Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M7.1 Determining the financing mix Use the following data for problems 12-1 and 12-2 FM - 1 Based on the above data, what is the

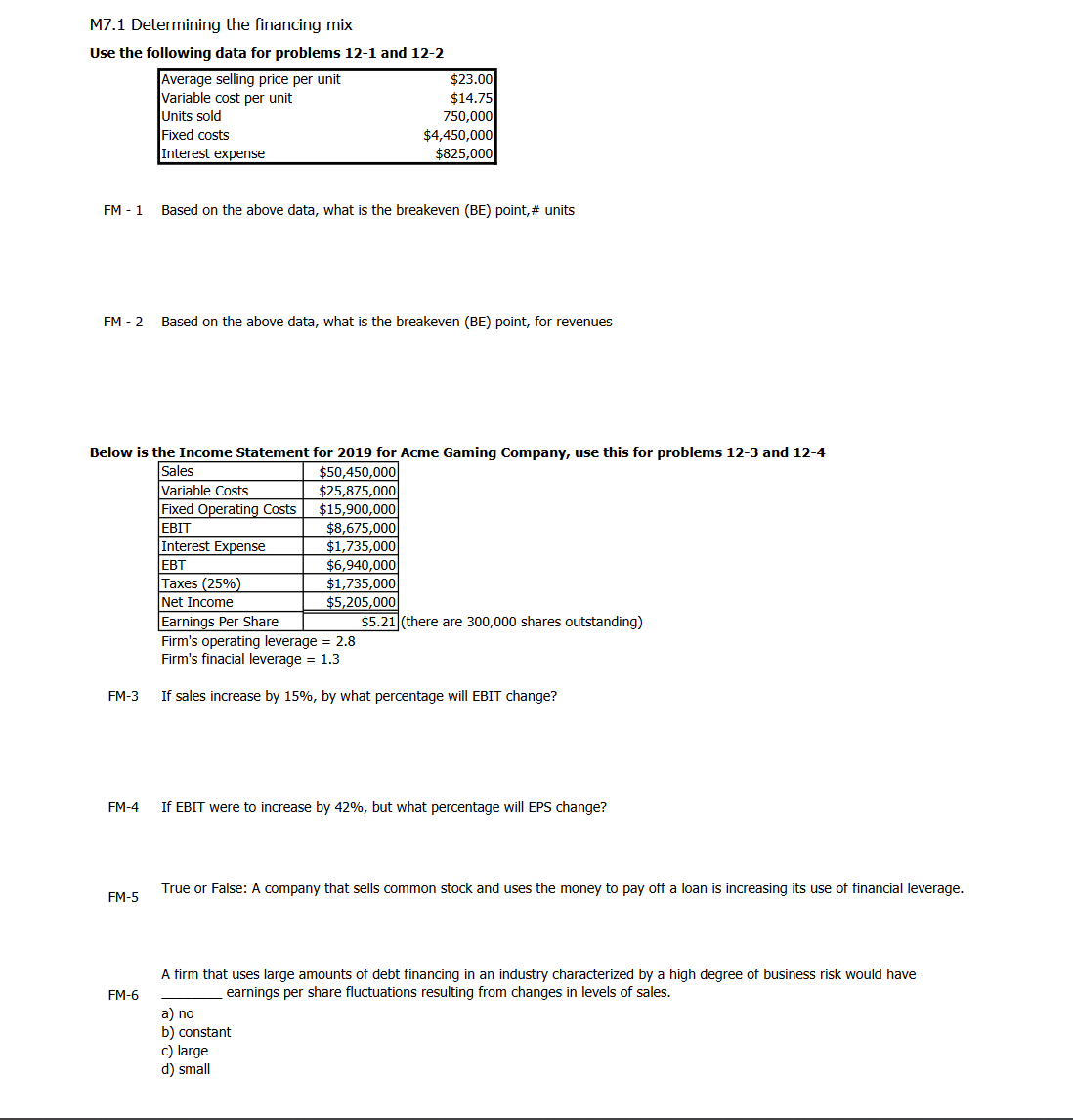

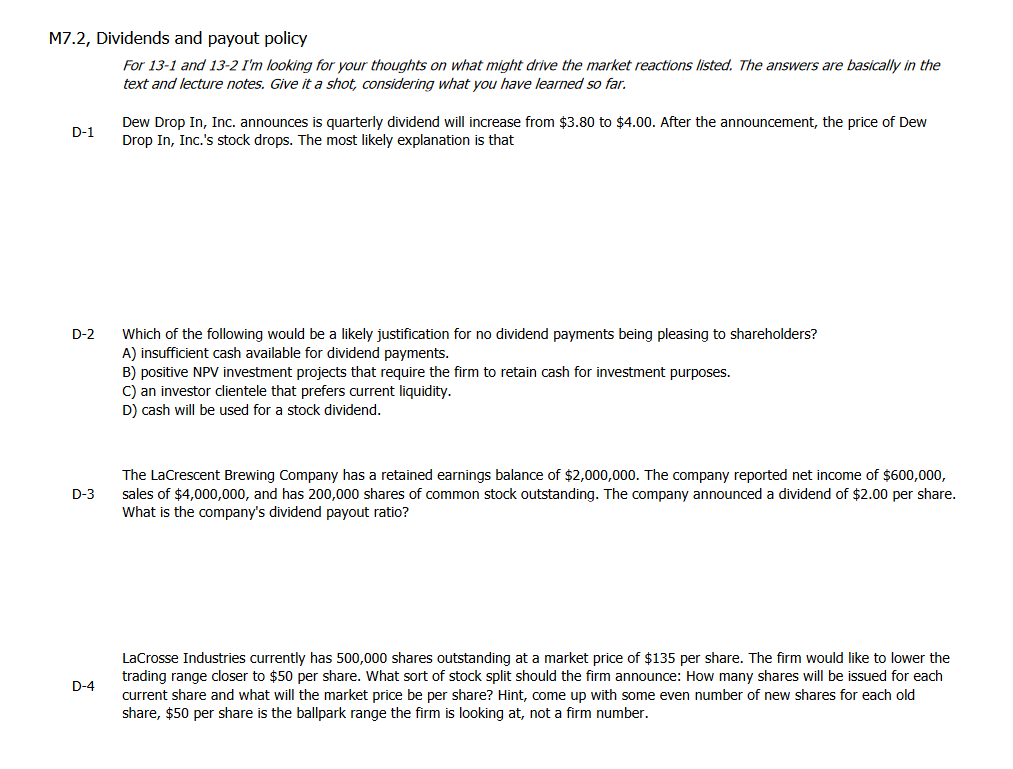

M7.1 Determining the financing mix Use the following data for problems 12-1 and 12-2 FM - 1 Based on the above data, what is the breakeven (BE) point,\# units FM - 2 Based on the above data, what is the breakeven (BE) point, for revenues Below is the Income Statement for 2019 for Acme Gaming Company, use this for problems 12-3 and 12-4 there are 300,000 shares outstanding) rililis upelauly itvelaye =.0 Firm's finacial leverage =1.3 FM-3 If sales increase by 15%, by what percentage will EBIT change? FM-4 If EBIT were to increase by 42%, but what percentage will EPS change? FM-5 True or False: A company that sells common stock and uses the money to pay off a loan is increasing its use of financial leverage. A firm that uses large amounts of debt financing in an industry characterized by a high degree of business risk would have FM-6 earnings per share fluctuations resulting from changes in levels of sales. a) no b) constant c) large d) small 17.2, Dividends and payout policy For 13-1 and 13-2 I'm looking for your thoughts on what might drive the market reactions listed. The answers are basically in the text and lecture notes. Give it a shot, considering what you have learned so far. D-1 Dew Drop In, Inc. announces is quarterly dividend will increase from $3.80 to $4.00. After the announcement, the price of Dew Drop In, Inc.'s stock drops. The most likely explanation is that D-2 Which of the following would be a likely justification for no dividend payments being pleasing to shareholders? A) insufficient cash available for dividend payments. B) positive NPV investment projects that require the firm to retain cash for investment purposes. C) an investor clientele that prefers current liquidity. D) cash will be used for a stock dividend. The LaCrescent Brewing Company has a retained earnings balance of $2,000,000. The company reported net income of $600,000, D-3 sales of $4,000,000, and has 200,000 shares of common stock outstanding. The company announced a dividend of $2.00 per share. What is the company's dividend payout ratio? LaCrosse Industries currently has 500,000 shares outstanding at a market price of $135 per share. The firm would like to lower the D-4 trading range closer to $50 per share. What sort of stock split should the firm announce: How many shares will be issued for each current share and what will the market price be per share? Hint, come up with some even number of new shares for each old share, $50 per share is the ballpark range the firm is looking at, not a firm number

