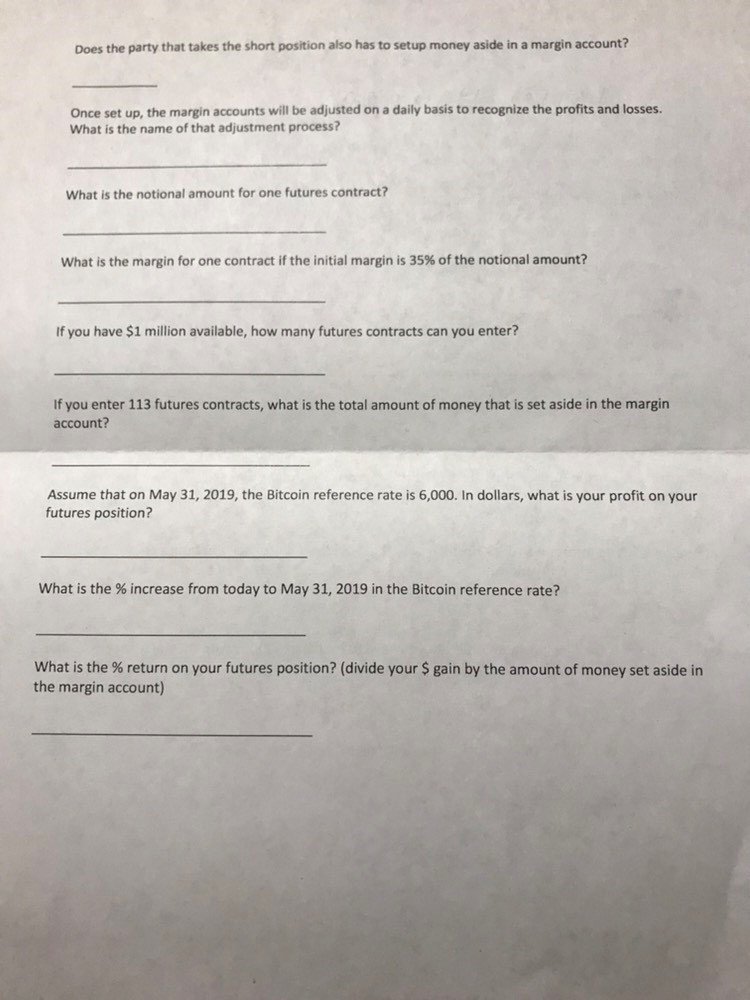

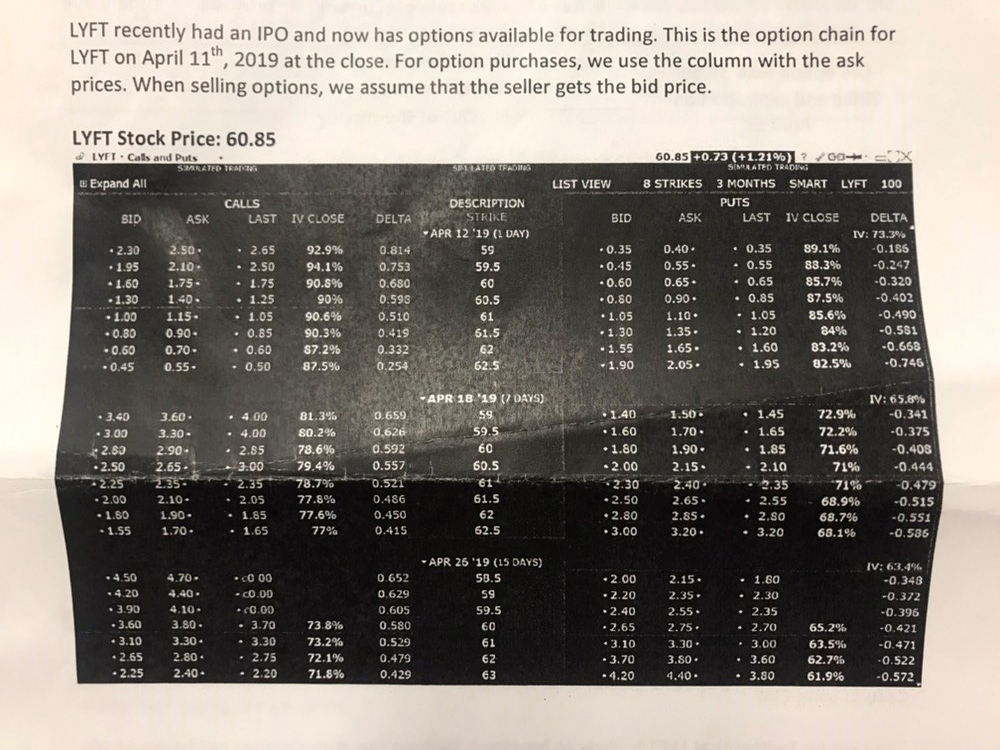

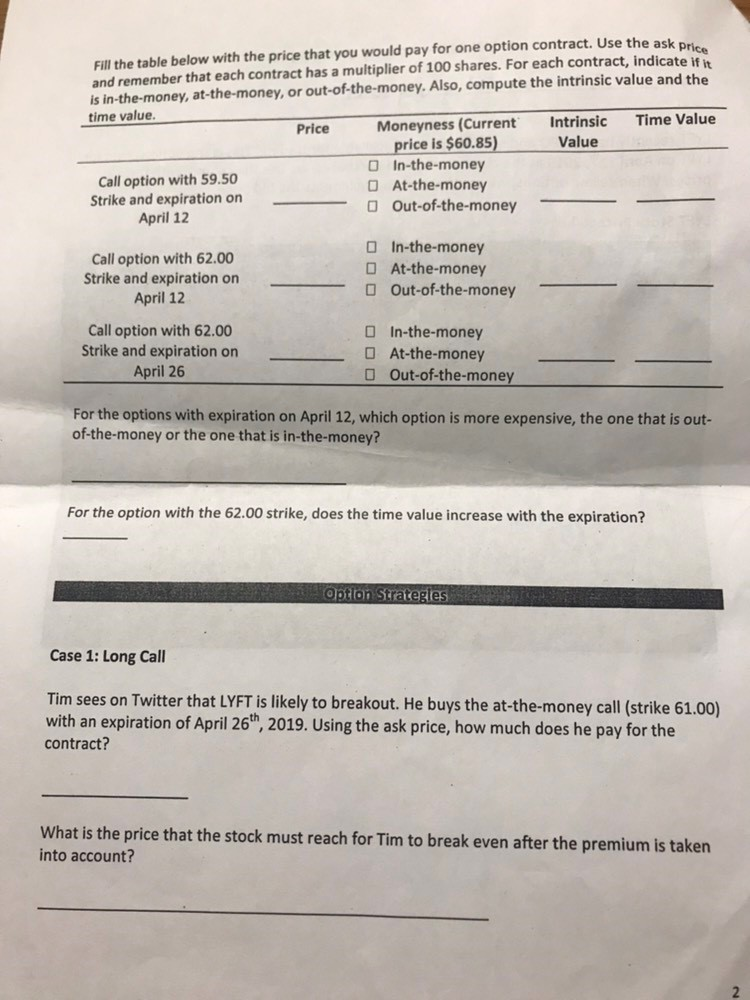

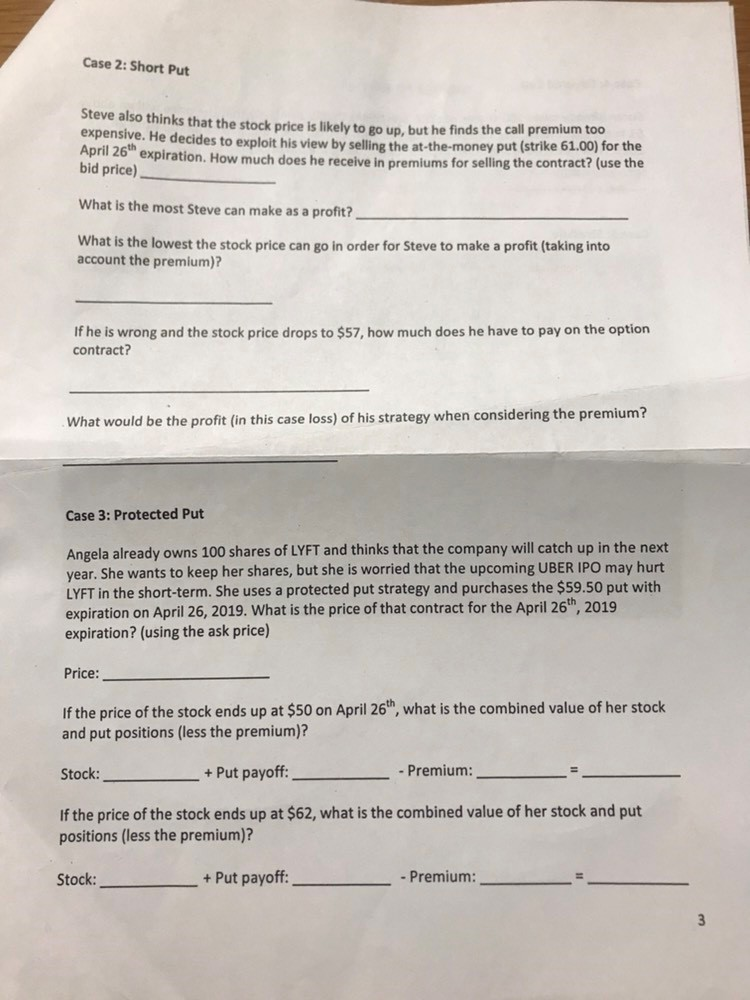

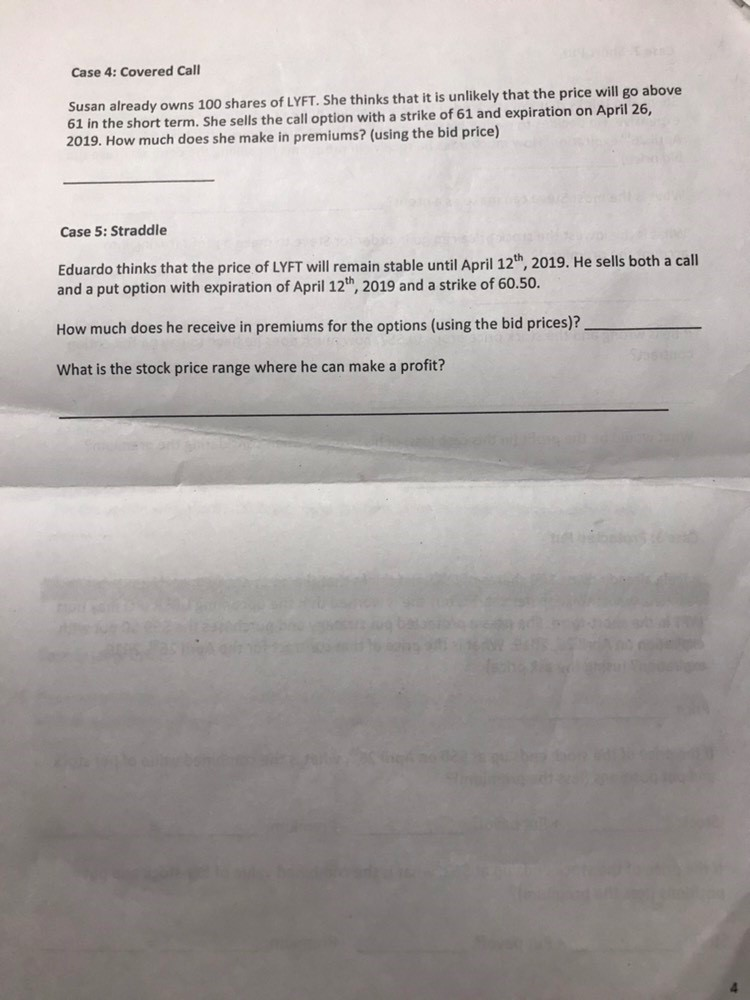

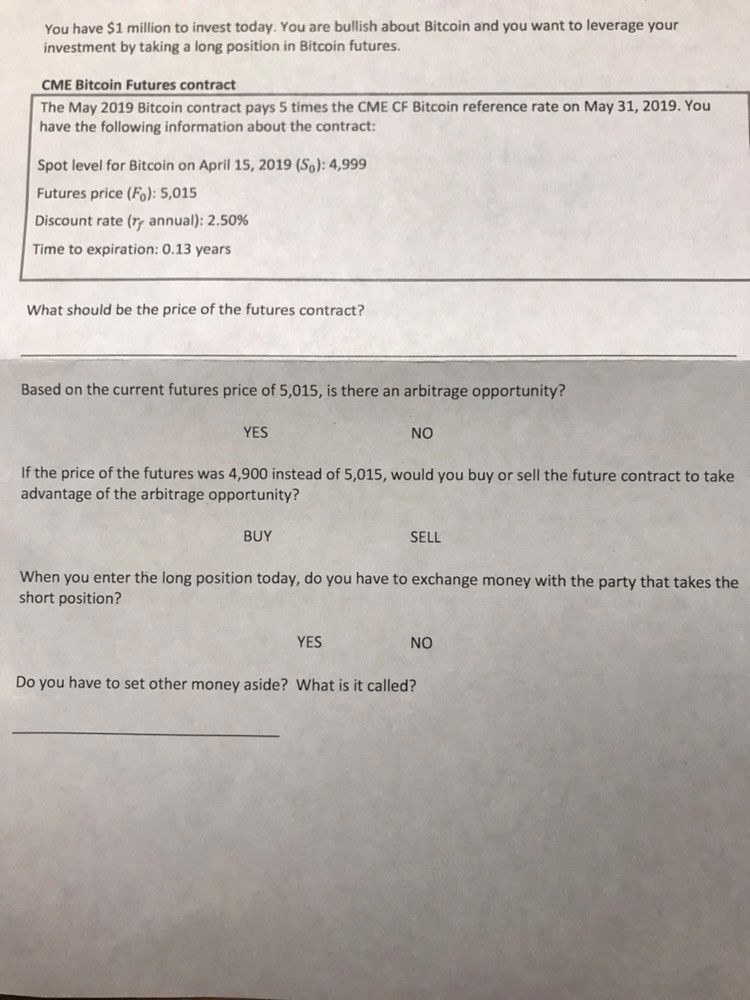

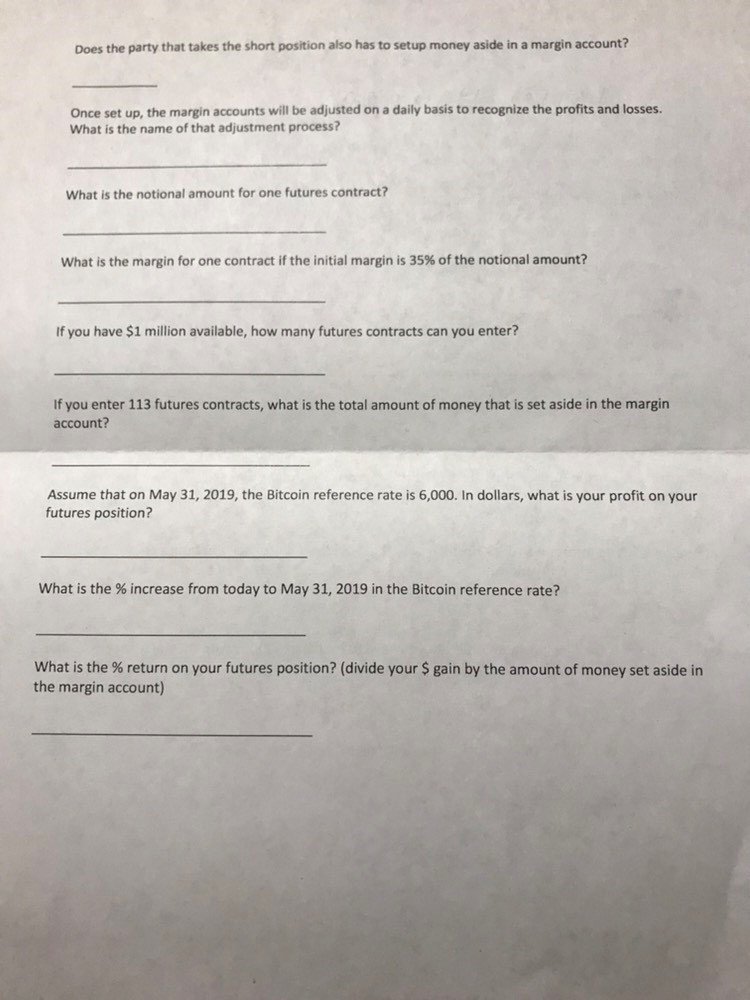

LYFT recently had an IPO and now has options available for trading. This is the option chain for LYFT on April 11th, 2019 at the close. For option purchases, we use the column with the ask prices. When selling options, we assume that the seller gets the bid price. LYFT Stock Price: 60.85 LYTT Cals and Puts +0.73 (+1.21%) 60.85 LIST VIEW 8STRIKES 3 MONTHS SMART LYFT 100 PUTS CALLS DESCRIPTION LAST IV CLOSEDELTA ASK LASTV CLOSE DELTA 73.3% ASK APR 12 19 (L DAY) .0.35 0.40 . . 0.35 89.1% -0.186 .0.45 0.55- .0.55 88.3% .0.247 .0.60 0.65- .0.65 85.7% -0.320 .0.60 0.90. . 0.85 87.5% -0.402 .1.05 1.10. . 1.05 85.6% -0490 1.20 .1.55 1.65 . . 1.60 83.2% -0.663 . 1.95 2.302.50 1.952.10 92.9% 59 59.5 60 60.5 0.753 1.60 1.75-1.75 90.8% 0.680 90 90.6% 1.301.40. 1.001.15. 0.593 0.510 1.05 .0.80 0.90 . . 0.85 90.396 0.419 84% -0.531 0.332 0.50 87.5% . 0.254 +0.60 0.70. *0.60 87.2% 0.450.55- 82.5% -0.745; 62.5 APR 18 19 7 DAYS) : 65.8% v1.40, 1.50 . . 1.4S 72.9% -0.341 +1.60 1.70 . . 1.65 72.2% -0.375 .1.80 1.90 . . 