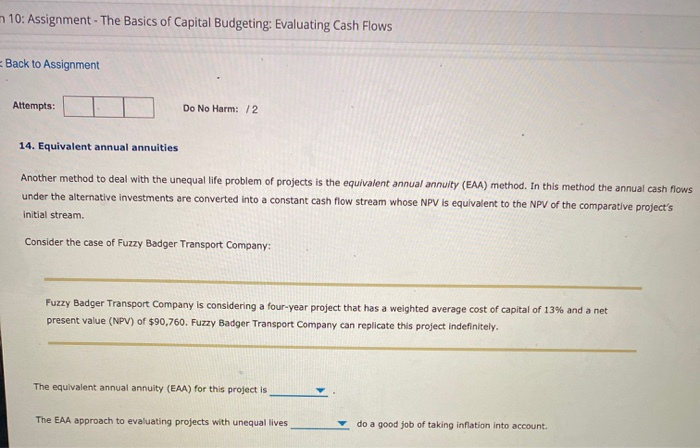

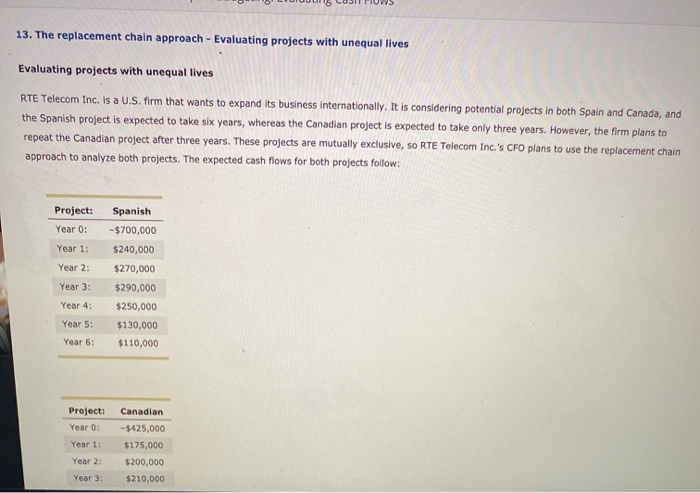

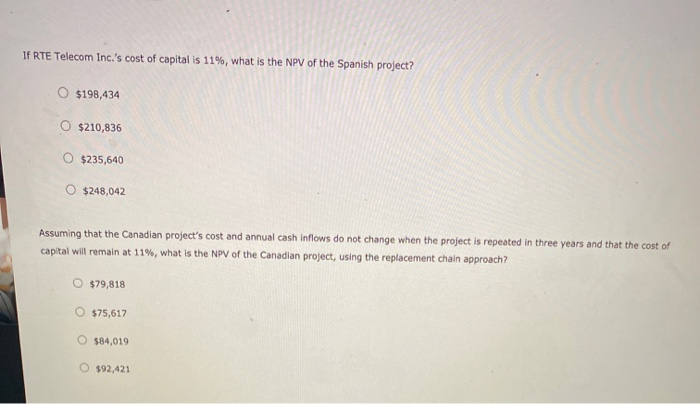

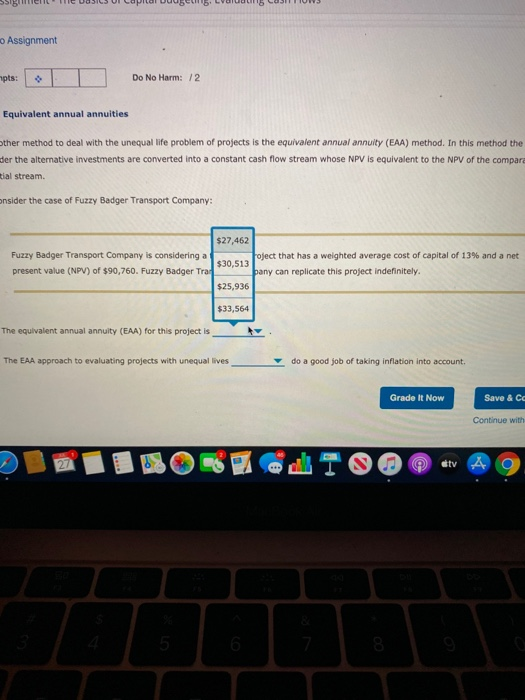

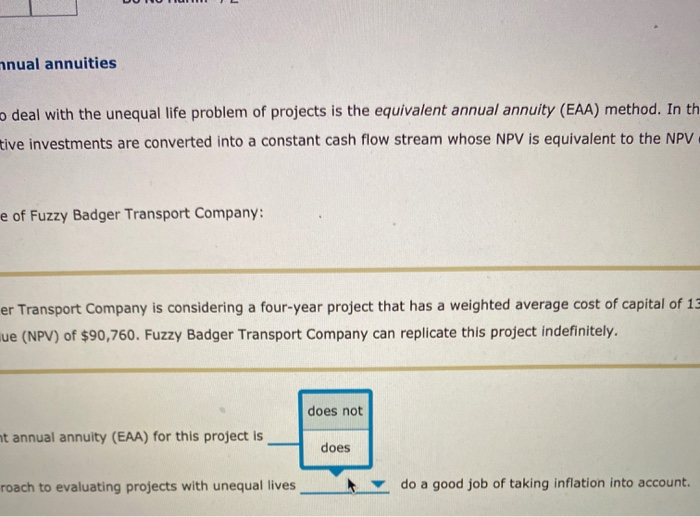

m 10: Assignment - The Basics of Capital Budgeting: Evaluating Cash Flows Back to Assignment Attempts: Do No Harm: 12 14. Equivalent annual annuities Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's initial stream. Consider the case of Fuzzy Badger Transport Company: Fuzzy Badger Transport Company is considering a four-year project that has a weighted average cost of capital of 13% and a net present value (NPV) of $90,760. Fuzzy Badger Transport Company can replicate this project indefinitely The equivalent annual annuity (EAA) for this project is The EAA approach to evaluating projects with unequal lives do a good job of taking inflation into account. 13. The replacement chain approach - Evaluating projects with unequal lives Evaluating projects with unequal lives RTE Telecom Inc. is a U.S. firm that wants to expand its business internationally. It is considering potential projects in both Spain and Canada, and the Spanish project is expected to take six years, whereas the Canadian project is expected to take only three years. However, the firm plans to repeat the Canadian project after three years. These projects are mutually exclusive, so RTE Telecom Inc.'s CFO plans to use the replacement chain approach to analyze both projects. The expected cash flows for both projects follow: Project: Year 0: Year 1: Year 2: Spanish -$700,000 $240,000 $270,000 $290,000 $250,000 $130,000 $110,000 Year 3: Year 4: Year 5: Year 6: Project: Year 0: Year 1: Canadian - $425,000 $175,000 $200,000 $210,000 Year 2: Year 3 IF RTE Telecom Inc.'s cost of capital is 11%, what is the NPV of the Spanish project? $198,434 O $210,836 $235,640 $248,042 Assuming that the Canadian project's cost and annual cash inflows do not change when the project is repeated in three years and that the cost of capital will remain at 11%, what is the NPV of the Canadian project, using the replacement chain approach? $79,818 O $75,617 $84,019 $92,421 Assignment mpts: Do No Harm: /2 Equivalent annual annuities other method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the der the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the compare tial stream. onsider the case of Fuzzy Badger Transport Company: Fuzzy Badger Transport Company is considering a present value (NPV) of $90,760. Fuzzy Badger Tra $27,462 Foject that has a weighted average cost of capital of 13% and a net $30,513 pany can replicate this project indefinitely $25,936 $33,564 The equivalent annual annuity (EAA) for this project is The EAA approach to evaluating projects with unequal lives do a good job of taking inflation into account. Grade It Now Save & Cc Continue with ctv 6 anual annuities o deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In th tive investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV e of Fuzzy Badger Transport Company: er Transport Company is considering a four-year project that has a weighted average cost of capital of 13 que (NPV) of $90,760. Fuzzy Badger Transport Company can replicate this project indefinitely. does not nt annual annuity (EAA) for this project is does roach to evaluating projects with unequal lives do a good job of taking inflation into account