Question

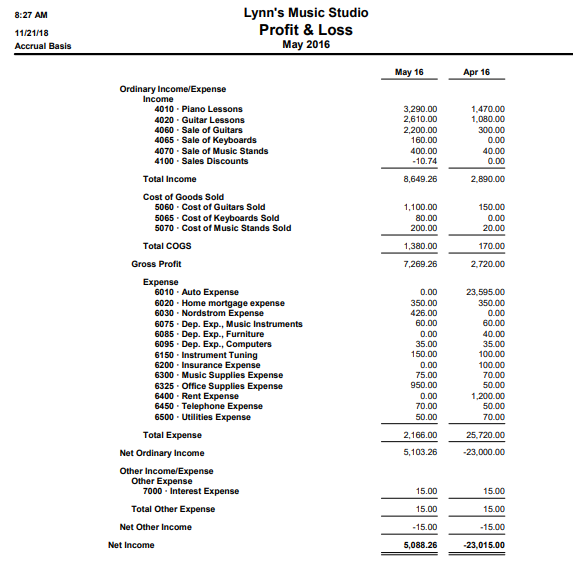

Lynns Music Studio (Extra Credit 20 points) Background: You are the manager for Lynns Music Studio. You have been in business for about 2 years.

Lynns Music Studio (Extra Credit 20 points)

Background:

You are the manager for Lynns Music Studio. You have been in business for about 2 years. The company is both a retailer and a service company. The company teaches piano and guitar lessons, mainly to schools and some to private individuals at both your store and at the schools. You sell guitars, keyboards, and music stands. You hired me to do your books because you want to dedicate your time to sales and growing the business. Every month on Tuesday morning at 10:30 you hold a staff meeting and go over the financial statements for the month. I pass out the Comparative Balance Sheet and Income Statement for review. Use the Need to Know to find the mistakes in my reports.

Need to Know:

The owners want accounting to be done on an accrual basis, not cash basis.

Vendors are approved by management, and are mainly music instrument-based vendors.

On January 1, the company renewed its annual insurance policy and paid the total amount at that time.

The rent for the store front is $600 per month.

The company pays the accountant and secretary through QuickBooks using an account called Staff Payroll Expense, and Staff Payroll Liability.

The company has an equal payment plan set up with the electric and the phone company.

The owner purchased a new company car in the month of April costing $23,595 that will be financed through My City Bank using a Note Payable. 100% financed no money down. The car will be depreciated each month according to an IRS approved depreciation schedule for 5 years.

Typically April is the best month for revenue sales as schools prepare for graduation in May. Historically sales tail off in May and then pick up during the summer month.

You authorized the purchase of a new Printer/Scanner in May costing $900.

All fixed assets depreciate and are recorded monthly rather than at the end of the year since the amount isnt that much. The accountant records month-end depreciation expense and accumulated depreciation.

Action:

Review the two financial statements by circling accounts and dollar amounts that may be incorrect. Now in a Word document, write your concerns. For example: Why is revenue so low? Next line, why werent funds deposited? Next line, who approved this expense account? Get the idea? Just one line per question. My job will be to head back to my office, red faced, and fix the errors.

How you earn points:

Identify and ask about at least 10 of the 21 mistakes in the two reports. You may come up with other errors not identified in my rubric. Think like a manager. Your job is to ask intelligent questions. Submit your Word Doc in Canvas by submission and attaching your Word Doc. I will give feedback on your submission, and include the points earned.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started