Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M PLUS LTD operates a factory that employs 40 direct workers throughout a four-week period.Direct workers are paid a basic rate of GHC 4.00

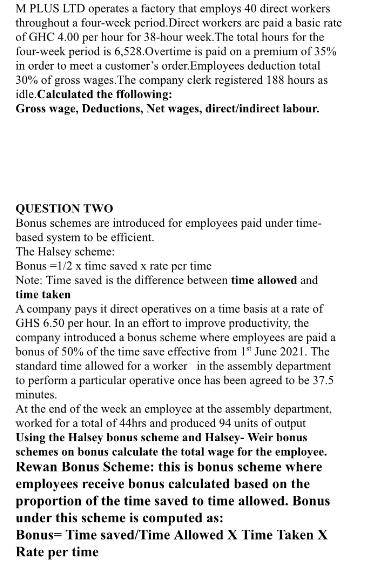

M PLUS LTD operates a factory that employs 40 direct workers throughout a four-week period.Direct workers are paid a basic rate of GHC 4.00 per hour for 38-hour week. The total hours for the four-week period is 6,528.Overtime is paid on a premium of 35% in order to meet a customer's order.Employees deduction total 30% of gross wages. The company clerk registered 188 hours as idle.Calculated the following: Gross wage, Deductions, Net wages, direct/indirect labour. QUESTION TWO Bonus schemes are introduced for employees paid under time- based system to be efficient. The Halsey scheme: Bonus =1/2 x time saved x rate per time Note: Time saved is the difference between time allowed and time taken A company pays it direct operatives on a time basis at a rate of GHS 6.50 per hour. In an effort to improve productivity, the company introduced a bonus scheme where employees are paid a bonus of 50% of the time save effective from 1st June 2021. The standard time allowed for a worker in the assembly department to perform a particular operative once has been agreed to be 37.5 minutes. At the end of the week an employee at the assembly department. worked for a total of 44hrs and produced 94 units of output Using the Halsey bonus scheme and Halsey- Weir bonus schemes on bonus calculate the total wage for the employee. Rewan Bonus Scheme: this is bonus scheme where employees receive bonus calculated based on the proportion of the time saved to time allowed. Bonus under this scheme is computed as: Bonus Time saved/Time Allowed X Time Taken X Rate per time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started