Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5. On March 1, 2021, Lala received a building property from her parents as inheritance with fair market value of P10,000,000.00. The property was

Problem 5. On March 1, 2021, Lala received a building property from her parents as inheritance with fair market value of P10,000,000.00. The property was acquired for P8,000,000.00 five years ago by her parents. The monthly rental income of the property is P100,000.00 with an average monthly expense of P20,000.00. Lala's taxable income for the year, if any is:

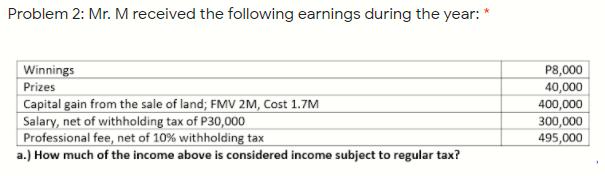

Problem 5. On March 1, 2021, Lala received a building property from her parents as inheritance with fair market value of P10,000,000.00. The property was acquired for P8,000,000.00 five years ago by her parents. The monthly rental income of the property is P100,000.00 with an average monthly expense of P20,000.00. Lala's taxable income for the year, if any is:M Corporation provided you with the following records: Payment for damages for unrealized profits deposited in court by a competitor in favor of M Corporation Interest credited on peso-savings deposit, net of tax Decrease in value of investment in bonds, not yet collected Matured interest on coupon bonds, not yet collected Cancellation of indebtedness from J Corporation Increase in the fair market value of ABC equity investments Profit share in joint venture not yet received Based on the foregoing information, how much is the total amount of realized income of M Corporation? P60,000 40,000 50,000 80,000 120,000 30,000 200,000

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

PROBLEM 1 Determine the total amount of realized income for M Corporation Interest credited on pesosavings deposit net of tax P40000 Matured interest on coupon bonds not yet collected P50000 Cancellat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started