1.85 71.6% -0.408 -0.444 3.403.60 81.3% 0.659 . 80.2% 78.6% 79.4%, 0.557 ,a.626 . .4.00 2.80 2.90- 0.592 60.5 61 3:00,: 71% -0.479 2.40 0.486 .1.S0 .90. -1.85 77.6% 0.450 0.415 2.002.10- 77.8% 2.05 -2.50 2.65 . .2.55 68.9% -0.515 +2.80 2.85 . *2.80 68.7% -0.551 -0.536 62 62.5 3.20 77% 68.1% APR 26 19 (15 DAYS) IV: 63.4% -0.348 -0.372 4.504.70 c 00 4.204.40. 0.652 0.629 0.605 -3.60 3.80 . . 3.70 73.8% 0.580 0.529 58.5 59 1.80 -2.202.352.30 . 2.35 0.00 2.402.55 0.396 65.2% 63.5% 62.7% 61.9% 3.10 3.30 2.652.80 2.25 2.40 3.30 2.75 72.1% 0.479 73.2% 61 62 0.471 -0.522 0.572 3.70 4.20 3.60 . - 2.2071.8 0.429 Fill the table below with the price that you would pay for one option contract. Use the ask and remember that each contract has a multiplier of 100 shares. For each contract, indicate if is in-the-money, at-the-money, or out-of-the-money. Also, compute the intrinsic value and the time value f it Price Moneyness (Current Intrinsic Time Value price is $60.85) O In-the-money O At-the-money Value Call option with 59.50 Strike and expiration on April 12 Out-of-the-money a In-the-money O At-the-money Call option with 62.00 Strike and expiration on April 12 Out-of-the-money Call option with 62.00 Strike and expiration on April 26 O In-the-money At-the-money OOut-of-the-money For the options