MA17-35. Assessing the Impact of an Incentive Plan

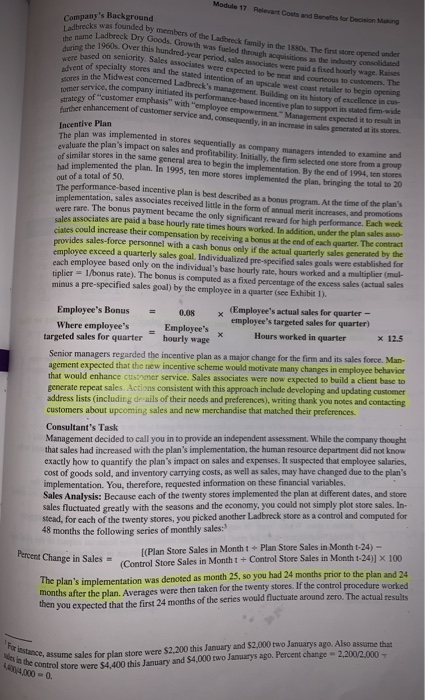

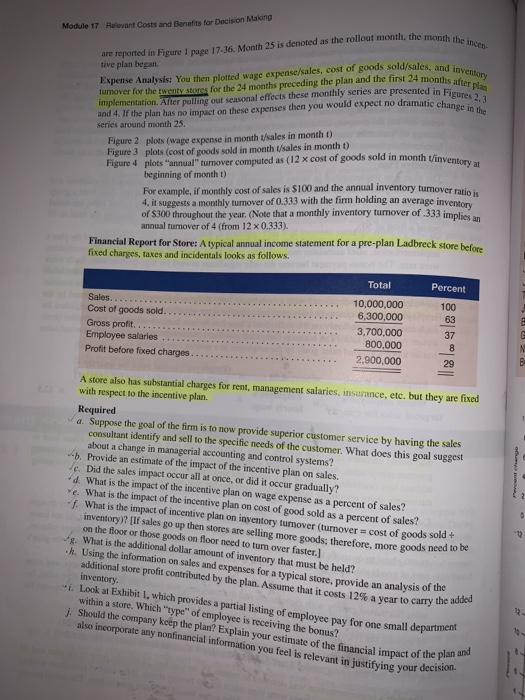

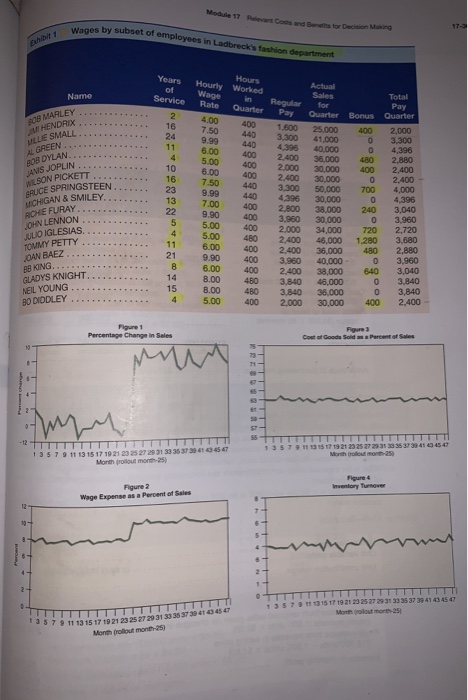

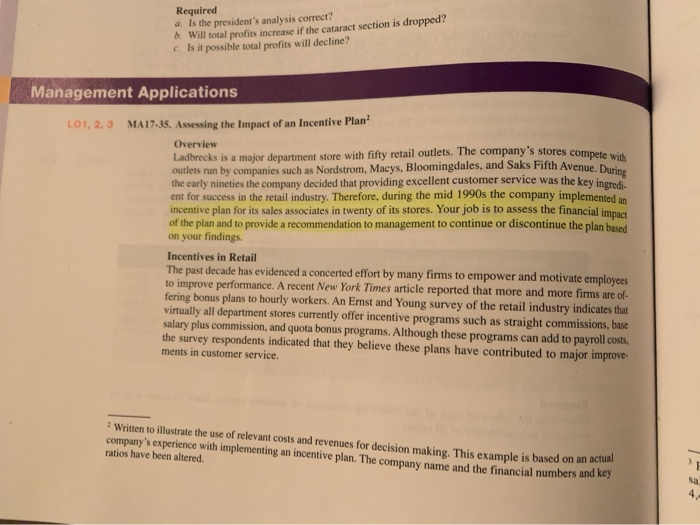

Required a. Is the president's analysis correct? b. Will total profits increase if the cataract section is dropped? c. Is it possible total profits will decline? Management Applications L01, 2, 3 we. During MA17-35. Assessing the Impact of an Incentive Plan Overview Ladbrecks is a major department store with fifty retail outlets. The company's stores compete outlets run by companies such as Nordstrom, Macys, Bloomingdales, and Saks Fifth Avenue .. the early nineties the company decided that providing excellent customer service was the key in ent for success in the retail industry. Therefore, during the mid 1990s the company implement mplemented an incentive plan for its sales associates in twenty of its stores. Your job is to assess the financial impact of the plan and to provide a recommendation to management to continue or discontinue the plan based on your findings Incentives in Retail The past decade has evidenced a concerted effort by many firms to empower and motivate employees to improve performance. A recent New York Times article reported that more and more firms are of fering bonus plans to hourly workers. An Emst and Young survey of the retail industry indicates that virtually all department stores currently offer incentive programs such as straight commissions, base salary plus commission, and quota bonus programs. Although these programs can add to payroll costs, the survey respondents indicated that they believe these plans have contributed to major improve ments in customer service. Written to illustrate the use of relevant costs and revenues for decision makine. This example is based on an ac company's experience with implementing an incentive plan. The company name and the financial numbers and ratios have been altered. Module 17 Relevant costs and arts for Decision Making Company's Background recks was founded by members of the Ladbeck family in the I s The first store opened under me Ladbrock Dry Goods. Growth was fueled that is the industry consolidac the 1960s. Over this hundred-year period, alles was w aid a fixed hourly wage. Rae hused on seniority. Sales associates were expected to be and sounous to customers. The ant of specialty stores and the stated intention of an lee s ter to begin ons in the Midwest concerned Ladbrock's management Build its history of excellence in service, the company initiated its performance-based Incentive to support ed y of customer emphasis with employee empowerment Manar e spected it to me e nhancement of customer service and consequently, in an increase in sales generated at Incentive Plan The plan was implemented in stores sequentially as company managers intended to examine and laste the plan's impact on sales and profitability. Initially, the firm selected one store from a group Similar stores in the same general area to begin the implementation. By the end of 1994, ten stores implemented the plan. In 1995. ten more stores implemented the plan, bringing the total to 20 out of a total of 50. The performance-based incentive plan is best described as a bonus program. At the time of the plan's plementation, sales associates received little in the form of annual meris increases, and promotions were rare. The bonus payment became the only significant reward for high performance. Each weck sales associates are paid a base hourly rattetimes hours worked. In addition under the plan sales asso- cute could increase their