Answered step by step

Verified Expert Solution

Question

1 Approved Answer

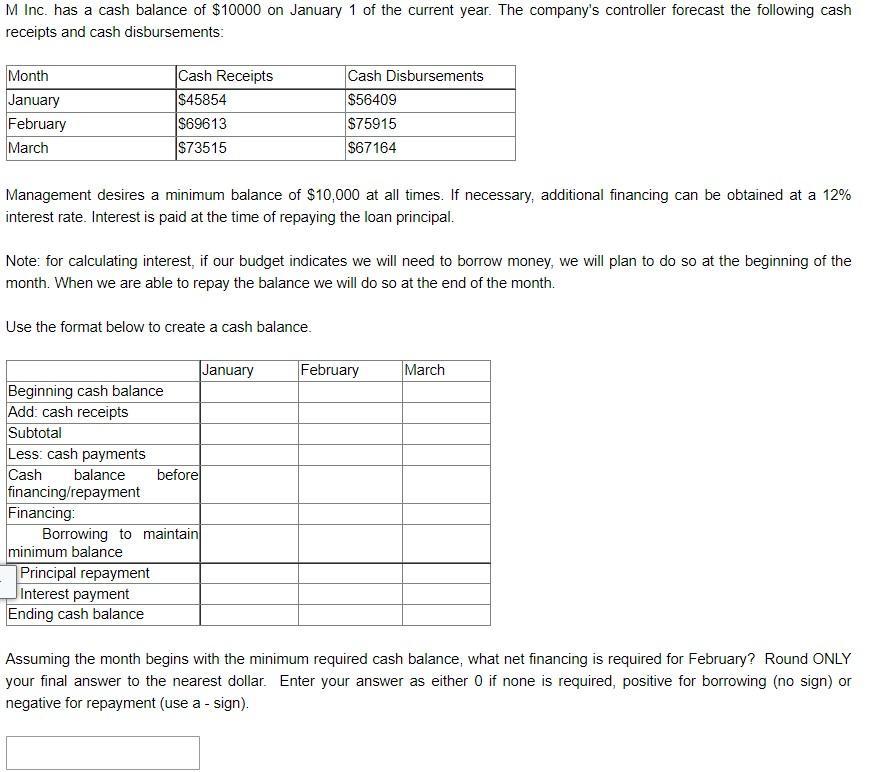

M Inc. has a cash balance of $10000 on January 1 of the current year. The company's controller forecast the following cash receipts and

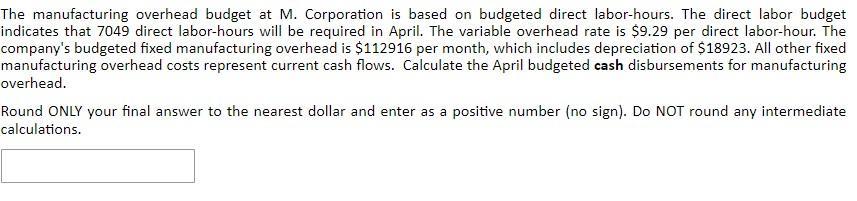

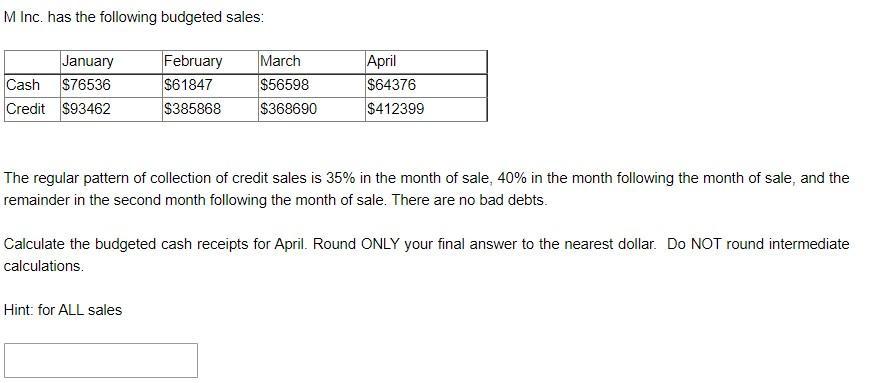

M Inc. has a cash balance of $10000 on January 1 of the current year. The company's controller forecast the following cash receipts and cash disbursements: Month January February March Cash Receipts $45854 $69613 $73515 Management desires a minimum balance of $10,000 at all times. If necessary, additional financing can be obtained at a 12% interest rate. Interest is paid at the time of repaying the loan principal. Note: for calculating interest, if our budget indicates we will need to borrow money, we will plan to do so at the beginning of the month. When we are able to repay the balance we will do so at the end of the month. Use the format below to create a cash balance. Beginning cash balance Add: cash receipts Subtotal Less: cash payments balance Cash financing/repayment Financing: minimum balance Principal repayment Interest payment Ending cash balance before Borrowing to maintain Cash Disbursements $56409 $75915 $67164 January February March Assuming the month begins with the minimum required cash balance, what net financing is required for February? Round ONLY your final answer to the nearest dollar. Enter your answer as either 0 if none is required, positive for borrowing (no sign) or negative for repayment (use a - sign). The manufacturing overhead budget at M. Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 7049 direct labor-hours will be required in April. The variable overhead rate is $9.29 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $112916 per month, which includes depreciation of $18923. All other fixed manufacturing overhead costs represent current cash flows. Calculate the April budgeted cash disbursements for manufacturing overhead. Round ONLY your final answer to the nearest dollar and enter as a positive number (no sign). Do NOT round any intermediate calculations. M Inc. has the following budgeted sales: January Cash $76536 Credit $93462 February March $61847 $56598 $385868 $368690 April $64376 $412399 The regular pattern of collection of credit sales is 35% in the month of sale, 40% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts. Hint: for ALL sales Calculate the budgeted cash receipts for April. Round ONLY your final answer to the nearest dollar. Do NOT round intermediate calculations.

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 6302 Answer 2 159478 Answer 3 452659 a Opening Cash Balanc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started