with expiration on April 12, which option is more expensive, the one that is out- of-the-money or the one that is in-the-money? For the option with the 62.00 strike, does the time value increase with the expiration? optton Strategies Case 1: Long Call Tim sees on Twitter that LYFT is likely to breakout. He buys the at-the-money call (strike 61.00) with an expiration of April 26th, 2019. Using the ask price, how much does he pay for the contract? What is the price that the stock must reach for Tim to break even after the premium is taker into account? Case 4: Covered Call Susan already owns 100 shares of LYFT. She thinks that it is unlikely that the price will go above 61 in the short term. She sells the call option with a strike of 61 and expiration on April 26, 19. How much does she make in premiums? (using the bid price) Case 5: Straddle Eduardo thinks that the price of LYFT will remain stable until April 12th, 2019. He sells both a call and a put option with expiration of April 12th, 2019 and a strike of 60.50. How much does he receive in premiums for the options (using the bid prices)? What is the stock price range where he can make a profit? You have $1 million to invest today. You are bullish about Bitcoin and you want to leverage your investment by taking a long position in Bitcoin futures CME Bitcoin Futures contract The May 2019 Bitcoin contract pays 5 times the CME CF Bitcoin reference rate on May 31, 2019. You have the following information about the contract: Spot level for Bitcoin on April 15, 2019 (So):4,999 Futures price (Fo): 5,015 Discount rate (rr annual): 2.50% Time to expiration: 0.13 years What should be the price of the futures contract? Based on the current futures price of 5,015, is there an arbitrage opportunity? YES NO If the price of the futures was 4,900 instead of 5,015, would you buy or sell the future contract to take advantage of the arbitrage opportunity? BUY SELL When you enter the long position today, do you have to exchange money with the party that takes the short position? YES NO Do you have to set other money aside? What is it called? LYFT recently had an IPO and now has options available for trading. This is the option chain for LYFT on April 11th, 2019 at the close. For option purchases, we use the column with the ask prices. When selling options, we assume that the seller gets the bid price. LYFT Stock Price: 60.85 LYTT Cals and Puts +0.73 (+1.21%) 60.85 LIST VIEW 8STRIKES 3 MONTHS SMART LYFT 100 PUTS CALLS DESCRIPTION LAST IV CLOSEDELTA ASK LASTV CLOSE DELTA 73.3% ASK APR 12 19 (L DAY) .0.35 0.40 . . 