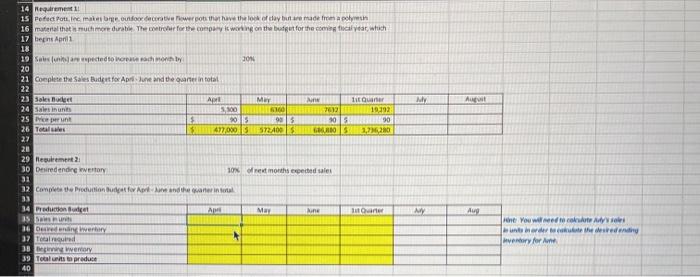

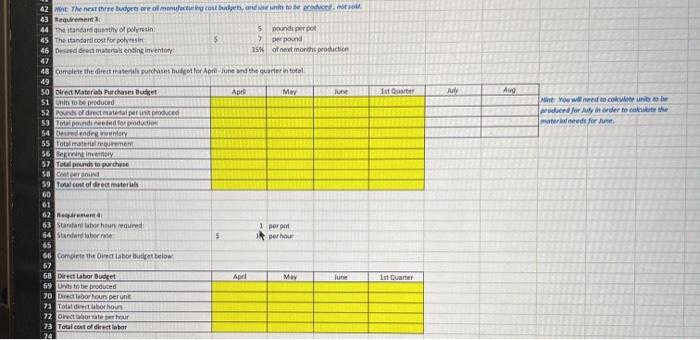

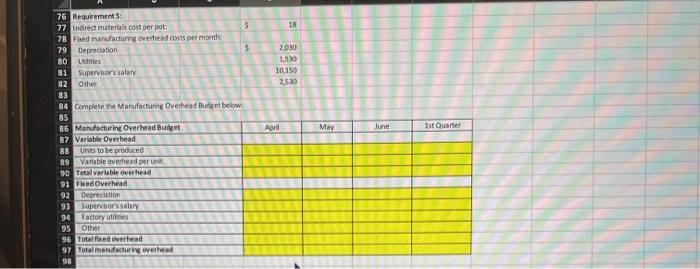

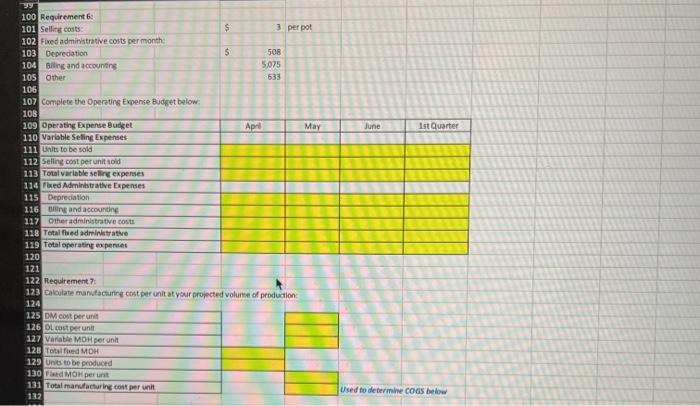

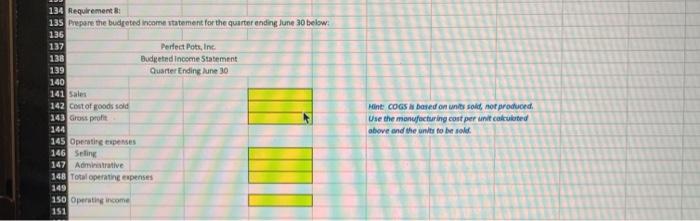

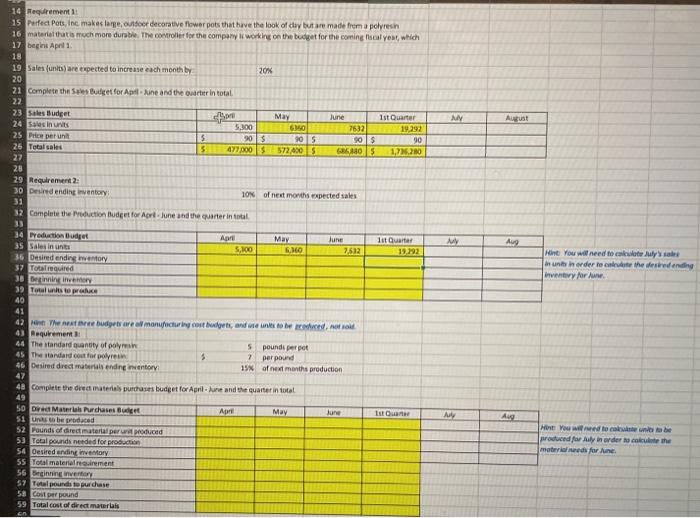

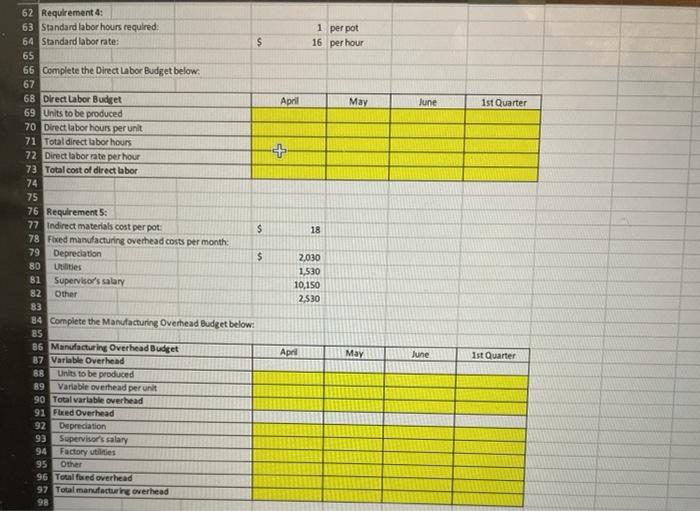

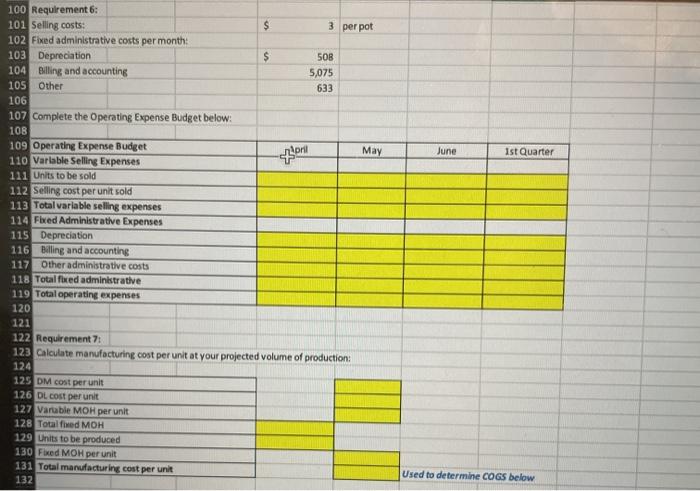

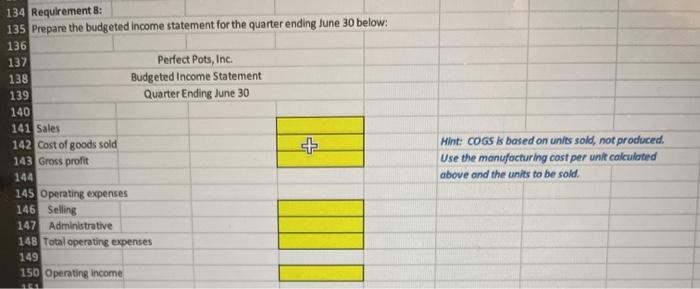

M A 14 Requirement 15 Pelect Potile maternative Powerpots that have the of day be made a plyn 16 material that is much more durable. The control for the company is writing on the budget for the comical year, which 17 bent April 18 19 Serpected to acho 301 20 21 Complete the Sales Badefox Apre and the quartet in total 22 23 S Budet April My Titan 24 Steinun 310000 19.192 25 Punt 5 2015 93 105 30 26 Totale $ 477.000 572.400$ HOS 3,736,280 27 21 29 feguirement: 30 Deredending wory 10% ofret months expected sales 31 12 Complete Production Budget And the water in 13 34 Production et A May ne Our ISS 16 Devening werbany 37 Tancred 38 WERY 39 Total units to produce 40 MY Aug Pre you will need to make dyr vary for A 1st Quarter ut Aug Min You will need to count to be produced in order to the matarred for 42 Mt The best the buttore of manufacturing contents and ineunter 43 Requirement 44 The standard quality of polyusin 5 pounds per por 45 The standard cost for presin $ 7 per pound 46 Daddrol marketing inventory 25% of next month production 47 48 Comelete the direct mater purchases budget for April-June and the quarter in total 49 50 Direct Mater Purchases. Budet April May June s1 units to be produced 52 Photmate per produced 50 Topounded for production 54 Devender 55 Totalment 56 Beginner 57 Total pounds to purchase Sa contro 59 Total cost of red materials 60 61 62 Roman 63 Starfar bor houred 1 per 64 Standard labor role $ i per hour 65 66 Complete the tabouret below 67 68 Direct Labor Budet April My June 69 Units to be produced 70 Direct labor hours perunt 71 Total descuborhous 72 Directorate per hour 73 Total cost direct labor 24 1st Quarter 18 2,030 1530 10.150 2,50 Agrl May June Ist Quarter 76 Requirements: 77 indirect materials cost per pot $ 78 Fired manufacturing overhead coves per month 79 Depreciation 5 80 Uites 81 Supervisor's salary 82 Other 83 84 Complete the Manufacturing Overhead Budget below 85 B6 Manufacturing Overhead Budget 87 Variable Overhead 88 Units to be produced 89 Variable overhead per una 90 Total variable overhead 91 Fked Overhead 92 Deprecation 93 Supervisor's salary 94 Factory tiles 95 Other 96 Total fixed overhead 97 Total mandring over 98 June Ist Quarter 100 Requirement 101 Selling costs $ 3 per pot 102 Fixed administrative costs per month 103 Depreciation $ 508 104 Bling and accounting 5,075 105 Other 106 107 Complete the Operating Expense Budget below 108 109 Operating Expense Budget April May 110 Variable Selling Expenses 111 Units to be sold 112 Selling cont per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Deprecation 116 ing and accounting 117 Other administrative costs 118 Total hedadministrative 119 Total operating experts 120 121 122 Requirement 7. 