Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M manufacturing Ltd produces washing machines, dryers and dishwashers. Because of increasing competition, M Ltd is considering investing in a new automated manufacturing system.

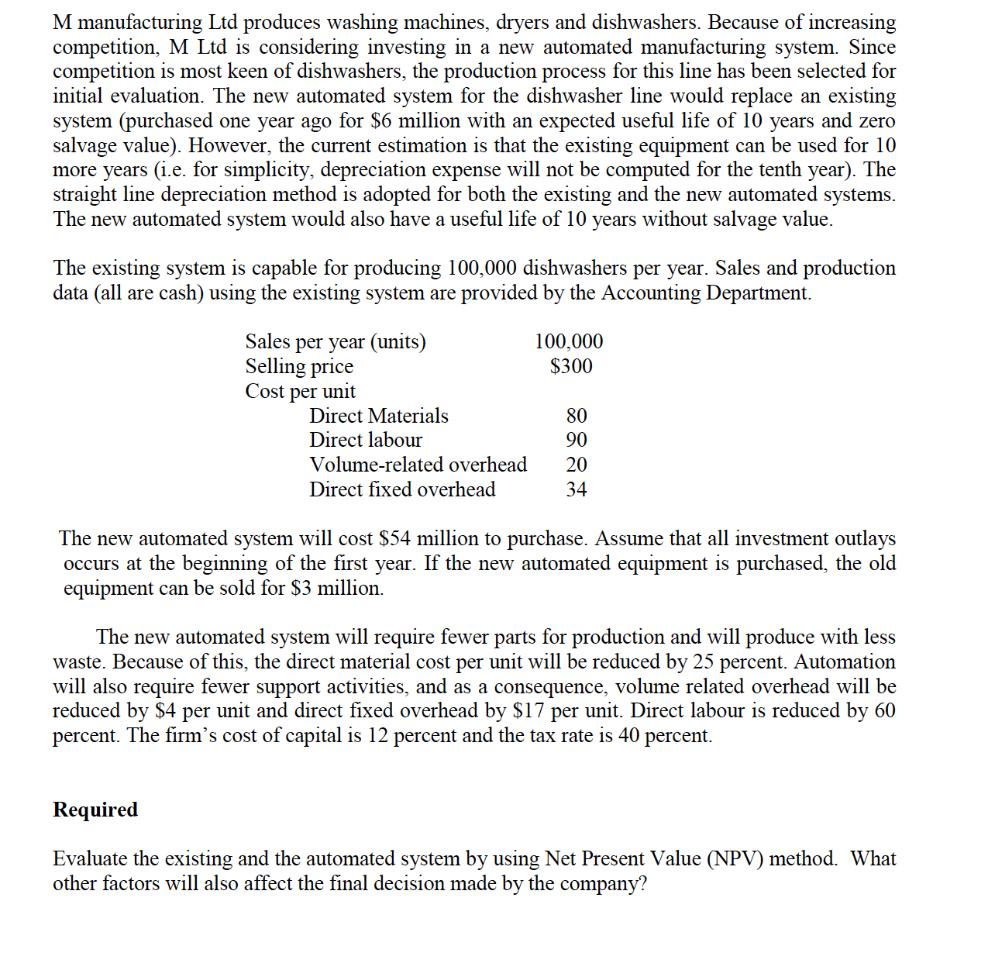

M manufacturing Ltd produces washing machines, dryers and dishwashers. Because of increasing competition, M Ltd is considering investing in a new automated manufacturing system. Since competition is most keen of dishwashers, the production process for this line has been selected for initial evaluation. The new automated system for the dishwasher line would replace an existing system (purchased one year ago for $6 million with an expected useful life of 10 years and zero salvage value). However, the current estimation is that the existing equipment can be used for 10 more years (i.e. for simplicity, depreciation expense will not be computed for the tenth year). The straight line depreciation method is adopted for both the existing and the new automated systems. The new automated system would also have a useful life of 10 years without salvage value. The existing system is capable for producing 100,000 dishwashers per year. Sales and production data (all are cash) using the existing system are provided by the Accounting Department. Sales per year (units) Selling price Cost per unit Direct Materials Direct labour Volume-related overhead Direct fixed overhead 100,000 $300 80 90 20 34 The new automated system will cost $54 million to purchase. Assume that all investment outlays occurs at the beginning of the first year. If the new automated equipment is purchased, the old equipment can be sold for $3 million. The new automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume related overhead will be reduced by $4 per unit and direct fixed overhead by $17 per unit. Direct labour is reduced by 60 percent. The firm's cost of capital is 12 percent and the tax rate is 40 percent. Required Evaluate the existing and the automated system by using Net Present Value (NPV) method. What other factors will also affect the final decision made by the company?

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Annual Cash Flow and Additional Cash Flow Annual Sales 100000 300 Direct materials 1000008060 Direct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started