compensation by receiving a hos the end of each quarter. The contract eroides sales-force persoanel with a cash bonus only if the stulgu rly sales generated by the employee exceed a quarterly sales goal. Individualired resesified ales als were established for cach employee based only on the individual's base hourly rate hours worked and a multiplier tiplier = 1/bonus rate). The bonus is computed as a fired percent of the excess sales actual sales minus a pre-specified sales goal) by the employee in a quarter (see Exhibit I). Employee's Bonus = 0.08 x Employee's actual sales for quarter - Where employee's Employee's employee's targeted sales for quarter) targeted sales for quarter hourly wage X Hours worked in quarter x 12.5 Senior managers regarded the incentive plan as a major change for the firm and its sales force. Man- agement expected that the new incentive scheme would motivate many changes in employee behavior that would enhance tomer service. Sales associates were now expected to build a client base to generate repeat sales Actions consistent with this approach include developing and updating customer address lists (including drails of their needs and preferences), writing thank you notes and contacting customers about upcoming sales and new merchandise that matched their preferences. Consultant's Task Management decided to call you in to provide an independent assessment. While the company thought that sales had increased with the plan's implementation, the human resource department did not know exactly how to quantify the plan's impact on sales and expenses. It suspected that employee salaries, cost of goods sold, and inventory carrying costs, as well as sales, may have changed due to the plan's implementation. You, therefore, requested information on these financial variables, Sales Analysis: Because each of the twenty stores implemented the plan at different dates, and store sales fluctuated greatly with the seasons and the economy, you could not simply plot store sales, In- stead, for each of the twenty stores, you picked another Ladbreck store as a control and computed for 48 months the following series of monthly sales: (Plan Store Sales in Month t Plan Store Sales in Month-24) - Percent Change in Sales = (Control Store Sales in (Control Store Sales in Month + Control Store Sales in Month 1-24)] X 100 The plan's implementation was denoted as month 25, so you had 24 months prior to the plan and 24 months after the plan. Averages were then taken for the twenty stores. If the control procedure worked then you expected that the first 24 months of the series would fluctuate around zero. The actual results Face. ce assume sales for plan store were $2,200 this January and $2,000 to Januarys ago. Also assume that control store were $4.400 this January and $4,000 two Januarys ago. Percent change - 2.200/2.000 4,000 0. Module 17 Relevant Coats and Benefits for Decision Making nonth the incen- are 17-36. Month 25 is denoted as the rollout month, the month ib. are reported in Figure tive plan began es, and inventory A months after plan sted in Figures 2.3 Expense Analysis: You then plotted wage expense/sales, cost of goods sold/sales and lumover for the twenty stores for the 24 months preceding the plan and the first 24 months implementation Air pulling out sonsonal effects these monthly series are presented in and 4. If the plan has no impact on these expenses then you would expect no dramatic cha series around month 25. no dramatic change in the Figure 2 plots (wage expense in month t/sales in month t) Figure 3 plots (cost of goods sold in month t/sales in month t) Figure 4 plots annual