M7.1 Determining the financing mix Use the following data for problems 12-1 and 12-2 FM - 1 Based on the above data, what is the breakeven (BE) point,\# units FM - 2 Based on the above data, what is the breakeven (BE) point, for revenues Below is the Income Statement for 2019 for Acme Gaming Company, use this for problems 12-3 and 12-4 there are 300,000 shares outstanding) rililis upelauly itvelaye =.0 Firm's finacial leverage =1.3 FM-3 If sales increase by 15%, by what percentage will EBIT change? FM-4 If EBIT were to increase by 42%, but what percentage will EPS change? FM-5 True or False: A company that sells common stock and uses the money to pay off a loan is increasing its use of financial leverage. A firm that uses large amounts of debt financing in an industry characterized by a high degree of business risk would have FM-6 earnings per share fluctuations resulting from changes in levels of sales. a) no b) constant c) large d) small 17.2, Dividends and payout policy For 13-1 and 13-2 I'm looking for your thoughts on what might drive the market reactions listed. The answers are basically in the text and lecture notes. Give it a shot, considering what you have learned so far. D-1 Dew Drop In, Inc. announces is quarterly dividend will increase from $3.80 to $4.00. After the announcement, the price of Dew Drop In, Inc.'s stock drops. The most likely explanation is that D-2 Which of the following would be a likely justification for no dividend payments being pleasing to shareholders? A) insufficient cash available for dividend payments. B) positive NPV investment projects that require the firm to retain cash for investment purposes. C) an investor clientele that prefers current liquidity. D) cash will be used for a stock dividend. The LaCrescent Brewing Company has a retained earnings balance of $2,000,000. The company reported net income of $600,000, D-3 sales of $4,000,000, and has 200,000 shares of common stock outstanding. The company announced a dividend of $2.00 per share. What is the company's dividend payout ratio? LaCrosse Industries currently has 500,000 shares outstanding at a market price of $135 per share. The firm would like to lower the D-4 trading range closer to $50 per share. What sort of stock split should the firm announce: How many shares will be issued for each current share and what will the market price be per share? Hint, come up with some even number of new shares for each old share, $50 per share is the ballpark range the firm is looking at, not a firm number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started