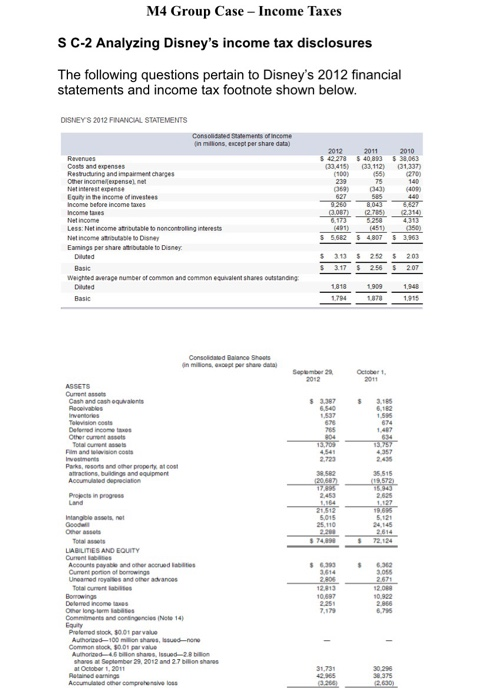

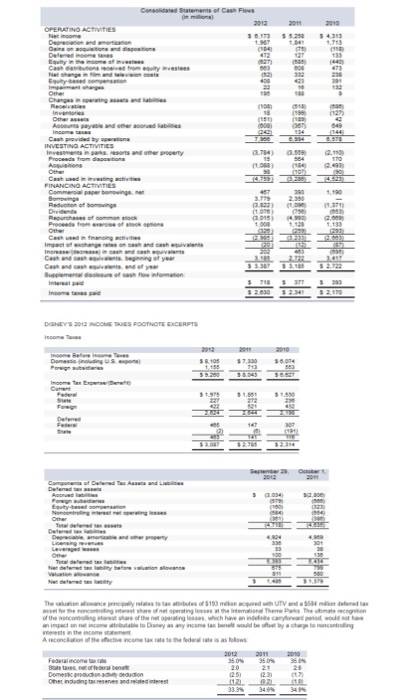

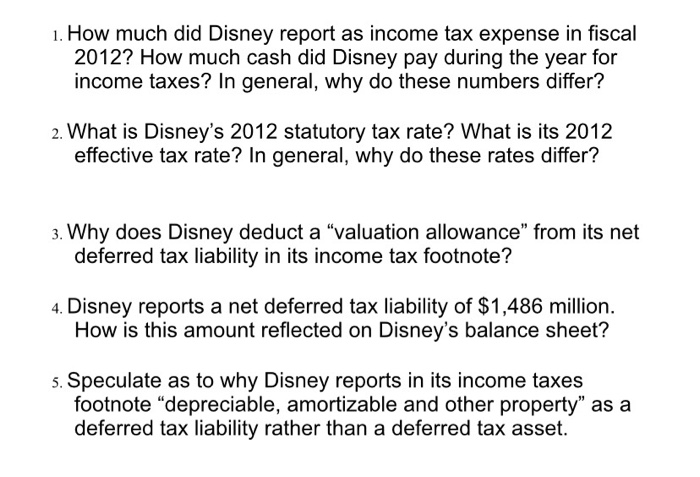

M4 Group Case Income Taxes S C-2 Analyzing Disney's income tax disclosures The following questions pertain to Disney's 2012 financial statements and income tax footnote shown below DISNEYS 2012 FINANCIAL STATEMENTS n millions, escept per share data) 2012 2011 42278 40.893 38,063 33415) 33,112) 31,337) Costs and expenses Ressucuing and impairment charges Equty in the income ofinvestees hms incme Less: Net income atbutable to noncontroling interests Net income atutable to Disi Eamings per share anbutable to Disney (491)(45)3500 313 252 20 weighoe average umber ef common and cman equvalent shares outstanong 1909 941.948 Current asso 82.367 3.185 Other cuent assets Parks, resorts and other propertk at cost Acoumulaned depreciation Projects in progess ntangible assets, net LIABILITIES AND EQUITY other accrued 63936362 3.055 portion of bonowinge Uneamed rayaiies and other advances 6795 Equity Authorined 4.6 billon shaes at Septamber 29, 2012 shares, Issued-2.8 bilion Accumulased other 1.088) FINANCINO ACTIVITIES TES FOOTNOTE IEXCERPTS 7.330 3000 1. How much did Disney report as income tax expense in fiscal 2012? How much cash did Disney pay during the year for income taxes? In general, why do these numbers differ? 2. What is Disney's 2012 statutory tax rate? What is its 2012 effective tax rate? In general, why do these rates differ? 3. Why does Disney deduct a "valuation allowance" from its net deferred tax liability in its income tax footnote? 4. Disney reports a net deferred tax liability of $1,486 million. How is this amount reflected on Disney's balance sheet? 5. Speculate as to why Disney reports in its income taxes footnote "depreciable, amortizable and other property" as a deferred tax liability rather than a deferred tax asset. M4 Group Case Income Taxes S C-2 Analyzing Disney's income tax disclosures The following questions pertain to Disney's 2012 financial statements and income tax footnote shown below DISNEYS 2012 FINANCIAL STATEMENTS n millions, escept per share data) 2012 2011 42278 40.893 38,063 33415) 33,112) 31,337) Costs and expenses Ressucuing and impairment charges Equty in the income ofinvestees hms incme Less: Net income atbutable to noncontroling interests Net income atutable to Disi Eamings per share anbutable to Disney (491)(45)3500 313 252 20 weighoe average umber ef common and cman equvalent shares outstanong 1909 941.948 Current asso 82.367 3.185 Other cuent assets Parks, resorts and other propertk at cost Acoumulaned depreciation Projects in progess ntangible assets, net LIABILITIES AND EQUITY other accrued 63936362 3.055 portion of bonowinge Uneamed rayaiies and other advances 6795 Equity Authorined 4.6 billon shaes at Septamber 29, 2012 shares, Issued-2.8 bilion Accumulased other 1.088) FINANCINO ACTIVITIES TES FOOTNOTE IEXCERPTS 7.330 3000 1. How much did Disney report as income tax expense in fiscal 2012? How much cash did Disney pay during the year for income taxes? In general, why do these numbers differ? 2. What is Disney's 2012 statutory tax rate? What is its 2012 effective tax rate? In general, why do these rates differ? 3. Why does Disney deduct a "valuation allowance" from its net deferred tax liability in its income tax footnote? 4. Disney reports a net deferred tax liability of $1,486 million. How is this amount reflected on Disney's balance sheet? 5. Speculate as to why Disney reports in its income taxes footnote "depreciable, amortizable and other property" as a deferred tax liability rather than a deferred tax asset