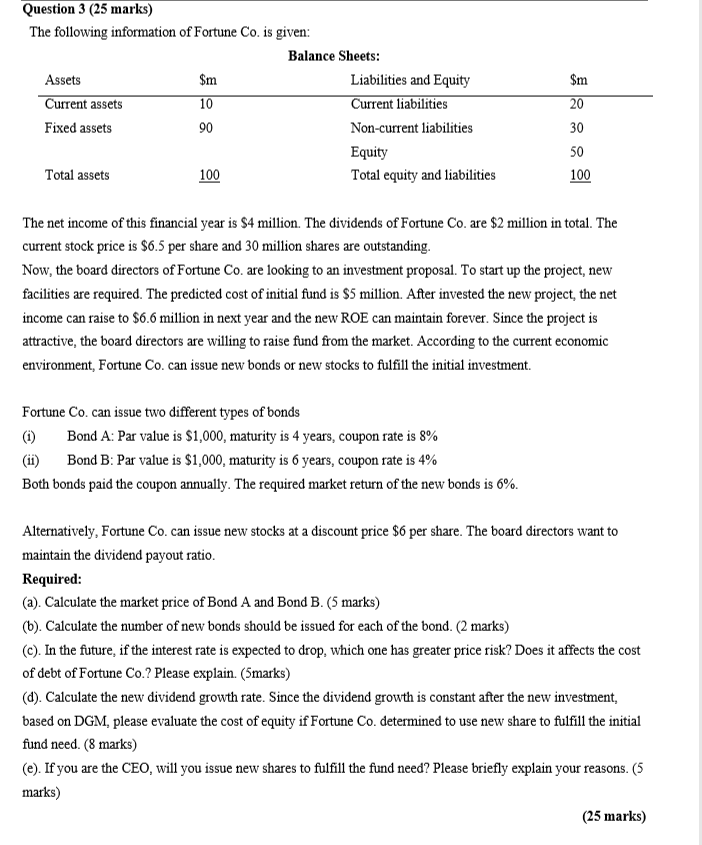

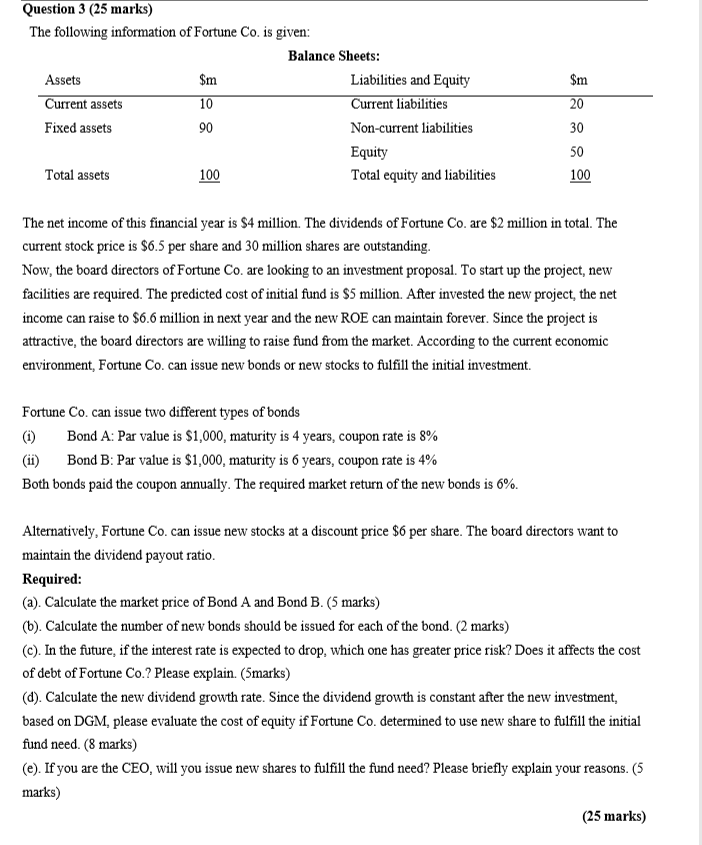

$m Question 3 (25 marks) The following information of Fortune Co. is given: Balance Sheets: Assets Liabilities and Equity Current assets 10 Current liabilities Fixed assets 90 Non-current liabilities Equity Total assets 100 Total equity and liabilities $m 20 30 50 100 The net income of this financial year is $4 million. The dividends of Fortune Co. are $2 million in total. The current stock price is $6.5 per share and 30 million shares are outstanding. Now, the board directors of Fortune Co. are looking to an investment proposal. To start up the project, new facilities are required. The predicted cost of initial fund is $5 million. After invested the new project, the net income can raise to $6.6 million in next year and the new ROE can maintain forever. Since the project is attractive, the board directors are willing to raise fund from the market. According to the current economic environment, Fortune Co.can issue new bonds or new stocks to fulfill the initial investment. Fortune Co. can issue two different types of bonds (1) Bond A: Par value is $1,000, maturity is 4 years, coupon rate is 8% (11) Bond B: Par value is $1,000, maturity is 6 years, coupon rate is 4% Both bonds paid the coupon annually. The required market return of the new bonds is 6%. Alternatively, Fortune Co. can issue new stocks at a discount price $6 per share. The board directors want to maintain the dividend payout ratio. Required: (a). Calculate the market price of Bond A and Bond B. (5 marks) (b). Calculate the number of new bonds should be issued for each of the bond. (2 marks) (c). In the future, if the interest rate is expected to drop, which one has greater price risk? Does it affects the cost of debt of Fortune Co.? Please explain. (5marks) (d). Calculate the new dividend growth rate. Since the dividend growth is constant after the new investment, based on DGM, please evaluate the cost of equity if Fortune Co. determined to use new share to fulfill the initial fund need. (8 marks) (e). If you are the CEO, will you issue new shares to fulfill the fund need? Please briefly