123 Calolate manufacturing cost per unit at your projected volume of production 124 125 DM cost per unit 126 OL cost per unit 127 Variable MOH per unit 128 Total Fed MOH 129 units to be produced 130 MOH perunt 131 Total manufacturing cost per unit 132 Used to determine coas below 134 Requirements 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Pots, Inc 138 Budgeted Income Statement 139 Quarter Ending lune 30 140 141 Sales 142 cost of goods sold 143 Gross profit ont COGS based on units sold, nor produced Use the manufacturing cost per un calculated above and the units to be solek 145 Operating expenses 146 Seling 147 Administrative 148 Total operating expenses 150 Operating income 151 14 Requirement1 15 Perfect Pots, Inc. makes large, outdoor decorative flower pots that have the look of day but are made from a polyresin 16 material that is much more durable. The controller for the company is working on the budget for the coming cal year, which 17 begins April 18 19 Sales funts) are expected to increase each month by 20% 20 21 Complete the Sales Budget for Apriline and the arter in total 22 23 Sales Budget May June 1st Quarter 24 Sie in uns 5.300 MO 7632 19,292 25 Price per unit $ 90 S90 S 90 $ 90 26 Total sales 5 477000 572 4305 605 1.215.20 27 28 29 Requirement: 30 Derending inventory 10% of next months expected sales 31 32 Complete the production Budget for Apr June and the quarter in total MY ADE 1st Quartas 19.292 Aug Hint You will need to cely in unit harder to the reden Invey for 34 Production but May June 35 Sale in uns 5,100 6.100 7,512 36 Desired ending inventory 37 Tourired 30 Beginning very 39 Total units to prace 40 41 42 The ne budgets are manufacturing costs, and went to be 43 Requirement 44 The standard quantity of polyse 5 pounds perpet 45 The standard cost for polyre $ 7 per pound 46 Desired direct materials ending into 15% of next months production 47 48 Complete the direct material purchases budget for Agriture and the quarter in total 49 50 D Material Purchases Budget May June 51 Uso be proced 52 Pounds of directora proced 53 Total pounds needed for production 54 Desired ending inventory 55 Total materialement SG Beginning invention 57 Total pounds to purchase 58 Cost per pound 59 Total cost of direct materiais Ist Quarte A Aug You will need to make it the produced for Aly in order to collete the materials for ne en 1 per pot 16 per hour April May June 1st Quarter 5 $ 18 62 Requirement 4: 63 Standard labor hours required: 64 Standard labor rate: $ 65 66 Complete the Direct Labor Budget below. 