Question

M Company purchased a new Twinky Stuffing machine on January 1, 2019 for $160,000. The machine will last for 8 years and then be worthless.

M

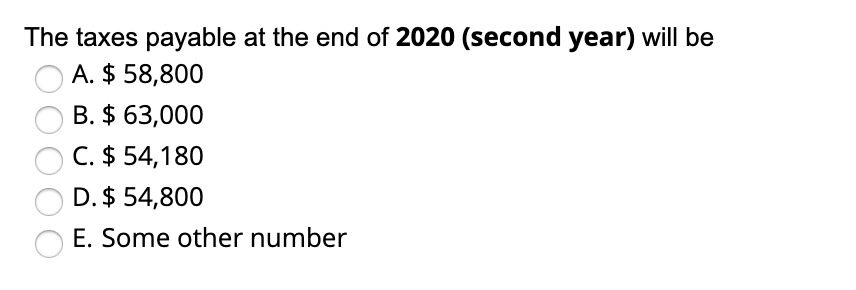

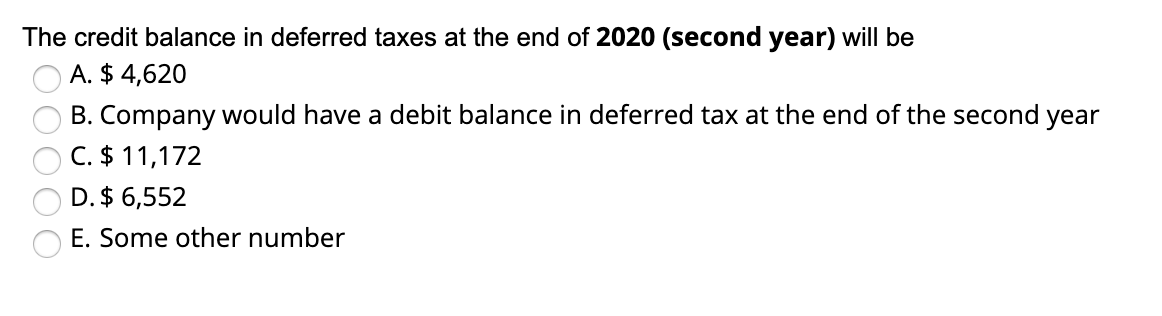

Company purchased a new Twinky Stuffing machine on January 1, 2019 for $160,000. The machine will last for 8 years and then be worthless. For financial reporting purposes, the company uses straight-line depreciation. (The company takes year depreciation in the year of purchase and in the year of sale). The Twinky Stuffer is considered 5-year property for tax purposes. The tax rate is 30% and the company pays current year taxes in the following year. The MACRS percentages for 5-year property are: 20.00; 32.00; 19.20; 11.52; 11.52; and 5.76. The company receives $10,000 in municipal bond interest each year. The company earned $300,000 before depreciation and taxes. (You may use this $300,000 income before depreciation and taxes for future years, also). The tax expense for 2019 will be

Company purchased a new Twinky Stuffing machine on January 1, 2019 for $160,000. The machine will last for 8 years and then be worthless. For financial reporting purposes, the company uses straight-line depreciation. (The company takes year depreciation in the year of purchase and in the year of sale). The Twinky Stuffer is considered 5-year property for tax purposes. The tax rate is 30% and the company pays current year taxes in the following year. The MACRS percentages for 5-year property are: 20.00; 32.00; 19.20; 11.52; 11.52; and 5.76. The company receives $10,000 in municipal bond interest each year. The company earned $300,000 before depreciation and taxes. (You may use this $300,000 income before depreciation and taxes for future years, also). The tax expense for 2019 will be

| A. | $ 54,180 | |

| B. | $ 58,800 | |

| C. | Some other number | |

| D. | $ 63,000 | |

| E. | $ 60,600 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started