Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What is the correct carrying value of the Patent as of December 31, 2018? What is the correct carrying value of the Licensing Agreement as

What is the correct carrying value of the Patent as of December 31, 2018?

What is the correct carrying value of the Licensing Agreement as of December 31, 2018?

What is the total retroactive adjustment to retained earnings in 2018 related to the Licensing agreements accounts?

What is the impairment loss recognized for the trademark (if any) correct carrying value of the Trademark as of December 31, 2018?

What is the correct carrying value of the Licensing Agreement as of December 31, 2018?

What is the total retroactive adjustment to retained earnings in 2018 related to the Licensing agreements accounts?

What is the impairment loss recognized for the trademark (if any) correct carrying value of the Trademark as of December 31, 2018?

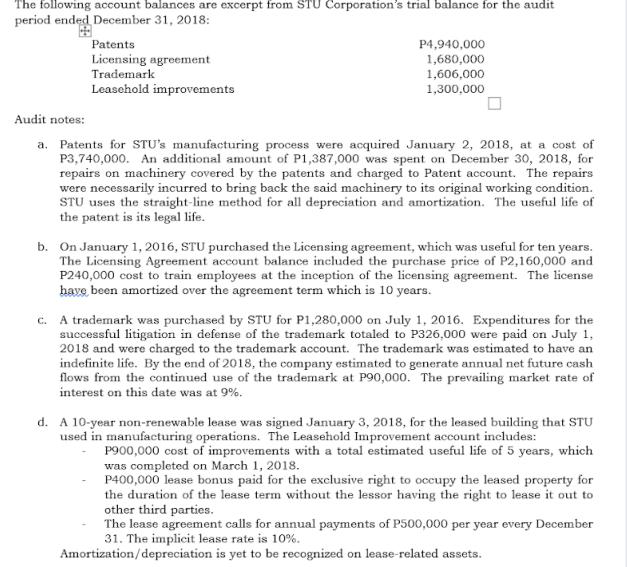

The following account balances are excerpt from STU Corporation's trial balance for the audit period ended December 31, 2018: Patents Licensing agreement Trademark Leasehold improvements P4,940,000 1,680,000 1,606,000 1,300.000 Audit notes: a. Patents for STU's manufacturing process were acquired January 2, 2018, at a cost of P3,740,000. An additional amount of P1,387,000 was spent on December 30, 2018, for repairs on machinery covered by the patents and charged to Patent account. The repairs were necessarily incurred to bring back the said machinery to its original working condition. STU uses the straight-line method for all depreciation and amortization. The useful life of the patent is its legal life. b. On January 1, 2016, STU purchased the Licensing agreement, which was useful for ten years. The Licensing Agreement account balance included the purchase price of P2,160,000 and P240,000 cost to train employees at the inception of the licensing agreement. The license have been amortized over the agreement term which is 10 years. c. A trademark was purchased by STU for P1,280,000 on July 1, 2016. Expenditures for the successful litigation in defense of the trademark totaled to P326,000 were paid on July 1, 2018 and were charged to the trademark account. The trademark was estimated to have an indefinite life. By the end of 2018, the company estimated to generate annual net future cash flows from the continued use of the trademark at P90,000. The prevailing market rate of interest on this date was at 9%. d. A 10-year non-renewable lease was signed January 3, 2018, for the leased building that STU used in manufacturing operations. The Leasehold Improvement account includes: P900,000 cost of improvements with a total estimated useful life of 5 years, which was completed on March 1, 2018. P400,000 lease bonus paid for the exclusive right to occupy the leased property for the duration of the lease term without the lessor having the right to lease it out to other third parties. The lease agreement calls for annual payments of P500,000 per year every December 31. The implicit lease rate is 10%. Amortization/depreciation is yet to be recognized on lease-related assets.

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Carrying value of the Patent as of December 31 2018 Cost of patent P3740000 P1387000 P5127000 Accu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started