0.35 89.1% -0.186 .0.45 0.55- .0.55 88.3% .0.247 .0.60 0.65- .0.65 85.7% -0.320 .0.60 0.90. . 0.85 87.5% -0.402 .1.05 1.10. . 1.05 85.6% -0490 1.20 .1.55 1.65 . . 1.60 83.2% -0.663 . 1.95 2.302.50 1.952.10 92.9% 59 59.5 60 60.5 0.753 1.60 1.75-1.75 90.8% 0.680 90 90.6% 1.301.40. 1.001.15. 0.593 0.510 1.05 .0.80 0.90 . . 0.85 90.396 0.419 84% -0.531 0.332 0.50 87.5% . 0.254 +0.60 0.70. *0.60 87.2% 0.450.55- 82.5% -0.745; 62.5 APR 18 19 7 DAYS) : 65.8% v1.40, 1.50 . . 1.4S 72.9% -0.341 +1.60 1.70 . . 1.65 72.2% -0.375 .1.80 1.90 . . 1.85 71.6% -0.408 -0.444 3.403.60 81.3% 0.659 . 80.2% 78.6% 79.4%, 0.557 ,a.626 . .4.00 2.80 2.90- 0.592 60.5 61 3:00,: 71% -0.479 2.40 0.486 .1.S0 .90. -1.85 77.6% 0.450 0.415 2.002.10- 77.8% 2.05 -2.50 2.65 . .2.55 68.9% -0.515 +2.80 2.85 . *2.80 68.7% -0.551 -0.536 62 62.5 3.20 77% 68.1% APR 26 19 (15 DAYS) IV: 63.4% -0.348 -0.372 4.504.70 c 00 4.204.40. 0.652 0.629 0.605 -3.60 3.80 . . 3.70 73.8% 0.580 0.529 58.5 59 1.80 -2.202.352.30 . 2.35 0.00 2.402.55 0.396 65.2% 63.5% 62.7% 61.9% 3.10 3.30 2.652.80 2.25 2.40 3.30 2.75 72.1% 0.479 73.2% 61 62 0.471 -0.522 0.572 3.70 4.20 3.60 . - 2.2071.8 0.429 Fill the table below with the price that you would pay for one option contract. Use the ask and remember that each contract has a multiplier of 100 shares. For each contract, indicate if