turnover computed as (12 x cost of goods sold in month t/invento beginning of month t) For example, if monthly cost of sales is $100 and the annual inventory tumover moti 4. it suggests a monthly tumover of 0.333 with the firm holding an average invent of $300 throughout the year. (Note that a monthly inventory tumover of .333 implies annual tumover of 4 (from 12 x 0.333). Financial Report for Store: A typical annual income statement for a pre-plan Ladbreck store before fixed charges, taxes and incidentals looks as follows. Percent Sales, Cost of goods sold... Gross profit... Employee salaries ....... Profit before foxed charges.... Total 10,000,000 6,300,000 3.700.000 800,000 2.900.000 A store also has substantial charges for rent, management salaries, in sarance, etc, but they are fixed with respect to the incentive plan. Required a. Suppose the goal of the firm is to now provide superior customer service by having the sales consultant identify and sell to the specific needs of the customer. What does this goal suggest about a change in managerial accounting and control systems? b. Provide an estimate of the impact of the incentive plan on sales. c. Did the sales impact occur all at once, or did it occur gradually? What is the impact of the incentive plan on wage expense as a percent of sales? e. What is the impact of the incentive plan on cost of good sold as a percent of sales? f. What is the impact of incentive plan on inventory turnover (turnover = cost of goods sold inventory? lif sales go up then stores are selling more goods: therefore, more goods need on the floor or those goods on floor need to turn over faster.) g. What is the additional dollar amount of inventory that must be held? h. Using the information on sales and expenses for a typical store provide an analysis of the additional store profit contributed by the plan. Assume that it costs 125 a vear to carry the inventory. i Look at Exhibit I, which provides a partial listing of employee pay for one small deparum within a store. Which "type of employee is receiving the bonus? Should the company keep the plant Explain your estimate of the financial impact of also incorporate any nonfinancial information you feel is relevant in justifying your Year to carry the added also incorpor y keep the plan? Explais receiving the be pay for one small department pact of the plan and Module 17 Wages by subset of employees in Lad Decision Man Wan nhint 1 e nt Years of Service Actual Sales Name Regular Pay for Quarter Total Pay 4.00 Bonus BOB MARLEY HENDRIX VELIE SMALL AL GREEN.. BOB DYLAN ANS JOPLIN Hours Hourly worked Wage in Rate Quarter 400 7.50 440 9.99 440 400 400 6.00 400 7.50 6.00 5.00 1.600 3.300 4305 2400 2.000 2.400 3.300 16 23 4 396 13 400 22 400 WLSON PICKETT BRUCE SPRINGSTEEN.. CHIGAN & SMILEY ACHE FURAY OHN LENNON JULIO IGLESIAS TOMMY PETTY OAN BAEZ AB KING... GLADYS KNIGHT. NEL YOUNG BO DIDDLEY 9.99 7.00 9.90 5.00 5.00 6.00 9.90 6.00 25.000 41.000 40.000 35.000 30 000 30.000 50.000 30.000 38,000 30.000 34,000 46,000 36,000 40.000 38.000 46,000 36,000 30.000 400 2.000 03.300 0 4.398 2.880 400 2,400 2.400 700 4,000 04.396 240 3.040 03.960 720 2.720 1.280 3.6.80 480 2.880 03.960 840 3,040 0 3,840 0 3,840 400 2.400 - 400 480 2.800 3.980 2.000 2,400 2.400 3.960 2.400 3,840 3,840 2.000 400 21 400 400 8.00 480 480 400 Figure 1 Percentage Change in Sales Figures Cowel Goods Soda Pere M 4547 7 9 11 13 15 17 19 21 23 25 27 293133353730410154 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 Monthlut mor-25) Inventory Turnover Figure 2 Wage Expense as a Percent of Sales 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 