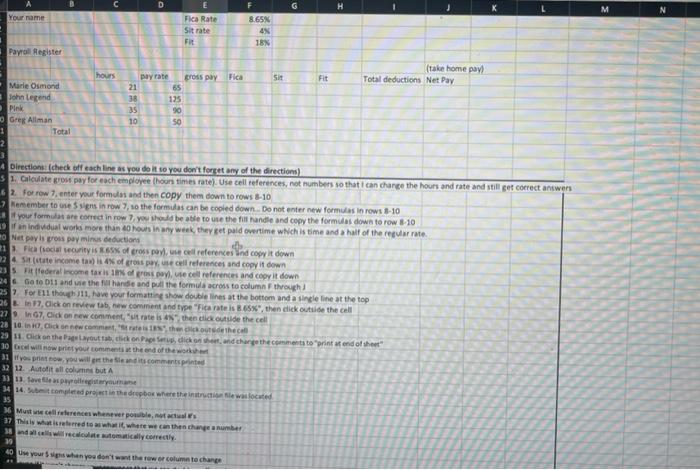

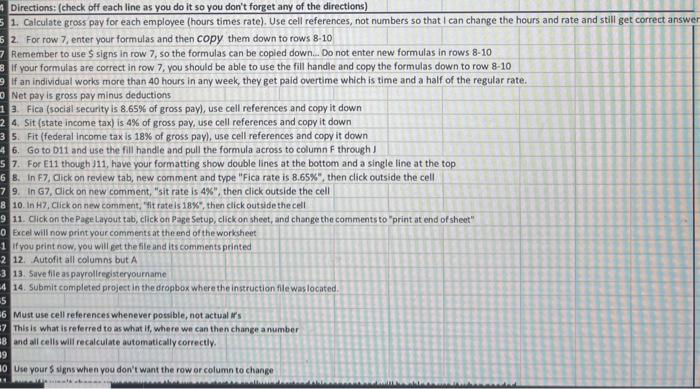

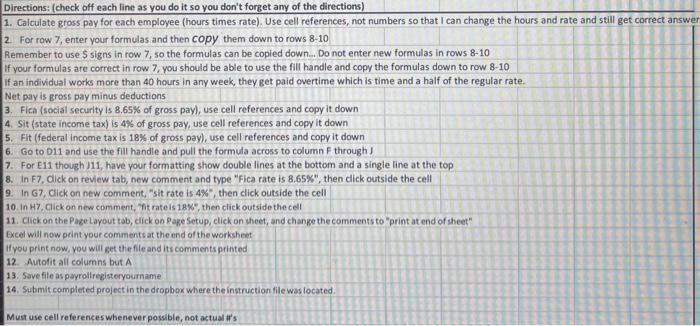

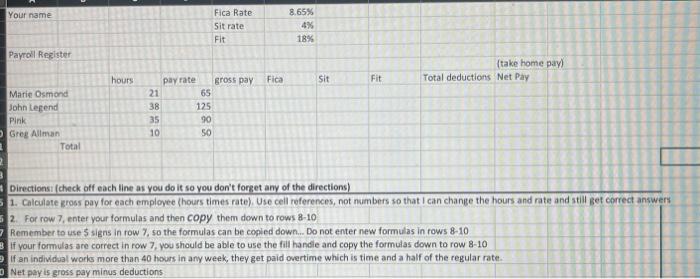

M Fica Total D G H Your name Fica Rate 8.65 Sitrate 4X Fit 18% Payroll Register (rake home pay hours pay rate BOSS DAY Sit Fit Total deductions Net Pay Marle Osmond 21 55 John Legend 38 125 Pink 35 90 Grer Allman 10 50 1 2 1 4 Directions (check off each line as you do it to you don't forget any of the directions) s 1. Calculate gross pay for each employee hour times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answers 62 Forrow 7. enter your formules and then copy them down to rows 5-10 7 Remember to use Signs in row 7, so the formulas can be copied down. Do not enter new formulas in rows 8-10 your formulare correct in row you should be able to use the file handle and copy the formulas down to row 8-10 of an individual works more than 20 hours in any week they get paid overtime which is time and half of the regular rute HO Net pays gross paymi deductions 21 Fica social security is of cross povlecel references ind copy it down 22 State income tax) 4of gross pays cell references and copy it down 235 Fit federal income taxis of gross povi, se cell references and copy it down 24 6 Go to D11 and the filhande and pull the formulacross to column through 25 For Ell though 11, have your formatting show double lines at the bottom and a single line at the top 26. in 17. Click on review tab new comment and type "Fica rate is 8.65, then click outside the cell 2767. Click on new comment, utrate is then click outside the cell 28 10. in 10. Click on new comment, then choose theca 29 11. Click on the layout click on Petu, dick on the and change the comments to print end of the 30 will now print your count the end of the work 31 Wow, you will get the lead its comments printed 32 12. Autofit all columns but 313 Saverne 34 14. We completed project in the dropbox where the introle was located Musical references whenever posible, to's 37 This is what isterred to as what it where we can then changer and will call wirect womaly correctly 40 me your when you don't want throw or column to change Directions: (check off each line as you do it so you don't forget any of the directions) 5 1. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answer 52 Forrow 7, enter your formulas and then copy them down to rows 8-10 Remember to use $ signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 If your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions 13. Fica (social security is 8.65% of grass pay), use cell references and copy it down 2.4. Sit (state income tax) is 4% of gross pay, use cell references and copy it down 3 5. Fit (federal income tax is 18% of gross pay), use cell references and copy it down 46. Go to D11 and use the fill handle and pull the formula across to column F through 57. For E11 though 111, have your formatting show double lines at the bottom and a single line at the top 6 8. In F7. Click on review tab, new comment and type "Fica rate is 8.65%", then click outside the cell 79. In G7, Click on new comment, "sit rate is 4%", then click outside the cell 8 10. In H7, Click on new comment, "Sitrate is 18X", then click outside the cell 9 11. Click on the Page Layout tab, click on Page Setup, click on sheet, and change the comments to "print at end of sheet" 0 Excel will now print your comments at the end of the worksheet 1 if you print now, you will get the file and its comments printed 2 12. Autofit all columns but A -3 13. Save file as payrollregisteryourname 14. Submit completed project in the dropbox where the instruction file was located 5 6 Must use cell references whenever possible, not actual it's 7 This is what is referred to as what it, where we can then change a number 8 and all cells will recalculate automatically correctly 19 10 Use your signs when you don't want the row or column to change 10 Directions: (check off each line as you do it so you don't forget any of the directions) 1. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answer 2. Forrow 7, enter your formulas and then copy them down to rows 8-10 Remember to use S signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 if your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions 3. Fica (social security is 8.65% of gross pay), use cell references and copy it down 4. Sit (state income tax) is 4% of gross pay, use cell references and copy it down 5. Fit (federal income tax is 18% of gross pay), use cell references and copy it down 6. Go to D11 and use the fill handle and pull the formula across to column F through 7. For E11 though )11, have your formatting show double lines at the bottom and a single line at the top 8. In F7, click on review tab, new comment and type "Fica rate is 8.65%", then click outside the cell 9. In G7, Click on new comment, "sit rate is 4%", then click outside the cell 10 In H7. Click on new comment, "trate is 18%", then click outside the cell 11. Click on the Page Layout tab, click on Pape Setup, click on sheet, and change the comments to "print at end of sheet" Excel will now print your comments at the end of the worksheet If you print now, you will get the file and its comments printed 12. Autofit all columns but A 13. Save file as payrollregisteryourname 14. Submit completed project in the dropbox where the instruction file was located Must use cell references whenever possible, not actual a's Your name Fica Rate Sit rate Fit 8.65% 4% 18% Payroll Register (take home pay Total deductions Net Pay hours Sit Fit Marie Osmond John Legend Pink Grog Allman Total pay rate gross pay Fica 21 65 38 125 35 90 10 50 Directions (check off each line as you do it so you don't forget any of the directions) 51. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answers 52. For row 7. enter your formulas and then copy them down to rows 8-10 Remember to use $ signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 if your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions M Fica Total D G H Your name Fica Rate 8.65 Sitrate 4X Fit 18% Payroll Register (rake home pay hours pay rate BOSS DAY Sit Fit Total deductions Net Pay Marle Osmond 21 55 John Legend 38 125 Pink 35 90 Grer Allman 10 50 1 2 1 4 Directions (check off each line as you do it to you don't forget any of the directions) s 1. Calculate gross pay for each employee hour times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answers 62 Forrow 7. enter your formules and then copy them down to rows 5-10 7 Remember to use Signs in row 7, so the formulas can be copied down. Do not enter new formulas in rows 8-10 your formulare correct in row you should be able to use the file handle and copy the formulas down to row 8-10 of an individual works more than 20 hours in any week they get paid overtime which is time and half of the regular rute HO Net pays gross paymi deductions 21 Fica social security is of cross povlecel references ind copy it down 22 State income tax) 4of gross pays cell references and copy it down 235 Fit federal income taxis of gross povi, se cell references and copy it down 24 6 Go to D11 and the filhande and pull the formulacross to column through 25 For Ell though 11, have your formatting show double lines at the bottom and a single line at the top 26. in 17. Click on review tab new comment and type "Fica rate is 8.65, then click outside the cell 2767. Click on new comment, utrate is then click outside the cell 28 10. in 10. Click on new comment, then choose theca 29 11. Click on the layout click on Petu, dick on the and change the comments to print end of the 30 will now print your count the end of the work 31 Wow, you will get the lead its comments printed 32 12. Autofit all columns but 313 Saverne 34 14. We completed project in the dropbox where the introle was located Musical references whenever posible, to's 37 This is what isterred to as what it where we can then changer and will call wirect womaly correctly 40 me your when you don't want throw or column to change Directions: (check off each line as you do it so you don't forget any of the directions) 5 1. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answer 52 Forrow 7, enter your formulas and then copy them down to rows 8-10 Remember to use $ signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 If your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions 13. Fica (social security is 8.65% of grass pay), use cell references and copy it down 2.4. Sit (state income tax) is 4% of gross pay, use cell references and copy it down 3 5. Fit (federal income tax is 18% of gross pay), use cell references and copy it down 46. Go to D11 and use the fill handle and pull the formula across to column F through 57. For E11 though 111, have your formatting show double lines at the bottom and a single line at the top 6 8. In F7. Click on review tab, new comment and type "Fica rate is 8.65%", then click outside the cell 79. In G7, Click on new comment, "sit rate is 4%", then click outside the cell 8 10. In H7, Click on new comment, "Sitrate is 18X", then click outside the cell 9 11. Click on the Page Layout tab, click on Page Setup, click on sheet, and change the comments to "print at end of sheet" 0 Excel will now print your comments at the end of the worksheet 1 if you print now, you will get the file and its comments printed 2 12. Autofit all columns but A -3 13. Save file as payrollregisteryourname 14. Submit completed project in the dropbox where the instruction file was located 5 6 Must use cell references whenever possible, not actual it's 7 This is what is referred to as what it, where we can then change a number 8 and all cells will recalculate automatically correctly 19 10 Use your signs when you don't want the row or column to change 10 Directions: (check off each line as you do it so you don't forget any of the directions) 1. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answer 2. Forrow 7, enter your formulas and then copy them down to rows 8-10 Remember to use S signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 if your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions 3. Fica (social security is 8.65% of gross pay), use cell references and copy it down 4. Sit (state income tax) is 4% of gross pay, use cell references and copy it down 5. Fit (federal income tax is 18% of gross pay), use cell references and copy it down 6. Go to D11 and use the fill handle and pull the formula across to column F through 7. For E11 though )11, have your formatting show double lines at the bottom and a single line at the top 8. In F7, click on review tab, new comment and type "Fica rate is 8.65%", then click outside the cell 9. In G7, Click on new comment, "sit rate is 4%", then click outside the cell 10 In H7. Click on new comment, "trate is 18%", then click outside the cell 11. Click on the Page Layout tab, click on Pape Setup, click on sheet, and change the comments to "print at end of sheet" Excel will now print your comments at the end of the worksheet If you print now, you will get the file and its comments printed 12. Autofit all columns but A 13. Save file as payrollregisteryourname 14. Submit completed project in the dropbox where the instruction file was located Must use cell references whenever possible, not actual a's Your name Fica Rate Sit rate Fit 8.65% 4% 18% Payroll Register (take home pay Total deductions Net Pay hours Sit Fit Marie Osmond John Legend Pink Grog Allman Total pay rate gross pay Fica 21 65 38 125 35 90 10 50 Directions (check off each line as you do it so you don't forget any of the directions) 51. Calculate gross pay for each employee (hours times rate). Use cell references, not numbers so that I can change the hours and rate and still get correct answers 52. For row 7. enter your formulas and then copy them down to rows 8-10 Remember to use $ signs in row 7, so the formulas can be copied down... Do not enter new formulas in rows 8-10 if your formulas are correct in row 7, you should be able to use the fill handle and copy the formulas down to row 8-10 If an individual works more than 40 hours in any week, they get paid overtime which is time and a half of the regular rate. Net pay is gross pay minus deductions