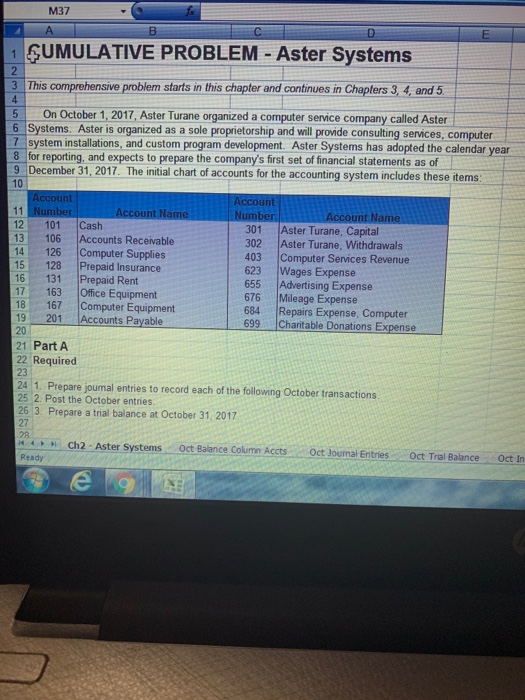

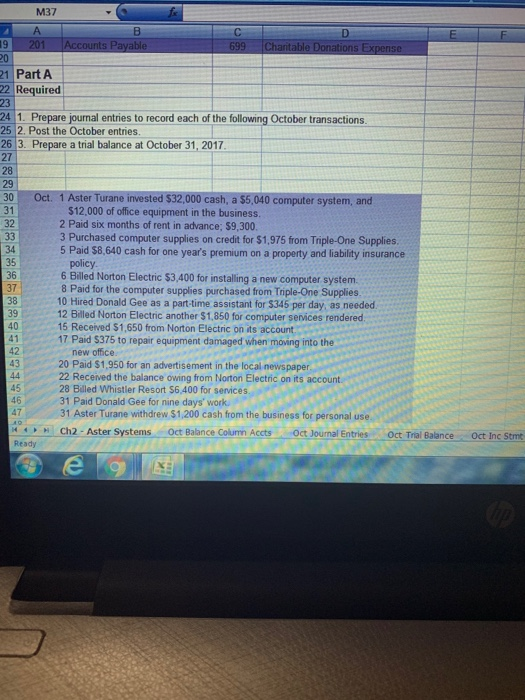

M37 B D E 1 SUMULATIVE PROBLEM - Aster Systems 2 3 This comprehensive problem starts in this chapter and continues in Chapters 3, 4, and 5. 4 5 On October 1, 2017, Aster Turane organized a computer service company called Aster 6 Systems. Aster is organized as a sole proprietorship and will provide consulting services, computer 7 system installations, and custom program development. Aster Systems has adopted the calendar year 8 for reporting, and expects to prepare the company's first set of financial statements as of 9 December 31, 2017. The initial chart of accounts for the accounting system includes these items 10 Account Account 11 Number Account Name Number Account Name 12 101 Cash 301 Aster Turane, Capital 13 106 Accounts Receivable 302 Aster Turane, Withdrawals 14 126 Computer Supplies 403 Computer Services Revenue 15 128 Prepaid Insurance 623 Wages Expense 16 131 Prepaid Rent 655 Advertising Expense 17 163 Office Equipment 676 Mileage Expense 18 167 Computer Equipment 684 Repairs Expense, Computer 19 201 Accounts Payable 699 Charitable Donations Expense 20 21 Part A 22 Required 23 24 1. Prepare journal entries to record each of the following October transactions 25 2. Post the October entries. 26 3. Prepare a trial balance at October 31, 2017 27 28 Hech2 - Aster Systems Oct Balance Column Accts Oct Journal Entries Oct Tral Balance Oct in Ready M37 A B D 19 201 Accounts Payable 699 Charitable Donations Expense 20 21 Part A 22 Required 23 24 1. Prepare journal entries to record each of the following October transactions. 25 2. Post the October entries. 26 3. Prepare a trial balance at October 31, 2017 27 28 29 30 Oct. 1 Aster Turane invested $32,000 cash, a $5,040 computer system, and 31 $12,000 of office equipment in the business, 32 2 Paid six months of rent in advance: $9,300 33 3 Purchased computer supplies on credit for $1,975 from Triple-One Supplies 34 5 Paid $8,640 cash for one year's premium on a property and liability insurance 35 policy 36 6 Billed Norton Electric $3,400 for installing a new computer system 37 8 Paid for the computer supplies purchased from Triple-One Supplies 38 10 Hired Donald Gee as a part-time assistant for $345 per day, as needed 39 12 Billed Norton Electric another $1,850 for computer services rendered 40 15 Received $1,650 from Norton Electric on its account. 17 Paid $375 to repair equipment damaged when moving into the 42 new office 43 20 Paid $1,950 for an advertisement in the local newspaper 44 22 Received the balance owing from Norton Electric on its account. 45 28 Billed Whistler Resort S6,400 for services. 46 31 Paid Donald Gee for nine days' work 47 31 Aster Turane withdrew $1,200 cash from the business for personal use. Ch2 - Aster Systems Oct Balance Column Accts Oct Journal Entries Oct Trial Balance Oct Inc Stm Ready e