67 68 Direct Labor Budget 69 Units to be produced 70 Direct labor hours per unit 71 Total direct labor hours 72 Direct labor rate per hour 73 Total cost of direct labor 74 75 76 Requirement : 77 Indirect materials cost per pot: $ 78 Fixed manufacturing overhead costs per month 79 Depreciation $ 80 Utilities 81 Supervisor's salary 82 Other B3 34 Complete the Manufacturing Overhead Budget below: 85 86 Manufacturing Overhead Budget 87 Variable Overhead 88 Units to be produced 89 Variable overhead per unit 90 Total variable overhead 91 Fixed Overhead 92 Depreciation 93 Supervisor's salary 94 Factory utilities 95 Other 96 Toulfused overhead 97 Total manufacturing overhead 98 2030 1,530 10,150 2,530 April May June 1st Quarter June Ist Quarter 100 Requirement 6: 101 Seling costs: $ 3 per pot 102 Fixed administrative costs per month 103 Depreciation 50B 104 Billing and accounting 5,075 105 Other 633 106 107 Complete the Operating Expense Budget below: 10B 109 Operating Expense Budget May 110 Variable Selling Expenses 111 Units to be sold 112 Selling cost per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Depreciation 116 Billing and accounting 117 Other administrative costs 118 Total fixed administrative 119 Total operating expenses 120 121 122 Requirement : 123 Calculate manufacturing cost per unit at your projected volume of production: 124 125 DM cost per unit 126 DL cost per unit 127 Varable MOH per unit 128 Totalfred MOH 129 Units to be produced 130 Fixed MOH per unit 131 Total manufacturing cost per unit 132 Used to determine COGS below 134 Requirement 8: 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Pots, Inc. 138 Budgeted Income Statement 139 Quarter Ending June 30 140 141 Sales 142 Cost of goods sold 143 Gross profit 144 145 Operating expenses 146 Selling 147 Administrative 148 Total operating expenses 149 150 Operating income Hint: COGS is based on units sold, not produced. Use the manufacturing cost per unit calculated above and the units to be sold. M A 14 Requirement 15 Pelect Potile maternative Powerpots that have the of day be made a plyn 16 material that is much more durable. The control for the company is writing on the budget for the comical year, which 17 bent April 18 19 Serpected to acho 301 20 21 Complete the Sales Badefox Apre and the quartet in total 22 23 S Budet April My Titan 24 Steinun 310000 19.192 25 Punt 5 2015 93 105 30 26 Totale $ 477.000 572.400$ HOS 3,736,280 27 21 29 feguirement: 30 Deredending wory 10% ofret months expected sales 31 12 Complete Production Budget And the water in 13 34 Production et A May ne Our ISS 16 Devening werbany 37 Tancred 38 WERY 39 Total units to produce 40 MY Aug Pre you will need to make dyr vary for A 1st Quarter ut Aug Min You will need to count to be produced in order to the matarred for 42 Mt The best the buttore of manufacturing contents and ineunter 43 Requirement 44 The standard quality of polyusin 5 pounds per por 45 The standard cost for presin $ 7 per pound 46 Daddrol marketing inventory 25% of next month production 47 48 Comelete the direct mater purchases budget for April-June and the quarter in total 49 50 Direct Mater Purchases. Budet April May June s1 units to be produced 52 Photmate per produced 50 Topounded for production 54 Devender 55 Totalment 56 Beginner 57 