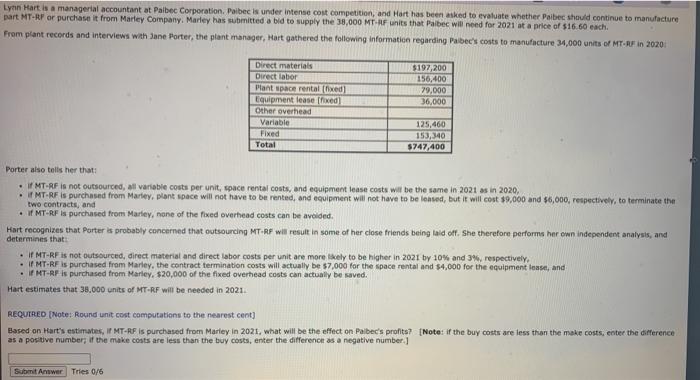

Lynn Hart is a managerial accountant at Palbec Corporation. Paibec is under intense cost competition, and Hart has been asked to evaluate whether Paibec should continue to manufacture part MT-RP or purchase it from Marley Company. Marley has submitted a bid to supply the 38,000 MT AF units that Palbec will need for 2021 at a price of $16.60 each From plant records and interviews with Jane Porter, the plant manager, Hart gathered the following information regarding Paibee's costs to manufacture 34,000 units of MT-RF in 2020 $197,200 156,400 79,000 36,000 Direct materials Direct labor Plant space rental (fixed) Equipment lease fixed Other overhead Variable Fixed Total 125,460 153,340 5747,400 Porter also tells her that MT-RF is not outsourced, all variable costs per unit, space rental costs, and equipment lease costs will be the same in 2021 as in 2020, IMT-RF is purchased from Marley, plant space will not have to be rented, and equipment will not have to be losed, but it will cost $9,000 and $6,000, respectively, to terminate the two contracts, and If MT-RF is purchased from Marley, none of the fixed overhead costs can be avoided. Hart recognizes that Porter is probably concerned that outsourcing MT-RF will result in some of her close friends being laid off. She therefore performs her own independent analysis, and determines that If MT-RF is not outsourced, direct material and direct labor costs per unit are more likely to be higher in 2021 by 10% and 3%, respectively. MT-RF is purchased from Marley, the contract termination costs will actually be $7,000 for the space rental and $4,000 for the equipment lease, and FNT RF is purchased from Marley, $20,000 of the fixed overhead costs can actually be saved. Hart estimates that 38,000 units of MT-RF will be needed in 2021 REQUIRED (Note: Round unit cost computations to the nearest cent) Based on Hart's estimates, If MT-RF is purchased from Marley in 2021, what will be the effect on Paibec's profits? (Note: if the buy costs are less than the make costs, enter the difference as a positive number if the make costs are less than the buy costs, enter the difference as a negative number] Submit Answer: Tries 0/6