is in-the-money, at-the-money, or out-of-the-money. Also, compute the intrinsic value and the time value f it Price Moneyness (Current Intrinsic Time Value price is $60.85) O In-the-money O At-the-money Value Call option with 59.50 Strike and expiration on April 12 Out-of-the-money a In-the-money O At-the-money Call option with 62.00 Strike and expiration on April 12 Out-of-the-money Call option with 62.00 Strike and expiration on April 26 O In-the-money At-the-money OOut-of-the-money For the options with expiration on April 12, which option is more expensive, the one that is out- of-the-money or the one that is in-the-money? For the option with the 62.00 strike, does the time value increase with the expiration? optton Strategies Case 1: Long Call Tim sees on Twitter that LYFT is likely to breakout. He buys the at-the-money call (strike 61.00) with an expiration of April 26th, 2019. Using the ask price, how much does he pay for the contract? What is the price that the stock must reach for Tim to break even after the premium is taker into account? Case 4: Covered Call Susan already owns 100 shares of LYFT. She thinks that it is unlikely that the price will go above 61 in the short term. She sells the call option with a strike of 61 and expiration on April 26, 19. How much does she make in premiums? (using the bid price) Case 5: Straddle Eduardo thinks that the price of LYFT will remain stable until April 12th, 2019. He sells both a call and a put option with expiration of April 12th, 2019 and a strike of 60.50. How much does he receive in premiums for the options (using the bid prices)? What is the stock price range where he can make a profit? You have $1 million to invest today. You are bullish about Bitcoin and you want to leverage your investment by taking a long position in Bitcoin futures CME Bitcoin Futures contract The May 2019 Bitcoin contract pays 5 times the CME CF Bitcoin reference rate on May 31, 2019. You have the following information about the contract: Spot level for Bitcoin on April 15, 2019 (So):4,999 Futures price (Fo): 5,015 Discount rate (rr annual): 2.50% Time to expiration: 0.13 years What should be the price of the futures contract? Based on the current futures price of 5,015, is there an arbitrage opportunity? YES NO If the price of the futures was 4,900 instead of 5,015, would you buy or sell the future contract to take advantage of the arbitrage opportunity? BUY SELL When you enter the long position today, do you have to exchange money with the party that takes the short position? YES NO Do you have to set other money aside? What is it called