Total pounds to purchase Sa contro 59 Total cost of red materials 60 61 62 Roman 63 Starfar bor houred 1 per 64 Standard labor role $ i per hour 65 66 Complete the tabouret below 67 68 Direct Labor Budet April My June 69 Units to be produced 70 Direct labor hours perunt 71 Total descuborhous 72 Directorate per hour 73 Total cost direct labor 24 1st Quarter 18 2,030 1530 10.150 2,50 Agrl May June Ist Quarter 76 Requirements: 77 indirect materials cost per pot $ 78 Fired manufacturing overhead coves per month 79 Depreciation 5 80 Uites 81 Supervisor's salary 82 Other 83 84 Complete the Manufacturing Overhead Budget below 85 B6 Manufacturing Overhead Budget 87 Variable Overhead 88 Units to be produced 89 Variable overhead per una 90 Total variable overhead 91 Fked Overhead 92 Deprecation 93 Supervisor's salary 94 Factory tiles 95 Other 96 Total fixed overhead 97 Total mandring over 98 June Ist Quarter 100 Requirement 101 Selling costs $ 3 per pot 102 Fixed administrative costs per month 103 Depreciation $ 508 104 Bling and accounting 5,075 105 Other 106 107 Complete the Operating Expense Budget below 108 109 Operating Expense Budget April May 110 Variable Selling Expenses 111 Units to be sold 112 Selling cont per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Deprecation 116 ing and accounting 117 Other administrative costs 118 Total hedadministrative 119 Total operating experts 120 121 122 Requirement 7. 123 Calolate manufacturing cost per unit at your projected volume of production 124 125 DM cost per unit 126 OL cost per unit 127 Variable MOH per unit 128 Total Fed MOH 129 units to be produced 130 MOH perunt 131 Total manufacturing cost per unit 132 Used to determine coas below 134 Requirements 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Pots, Inc 138 Budgeted Income Statement 139 Quarter Ending lune 30 140 141 Sales 142 cost of goods sold 143 Gross profit ont COGS based on units sold, nor produced Use the manufacturing cost per un calculated above and the units to be solek 145 Operating expenses 146 Seling 147 Administrative 148 Total operating expenses 150 Operating income 151 14 Requirement1 15 Perfect Pots, Inc. makes large, outdoor decorative flower pots that have the look of day but are made from a polyresin 16 material that is much more durable. The controller for the company is working on the budget for the coming cal year, which 17 begins April 18 19 Sales funts) are expected to increase each month by 20% 20 21 Complete the Sales Budget for Apriline and the arter in total 22 23 Sales Budget May June 1st Quarter 24 Sie in uns 5.300 MO 7632 19,292 25 Price per unit $ 90 S90 S 90 $ 90 26 Total sales 5 477000 572 4305 605 1.215.20 27 28 29 Requirement: 30 Derending inventory 10% of next months expected sales 31 32 Complete the production Budget for Apr June and the quarter in total MY ADE 1st Quartas 19.292 Aug Hint You will need to cely in unit harder to the reden Invey for 34 Production but May June 35 Sale in uns 5,100 