Montrout mort 25 TTTTTTTTTTTTTT 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 63450 Month rollout month Required a. Is the president's analysis correct? b. Will total profits increase if the cataract section is dropped? c. Is it possible total profits will decline? Management Applications L01, 2, 3 we. During MA17-35. Assessing the Impact of an Incentive Plan Overview Ladbrecks is a major department store with fifty retail outlets. The company's stores compete outlets run by companies such as Nordstrom, Macys, Bloomingdales, and Saks Fifth Avenue .. the early nineties the company decided that providing excellent customer service was the key in ent for success in the retail industry. Therefore, during the mid 1990s the company implement mplemented an incentive plan for its sales associates in twenty of its stores. Your job is to assess the financial impact of the plan and to provide a recommendation to management to continue or discontinue the plan based on your findings Incentives in Retail The past decade has evidenced a concerted effort by many firms to empower and motivate employees to improve performance. A recent New York Times article reported that more and more firms are of fering bonus plans to hourly workers. An Emst and Young survey of the retail industry indicates that virtually all department stores currently offer incentive programs such as straight commissions, base salary plus commission, and quota bonus programs. Although these programs can add to payroll costs, the survey respondents indicated that they believe these plans have contributed to major improve ments in customer service. Written to illustrate the use of relevant costs and revenues for decision makine. This example is based on an ac company's experience with implementing an incentive plan. The company name and the financial numbers and ratios have been altered. Module 17 Relevant costs and arts for Decision Making Company's Background recks was founded by members of the Ladbeck family in the I s The first store opened under me Ladbrock Dry Goods. Growth was fueled that is the industry consolidac the 1960s. Over this hundred-year period, alles was w aid a fixed hourly wage. Rae hused on seniority. Sales associates were expected to be and sounous to customers. The ant of specialty stores and the stated intention of an lee s ter to begin ons in the Midwest concerned Ladbrock's management Build its history of excellence in service, the company initiated its performance-based Incentive to support ed y of customer emphasis with employee empowerment Manar e spected it to me e nhancement of customer service and consequently, in an increase in sales generated at Incentive Plan The plan was implemented in stores sequentially as company managers intended to examine and laste the plan's impact on sales and profitability. Initially, the firm selected one store from a group Similar stores in the same general area to begin the implementation. By the end of 1994, ten stores implemented the plan. In 1995. ten more stores implemented the plan, bringing the total to 20 out of a total of 50. The performance-based incentive plan is best described as a bonus program. At the time of the plan's plementation, sales associates received little in the form of annual meris increases, and promotions were rare. The bonus payment became the only significant reward for high performance. Each weck sales associates are paid a base hourly rattetimes hours worked. In addition under the plan sales asso- cute could increase their compensation by receiving a hos the end of each quarter. The contract eroides sales-force persoanel with a cash