Answered step by step

Verified Expert Solution

Question

1 Approved Answer

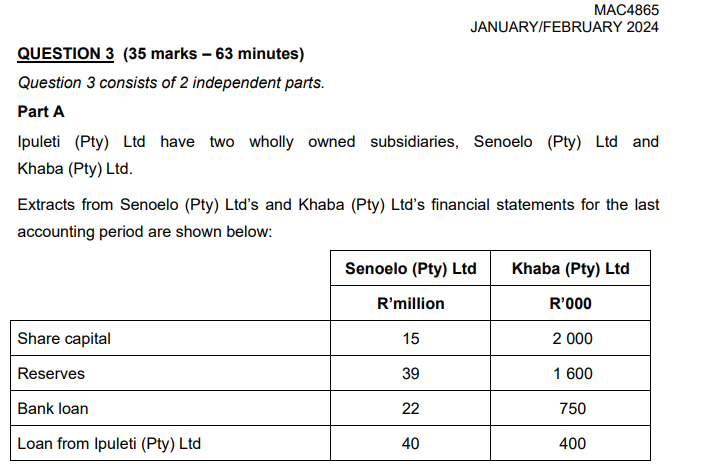

MAC4865 JANUARY/FEBRUARY 2024 QUESTION 3 (35 marks - 63 minutes) Question 3 consists of 2 independent parts. Part A Ipuleti (Pty) Ltd have two

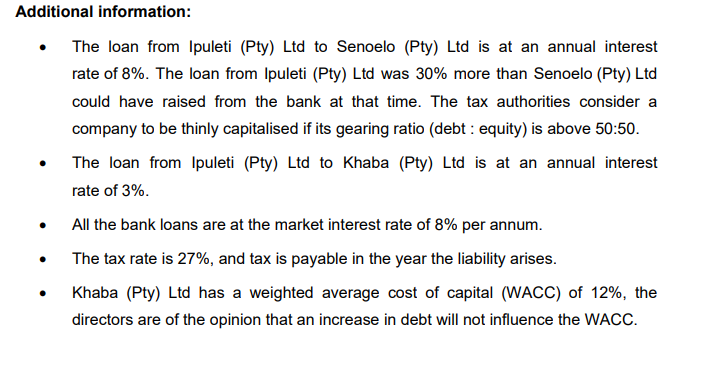

MAC4865 JANUARY/FEBRUARY 2024 QUESTION 3 (35 marks - 63 minutes) Question 3 consists of 2 independent parts. Part A Ipuleti (Pty) Ltd have two wholly owned subsidiaries, Senoelo (Pty) Ltd and Khaba (Pty) Ltd. Extracts from Senoelo (Pty) Ltd's and Khaba (Pty) Ltd's financial statements for the last accounting period are shown below: Senoelo (Pty) Ltd Khaba (Pty) Ltd R'million R'000 Share capital Reserves Bank loan 15 2 000 39 1 600 22 750 Loan from Ipuleti (Pty) Ltd 40 40 400 Additional information: The loan from Ipuleti (Pty) Ltd to Senoelo (Pty) Ltd is at an annual interest rate of 8%. The loan from Ipuleti (Pty) Ltd was 30% more than Senoelo (Pty) Ltd could have raised from the bank at that time. The tax authorities consider a company to be thinly capitalised if its gearing ratio (debt: equity) is above 50:50. The loan from Ipuleti (Pty) Ltd to Khaba (Pty) Ltd is at an annual interest rate of 3%. All the bank loans are at the market interest rate of 8% per annum. The tax rate is 27%, and tax is payable in the year the liability arises. Khaba (Pty) Ltd has a weighted average cost of capital (WACC) of 12%, the directors are of the opinion that an increase in debt will not influence the WACC. Required: 3.1 3.2 Evaluate the gearing ratio and determine if thin capitalisation rules will apply to Senoelo (Pty) Ltd. Calculate the amount of interest payable that will be allowed for tax relief relating to Senoelo (Pty) Ltd's loan from Ipuleti (Pty) Ltd. Show all calculations (4 marks) Calculate the amount of interest payable on the loan from Ipuleti (Pty) Ltd to Khaba (Pty) Ltd and calculate and comment on the adjustments to profit needed for tax purposes for both companies. Show all calculations (4 marks) 3.3 Critically discuss the statements and/or arguments made by the directors of Khaba (Pty) Ltd, per the information provided above relating to the weighted average cost of capital (WACC) (4 marks) [Part A total: 12 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started