Answered step by step

Verified Expert Solution

Question

1 Approved Answer

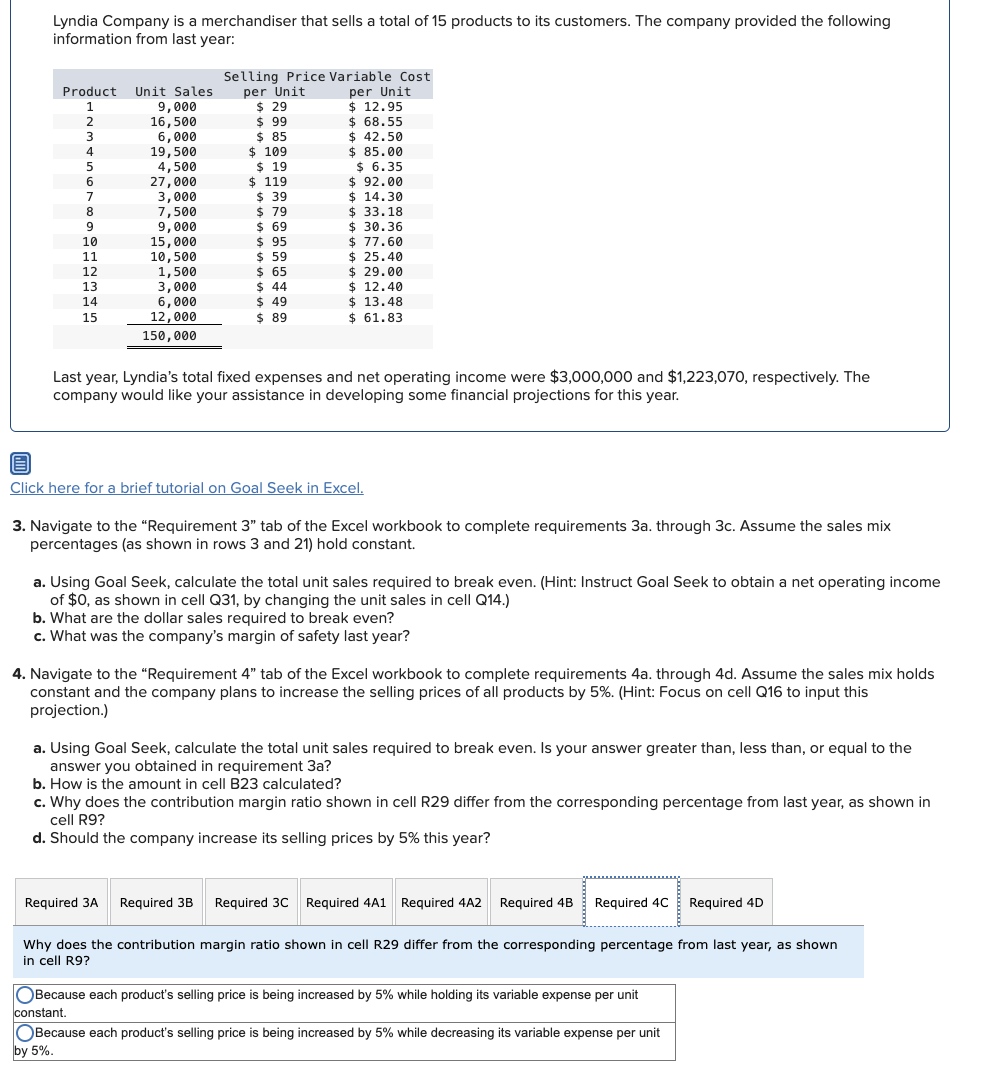

Lyndia Company is a merchandiser that sells a total of 1 5 products to its customers. The company provided the following information from last year:

Lyndia Company is a merchandiser that sells a total of products to its customers. The company provided the following

information from last year:

Last year, Lyndia's total fixed expenses and net operating income were $ and $ respectively. The

company would like your assistance in developing some financial projections for this year.

Click here for a brief tutorial on Goal Seek in Excel.

Navigate to the "Requirement tab of the Excel workbook to complete requirements a through c Assume the sales mix

percentages as shown in rows and hold constant.

a Using Goal Seek, calculate the total unit sales required to break even. Hint: Instruct Goal Seek to obtain a net operating income

of $ as shown in cell Q by changing the unit sales in cell Q

b What are the dollar sales required to break even?

c What was the company's margin of safety last year?

Navigate to the "Requirement tab of the Excel workbook to complete requirements a through d Assume the sales mix holds

constant and the company plans to increase the selling prices of all products by Hint: Focus on cell Q to input this

projection.

a Using Goal Seek, calculate the total unit sales required to break even. Is your answer greater than, less than, or equal to the

answer you obtained in requirement a

b How is the amount in cell B calculated?

c Why does the contribution margin ratio shown in cell R differ from the corresponding percentage from last year, as shown in

cell R

d Should the company increase its selling prices by this year?

Why does the contribution margin ratio shown in cell R differ from the corresponding percentage from last year, as shown

in cell R

Because each product's selling price is being increased by while holding its variable expense per unit

constant.

Because each product's selling price is being increased by while decreasing its variable expense per unit

by

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started