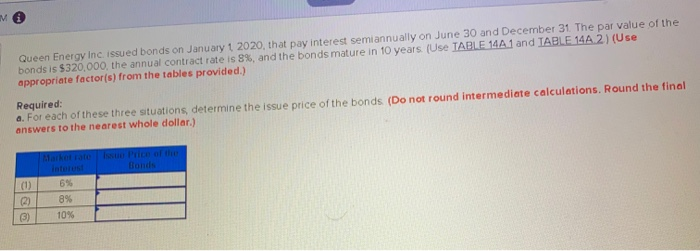

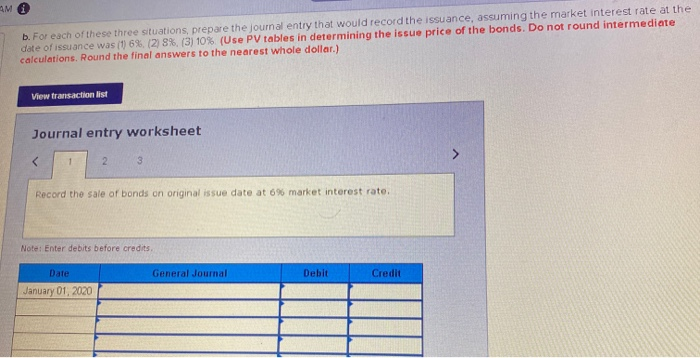

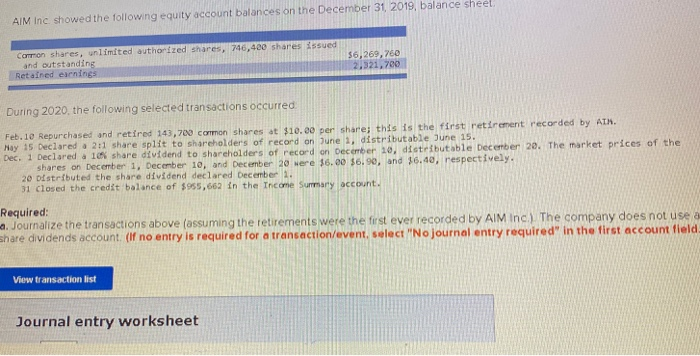

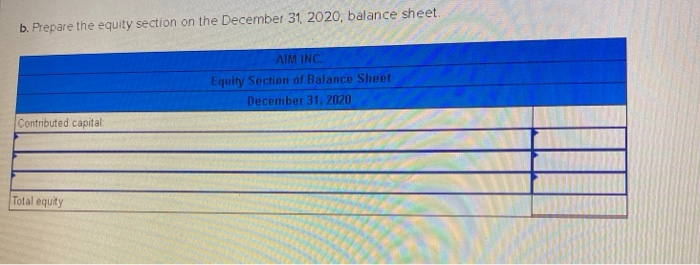

M Queen Energy Inc. issued bonds on January 1 2020, that pay interest semiannually on June 30 and December 31 The par value of the bonds is $320,000, the annual contract rate is 8%, and the bonds mature in 10 years (Use TABLE 14A1 and TABLE 14A 2) (Use appropriate factor(s) from the tables provided.) Required: a. For each of these three situations, determine the issue price of the bonds (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) (2) ) 6% 8% 10% AM b. For each of these three situations, prepare the journal entry that would record the issuance, assuming the market interest rate at the date of issuance was (1) 6%, (2) 8%, (3) 10% (Use PV tables in determining the issue price of the bonds. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 2 3 Record the sale of bonds on original issue date at 6% market interest rate. Note: Enter debits before credits Date General Journal Debit Credit January 01, 2020 AIM Inc. showed the following equity account balances on the December 31, 2019, balance sheel Common shares, unlimited authorized shares, 746,400 shares issued and outstanding Retained earnings $6,269,760 2,321,700 During 2020, the following selected transactions occurred Feb. 10 Repurchased and retired 143,700 common shares at $10.00 per share; this is the first retirement recorded by AIN. May 15 Declared a 2:1 share split to shareholders of record on June 1, distributable June 15. Dec. 1 Declared a 10% share dividend to shareholders of record on December 10, distributable December 20. The market prices of the shares on December 1, December 10, and December 20 were 16.00 $6.90, and 16.40, respectively. 20 Distributed the share dividend declared December 1. 31 closed the credit balance of $955,662 in the Income Summary account. Required: a. Journalize the transactions above (assuming the retirements were the first ever recorded by AIM Inc.) The company does not use a share dividends account. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet b. Prepare the equity section on the December 31, 2020, balance sheet AIM INC Equity Section of Balance Sheet December 31, 2020 Contributed capital Total equity