bonus only if the stulgu rly sales generated by the employee exceed a quarterly sales goal. Individualired resesified ales als were established for cach employee based only on the individual's base hourly rate hours worked and a multiplier tiplier = 1/bonus rate). The bonus is computed as a fired percent of the excess sales actual sales minus a pre-specified sales goal) by the employee in a quarter (see Exhibit I). Employee's Bonus = 0.08 x Employee's actual sales for quarter - Where employee's Employee's employee's targeted sales for quarter) targeted sales for quarter hourly wage X Hours worked in quarter x 12.5 Senior managers regarded the incentive plan as a major change for the firm and its sales force. Man- agement expected that the new incentive scheme would motivate many changes in employee behavior that would enhance tomer service. Sales associates were now expected to build a client base to generate repeat sales Actions consistent with this approach include developing and updating customer address lists (including drails of their needs and preferences), writing thank you notes and contacting customers about upcoming sales and new merchandise that matched their preferences. Consultant's Task Management decided to call you in to provide an independent assessment. While the company thought that sales had increased with the plan's implementation, the human resource department did not know exactly how to quantify the plan's impact on sales and expenses. It suspected that employee salaries, cost of goods sold, and inventory carrying costs, as well as sales, may have changed due to the plan's implementation. You, therefore, requested information on these financial variables, Sales Analysis: Because each of the twenty stores implemented the plan at different dates, and store sales fluctuated greatly with the seasons and the economy, you could not simply plot store sales, In- stead, for each of the twenty stores, you picked another Ladbreck store as a control and computed for 48 months the following series of monthly sales: (Plan Store Sales in Month t Plan Store Sales in Month-24) - Percent Change in Sales = (Control Store Sales in (Control Store Sales in Month + Control Store Sales in Month 1-24)] X 100 The plan's implementation was denoted as month 25, so you had 24 months prior to the plan and 24 months after the plan. Averages were then taken for the twenty stores. If the control procedure worked then you expected that the first 24 months of the series would fluctuate around zero. The actual results Face. ce assume sales for plan store were $2,200 this January and $2,000 to Januarys ago. Also assume that control store were $4.400 this January and $4,000 two Januarys ago. Percent change - 2.200/2.000 4,000 0. Module 17 Relevant Coats and Benefits for Decision Making nonth the incen- are 17-36. Month 25 is denoted as the rollout month, the month ib. are reported in Figure tive plan began es, and inventory A months after plan sted in Figures 2.3 Expense Analysis: You then plotted wage expense/sales, cost of goods sold/sales and lumover for the twenty stores for the 24 months preceding the plan and the first 24 months implementation Air pulling out sonsonal effects these monthly series are presented in and 4. If the plan has no impact on these expenses then you would expect no dramatic cha series around month 25. no dramatic change in the Figure 2 plots (wage expense in month t/sales in month t) Figure 3 plots (cost of goods sold in month t/sales in month t) Figure 4 plots annual turnover computed as (12 x cost of goods sold in month t/invento beginning of month t) For example, if