Question

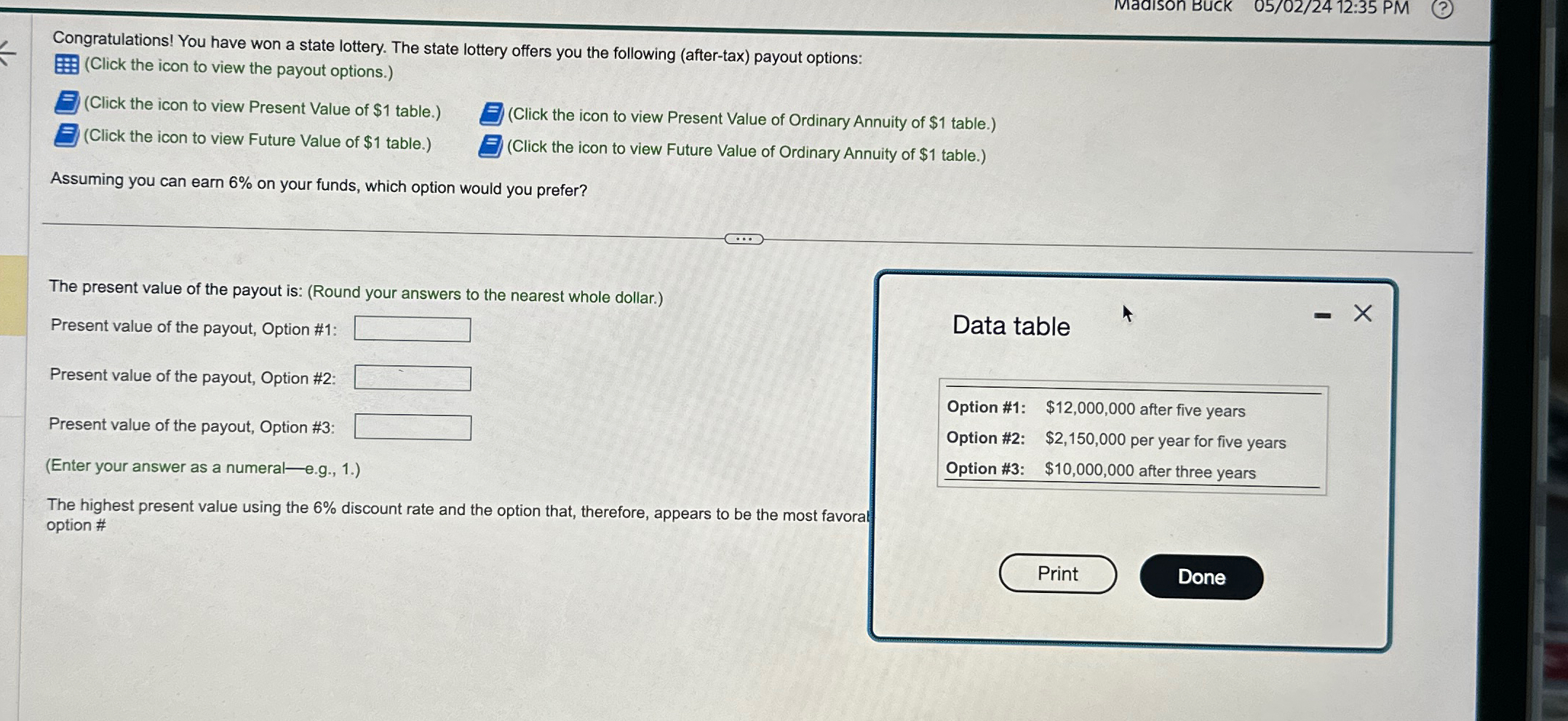

Maaison Buck 05/02/24 12:35 PM Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: (Click the icon

Maaison Buck 05/02/24 12:35 PM Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: (Click the icon to view the payout options.) (Click the icon to view Present Value of

$1table.) (Click the icon to view Future Value of

$1table.) (Click the icon to view Present Value of Ordinary Annuity of

$1table.) (Click the icon to view Future Value of Ordinary Annuity of

$1table.) Assuming you can earn

6%on your funds, which option would you prefer? The present value of the payout is: (Round your answers to the nearest whole dollar.) Present value of the payout, Option #1:

Data table Present value of the payout, Option #2:

Present value of the payout, Option #3:

(Enter your answer as a numeral-e.g., 1.) Option #1:

,$12,000,000after five years Option #2:

,$2,150,000per year for five years Option #3:

,$10,000,000after three years The highest present value using the

6%discount rate and the option that, therefore, appears to be the most favorat option

#

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started