explain your reasons. (5 marks) (25 marks) $m Question 3 (25 marks) The following information of Fortune Co. is given: Balance Sheets: Assets Liabilities and Equity Current assets 10 Current liabilities Fixed assets 90 Non-current liabilities Equity Total assets 100 Total equity and liabilities $m 20 30 50 100 The net income of this financial year is $4 million. The dividends of Fortune Co. are $2 million in total. The current stock price is $6.5 per share and 30 million shares are outstanding. Now, the board directors of Fortune Co. are looking to an investment proposal. To start up the project, new facilities are required. The predicted cost of initial fund is $5 million. After invested the new project, the net income can raise to $6.6 million in next year and the new ROE can maintain forever. Since the project is attractive, the board directors are willing to raise fund from the market. According to the current economic environment, Fortune Co.can issue new bonds or new stocks to fulfill the initial investment. Fortune Co. can issue two different types of bonds (1) Bond A: Par value is $1,000, maturity is 4 years, coupon rate is 8% (11) Bond B: Par value is $1,000, maturity is 6 years, coupon rate is 4% Both bonds paid the coupon annually. The required market return of the new bonds is 6%. Alternatively, Fortune Co. can issue new stocks at a discount price $6 per share. The board directors want to maintain the dividend payout ratio. Required: (a). Calculate the market price of Bond A and Bond B. (5 marks) (b). Calculate the number of new bonds should be issued for each of the bond. (2 marks) (c). In the future, if the interest rate is expected to drop, which one has greater price risk? Does it affects the cost of debt of Fortune Co.? Please explain. (5marks) (d). Calculate the new dividend growth rate. Since the dividend growth is constant after the new investment, based on DGM, please evaluate the cost of equity if Fortune Co. determined to use new share to fulfill the initial fund need. (8 marks) (e). If you are the CEO, will you issue new shares to fulfill the fund need? Please briefly explain your reasons. (5 marks) (25 marks)