6.100 7,512 36 Desired ending inventory 37 Tourired 30 Beginning very 39 Total units to prace 40 41 42 The ne budgets are manufacturing costs, and went to be 43 Requirement 44 The standard quantity of polyse 5 pounds perpet 45 The standard cost for polyre $ 7 per pound 46 Desired direct materials ending into 15% of next months production 47 48 Complete the direct material purchases budget for Agriture and the quarter in total 49 50 D Material Purchases Budget May June 51 Uso be proced 52 Pounds of directora proced 53 Total pounds needed for production 54 Desired ending inventory 55 Total materialement SG Beginning invention 57 Total pounds to purchase 58 Cost per pound 59 Total cost of direct materiais Ist Quarte A Aug You will need to make it the produced for Aly in order to collete the materials for ne en 1 per pot 16 per hour April May June 1st Quarter 5 $ 18 62 Requirement 4: 63 Standard labor hours required: 64 Standard labor rate: $ 65 66 Complete the Direct Labor Budget below. 67 68 Direct Labor Budget 69 Units to be produced 70 Direct labor hours per unit 71 Total direct labor hours 72 Direct labor rate per hour 73 Total cost of direct labor 74 75 76 Requirement : 77 Indirect materials cost per pot: $ 78 Fixed manufacturing overhead costs per month 79 Depreciation $ 80 Utilities 81 Supervisor's salary 82 Other B3 34 Complete the Manufacturing Overhead Budget below: 85 86 Manufacturing Overhead Budget 87 Variable Overhead 88 Units to be produced 89 Variable overhead per unit 90 Total variable overhead 91 Fixed Overhead 92 Depreciation 93 Supervisor's salary 94 Factory utilities 95 Other 96 Toulfused overhead 97 Total manufacturing overhead 98 2030 1,530 10,150 2,530 April May June 1st Quarter June Ist Quarter 100 Requirement 6: 101 Seling costs: $ 3 per pot 102 Fixed administrative costs per month 103 Depreciation 50B 104 Billing and accounting 5,075 105 Other 633 106 107 Complete the Operating Expense Budget below: 10B 109 Operating Expense Budget May 110 Variable Selling Expenses 111 Units to be sold 112 Selling cost per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Depreciation 116 Billing and accounting 117 Other administrative costs 118 Total fixed administrative 119 Total operating expenses 120 121 122 Requirement : 123 Calculate manufacturing cost per unit at your projected volume of production: 124 125 DM cost per unit 126 DL cost per unit 127 Varable MOH per unit 128 Totalfred MOH 129 Units to be produced 130 Fixed MOH per unit 131 Total manufacturing cost per unit 132 Used to determine COGS below 134 Requirement 8: 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Pots, Inc. 138 Budgeted Income Statement 139 Quarter Ending June 30 140 141 Sales 142 Cost of goods sold 143 Gross profit 144 145 Operating expenses 146 Selling 147 Administrative 148 Total operating expenses 149 150 Operating income Hint: COGS is based on units sold, not produced. Use the manufacturing cost per unit calculated above and the units to be sold