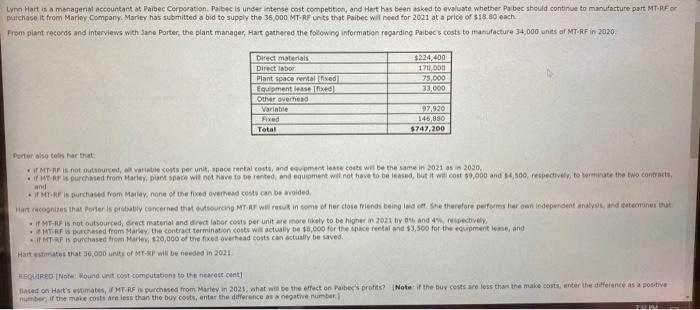

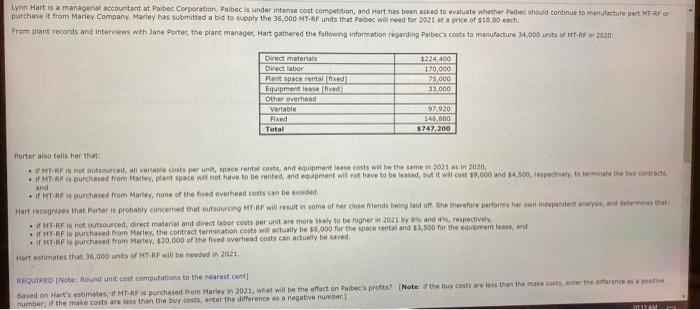

Lynn Hart is a managerial accountanta Pabec Corporation. Paibec is under intense cost competition, and Hart has been asked to evaluate whether Pabec should continue to manufacture part MT-RFOR purchase it from Marley Company. Mariey has submitted a bid to supply the 35,000 MT. RF units that Paibec will need for 2021 at a price of $18.80 each From plant records and interviews with Jane Porter, the plant manager, Hart gathered the following information regarding Paibec costs to manufacture 34,000 units of MIT-RF in 2020 $224,400 170,000 25,000 33,000 Direct materials Direct labor Plant space rental (ixed Eement, lease fixed Other overhead Variable Fixed Total 92920 146,880 $747,200 Porriso to that MTR is not outsourced, Variable costs per unit, pace rental costs, and evento costs will be the same in 2021 as in 2030, . HTF purchased from Harley, Dunt space will not have to be rented and equipment will not have to besed, but it will cost $9.000 and 14,500, respectively, to terminate the two contracts and IMT AF is purchased from Marley, none of the lived overhead costs can be avoided Harrucognies that porter is probably concerned that outsourcing MTR wisu in some of her close friends being in the therefore performs her own independent analys, and termines that . Mis not outsourced, direct material and Grect labor conta per unit me more likely to be higher in 2021 by 04 and spectively, HTRF chased from Marley contract termination costs will actually be $5,000 for the space rental and $3,500 for the equipment least, and TAPI purchased from Marley, 170,000 of the fixed overhead costs can actually be saved. Hart estimates that 36,000 units of MTF will be needed in 2001 HEQUIRED (NoteHound unit cost computations to the newest cent laced on Hart's mates, HTRF purchased from Marley in 2023, what will be the effect on aibe prots? Note if the truy costs are less than the make costs, enter the difference as a positive number if the male costs are less than the buy costs, enter the difference is negative number Lynn Hart is a managerial accountant at Padec Corporation Paibec is under intense cost competition, and Hart has been asked to evaluate whether he should continue to manufacture sart MT RF or purchase it from Marley Company, Marley has submitted a bid to supply the 36.000 MT-RF units that Paibec will need for 2021 at a price of $10.00 each From plant records and interviews with Jane Porter, the plant manager, Hart gathered the following information regarding Paibec's.costs to manufacture 34,000 units of HT-R 2020 Direct materials Direct labor Pant space rental fixed Equipment intelixed Other Overhead Variable Fixed Total $224,400 170,000 75,000 33.000 97,920 146,300 5747,200 Porter also tell her that . TRF is not outsource, all variatie costs per unit, space rental costs, and equipment was costs will be the same in 2021 ss in 2020, if HTR is purchased from Marley, plant space will not have to be rented, and equipment will not have to be seated, it wil.com 9,000 and 14,500, ripectively to make it contact and if MT AF is purchased from Mare, none of the red over and costs can be avoided. Hart recognizes that Porter is probably concerned that outsourcing I will result in some of her dose Manda belgado. She therefore performs her own inderly, and determines that .. not outsourced direct material and direct labor couts per unit are more kely to be higher in 2021. by, and respectively HTRF is purchased from Marley, the contract termination costs will actually $3,000 for the space rental and $3,500 for the equipment feme, . if HTRFI purchased from Marley, 120,000 of the lived overhead costs can actually be saved. Hart estimates that 36,000 units of HT. I will be needed in 2021 REQUIRED INote: Round unit cost computations to the nearest Cent Based on Hart's estimates, MT-is purchased from Marley in 2021, what will be the effect on Pibec pro (Notethe buy costs were tran the make cott, enter the recept number if the male costs are less than the buy costs, enter the difference as a negative number LI