Answered step by step

Verified Expert Solution

Question

1 Approved Answer

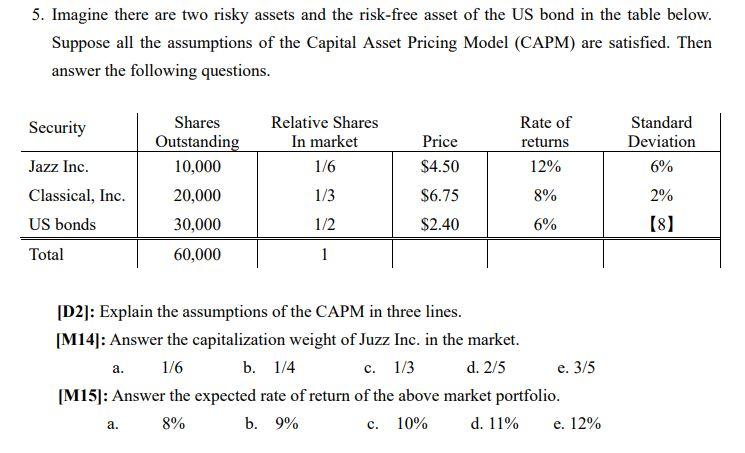

M14 and M15 please 5. Imagine there are two risky assets and the risk-free asset of the US bond in the table below. Suppose all

M14 and M15 please

5. Imagine there are two risky assets and the risk-free asset of the US bond in the table below. Suppose all the assumptions of the Capital Asset Pricing Model (CAPM) are satisfied. Then answer the following questions. Security Relative Shares In market 1/6 Rate of returns 12% Standard Deviation 6% Shares Outstanding 10,000 20,000 30,000 60,000 Price $4.50 $6.75 $2.40 Jazz Inc. Classical, Inc. US bonds Total 1/3 8% 2% (8) 1/2 6% 1 [D2]: Explain the assumptions of the CAPM in three lines. [M14): Answer the capitalization weight of Juzz Inc. in the market. a. 1/6 b. 1/4 c. 1/3 d. 2/5 e. 3/5 [M15): Answer the expected rate of return of the above market portfolio. 8% b. 9% c. 10% d. 11% e. 12% aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started