monthly cost of sales is $100 and the annual inventory tumover moti 4. it suggests a monthly tumover of 0.333 with the firm holding an average invent of $300 throughout the year. (Note that a monthly inventory tumover of .333 implies annual tumover of 4 (from 12 x 0.333). Financial Report for Store: A typical annual income statement for a pre-plan Ladbreck store before fixed charges, taxes and incidentals looks as follows. Percent Sales, Cost of goods sold... Gross profit... Employee salaries ....... Profit before foxed charges.... Total 10,000,000 6,300,000 3.700.000 800,000 2.900.000 A store also has substantial charges for rent, management salaries, in sarance, etc, but they are fixed with respect to the incentive plan. Required a. Suppose the goal of the firm is to now provide superior customer service by having the sales consultant identify and sell to the specific needs of the customer. What does this goal suggest about a change in managerial accounting and control systems? b. Provide an estimate of the impact of the incentive plan on sales. c. Did the sales impact occur all at once, or did it occur gradually? What is the impact of the incentive plan on wage expense as a percent of sales? e. What is the impact of the incentive plan on cost of good sold as a percent of sales? f. What is the impact of incentive plan on inventory turnover (turnover = cost of goods sold inventory? lif sales go up then stores are selling more goods: therefore, more goods need on the floor or those goods on floor need to turn over faster.) g. What is the additional dollar amount of inventory that must be held? h. Using the information on sales and expenses for a typical store provide an analysis of the additional store profit contributed by the plan. Assume that it costs 125 a vear to carry the inventory. i Look at Exhibit I, which provides a partial listing of employee pay for one small deparum within a store. Which "type of employee is receiving the bonus? Should the company keep the plant Explain your estimate of the financial impact of also incorporate any nonfinancial information you feel is relevant in justifying your Year to carry the added also incorpor y keep the plan? Explais receiving the be pay for one small department pact of the plan and Module 17 Wages by subset of employees in Lad Decision Man Wan nhint 1 e nt Years of Service Actual Sales Name Regular Pay for Quarter Total Pay 4.00 Bonus BOB MARLEY HENDRIX VELIE SMALL AL GREEN.. BOB DYLAN ANS JOPLIN Hours Hourly worked Wage in Rate Quarter 400 7.50 440 9.99 440 400 400 6.00 400 7.50 6.00 5.00 1.600 3.300 4305 2400 2.000 2.400 3.300 16 23 4 396 13 400 22 400 WLSON PICKETT BRUCE SPRINGSTEEN.. CHIGAN & SMILEY ACHE FURAY OHN LENNON JULIO IGLESIAS TOMMY PETTY OAN BAEZ AB KING... GLADYS KNIGHT. NEL YOUNG BO DIDDLEY 9.99 7.00 9.90 5.00 5.00 6.00 9.90 6.00 25.000 41.000 40.000 35.000 30 000 30.000 50.000 30.000 38,000 30.000 34,000 46,000 36,000 40.000 38.000 46,000 36,000 30.000 400 2.000 03.300 0 4.398 2.880 400 2,400 2.400 700 4,000 04.396 240 3.040 03.960 720 2.720 1.280 3.6.80 480 2.880 03.960 840 3,040 0 3,840 0 3,840 400 2.400 - 400 480 2.800 3.980 2.000 2,400 2.400 3.960 2.400 3,840 3,840 2.000 400 21 400 400 8.00 480 480 400 Figure 1 Percentage Change in Sales Figures Cowel Goods Soda Pere M 4547 7 9 11 13 15 17 19 21 23 25 27 293133353730410154 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 Monthlut mor-25) Inventory Turnover Figure 2 Wage Expense as a Percent of Sales 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 Montrout mort 25 TTTTTTTTTTTTTT 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 63450 Month rollout month