Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Total deductible expenses using itemized deduction. 2. Total deductible expenses using OSD. 3. Net taxable income using the amount that provides tax advantage. 4. Discuss

Total deductible expenses using itemized deduction.

2. Total deductible expenses using OSD.

3. Net taxable income using the amount that provides tax advantage.

4. Discuss what method of deduction provides tax advantage.

2. Total deductible expenses using OSD.

3. Net taxable income using the amount that provides tax advantage.

4. Discuss what method of deduction provides tax advantage.

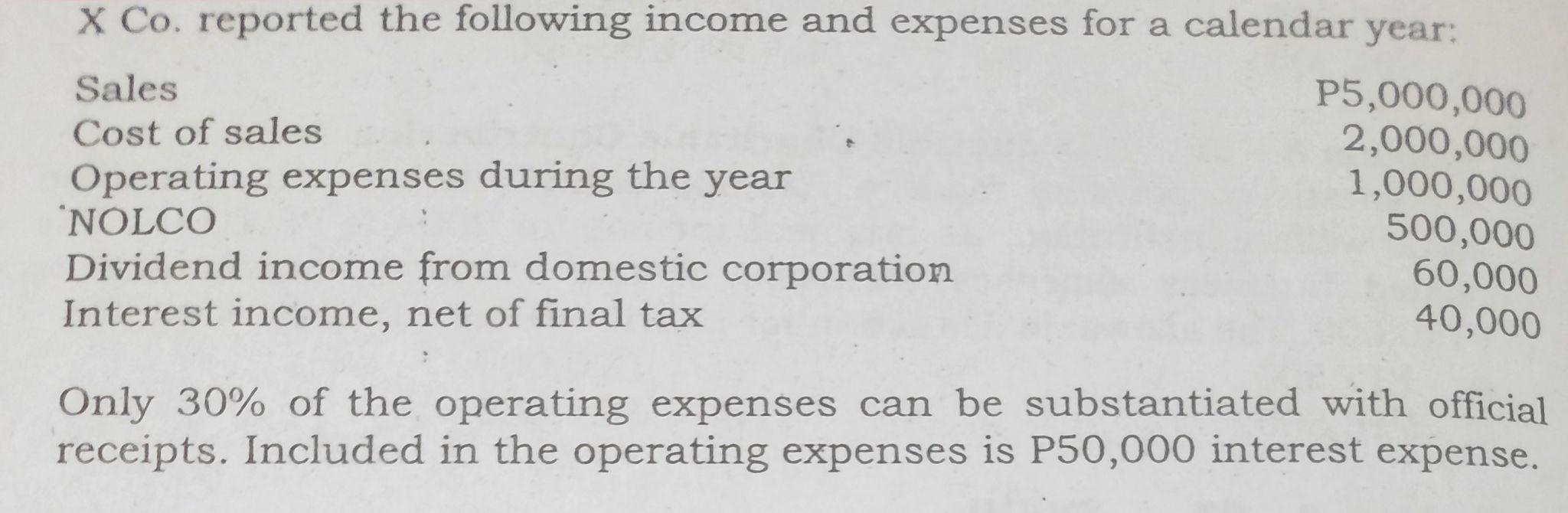

X Co. reported the following income and expenses for a calendar year: P5,000,000 2,000,000 1,000,000 Sales Cost of sales Operating expenses during the year NOLCO Dividend income from domestic corporation Interest income, net of final tax 500,000 60,000 40,000 Only 30% of the operating expenses can be substantiated with official receipts. Included in the operating expenses is P50,000 interest expense.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine the answers to the questions we need to calculate the deductible expenses using both itemized deduction and optional standard deduction O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started