Answered step by step

Verified Expert Solution

Question

1 Approved Answer

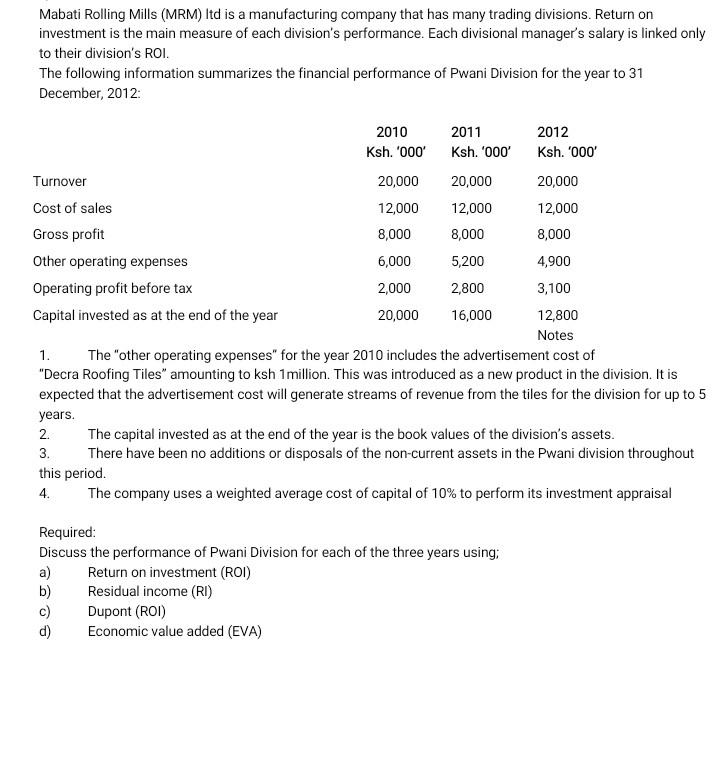

Mabati Rolling Mills (MRM) Itd is a manufacturing company that has many trading divisions. Return on investment is the main measure of each division's performance.

Mabati Rolling Mills (MRM) Itd is a manufacturing company that has many trading divisions. Return on investment is the main measure of each division's performance. Each divisional manager's salary is linked only to their division's ROI. The following information summarizes the financial performance of Pwani Division for the year to 31 December, 2012: 1. The "other operating expenses" for the year 2010 includes the advertisement cost of "Decra Roofing Tiles" amounting to ksh 1 million. This was introduced as a new product in the division. It is expected that the advertisement cost will generate streams of revenue from the tiles for the division for up to 5 years. 2. The capital invested as at the end of the year is the book values of the division's assets. 3. There have been no additions or disposals of the non-current assets in the Pwani division throughout this period. 4. The company uses a weighted average cost of capital of 10% to perform its investment appraisal Required: Discuss the performance of Pwani Division for each of the three years using; a) Return on investment (ROI) b) Residual income (RI) c) Dupont (ROI) d) Economic value added (EVA) Mabati Rolling Mills (MRM) Itd is a manufacturing company that has many trading divisions. Return on investment is the main measure of each division's performance. Each divisional manager's salary is linked only to their division's ROI. The following information summarizes the financial performance of Pwani Division for the year to 31 December, 2012: 1. The "other operating expenses" for the year 2010 includes the advertisement cost of "Decra Roofing Tiles" amounting to ksh 1 million. This was introduced as a new product in the division. It is expected that the advertisement cost will generate streams of revenue from the tiles for the division for up to 5 years. 2. The capital invested as at the end of the year is the book values of the division's assets. 3. There have been no additions or disposals of the non-current assets in the Pwani division throughout this period. 4. The company uses a weighted average cost of capital of 10% to perform its investment appraisal Required: Discuss the performance of Pwani Division for each of the three years using; a) Return on investment (ROI) b) Residual income (RI) c) Dupont (ROI) d) Economic value added (EVA)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started