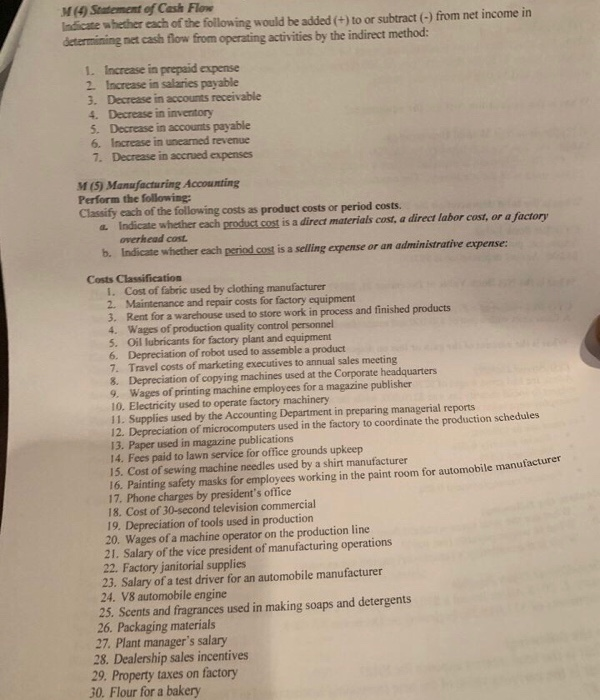

M (4) Statement of Cash Flow Indicate whether each of the following would be added (+)to or subtract (-) from net income in determining net cash flow from operating activities by the indirect method: 1. Increase in prepaid expense 2 Increase in salaries payable 3. Decrease in accounts receivable 4. Decrease in inventory 5. Decrease in accounts payable 6. Increase in unearned revenue 7. Decrease in accrued expenses M (5) Manufacturing Accounting Perform the following Classify each of the following costs as product costs or period costs. a Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory overkead cost. Indicate whether each period cos is a selling expense or an administrative expense: Costs 1. Cost of fabric used by clothing manufacturer 2. Maintenance and repair costs for factory equipment 3. Rent for a warehouse used to store work in process and finished products 4. Wages of production quality control personnel 5. Oil lubricants for factory plant and equipment 6. Depreciation of robot used to assemble a product 7. Travel costs of marketing executives to annual sales meeting 8. Depreciation of copying machines used at the Corporate headquarters 9. Wages of printing machine employees for a magazine publisher 10. Electricity used to operate factory machinery 11. Supplies used by the Accounting Department in preparing managerial reports 12. Depreciation of microcomputers used in the factory to coordinate the production schedules 13. Paper used in magazine publications 14. Fees paid to lawn service for office grounds upkeep 15. Cost of sewing machine needles used by a shirt manufacturer 16. Painting safety masks for employees working in the paint room for automobilnuac e manufacturer 17. Phone charges by president's office 18. Cost of 30-second television commercial 19. Depreciation of tools used in production 20. Wages of a machine operator on the production line 21. Salary of the vice president of manufacturing operations 22. Factory janitorial supplies 23. Salary of a test driver for an automobile manufacturer 24. V8 automobile engine 25. Scents and fragrances used in making soaps and detergents 26. Packaging materials 27. Plant manager's salary 28. Dealership sales incentives 29. Property taxes on factory 30. Flour for a bakery