Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mace Company acquired equipment that cost $66,000, which will be depreciated on the assumption that the equipment will last six years and have a $4,300

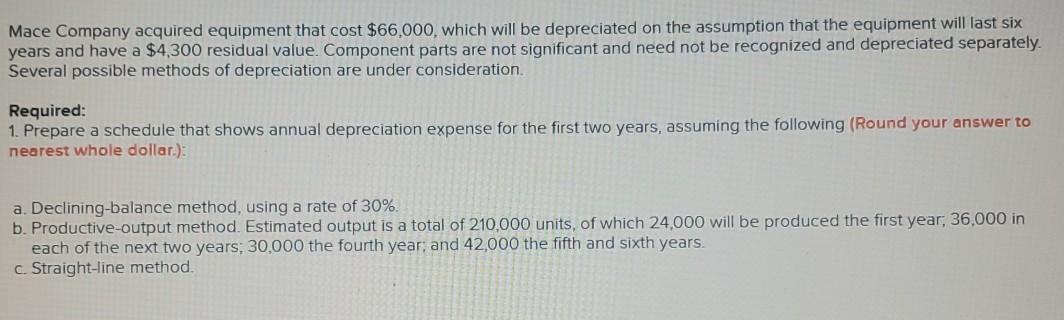

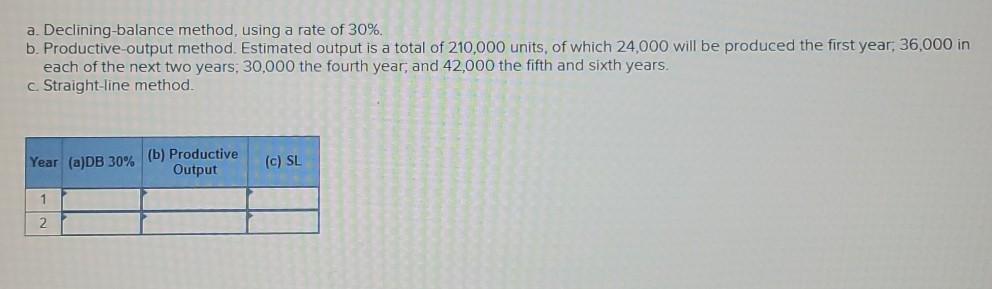

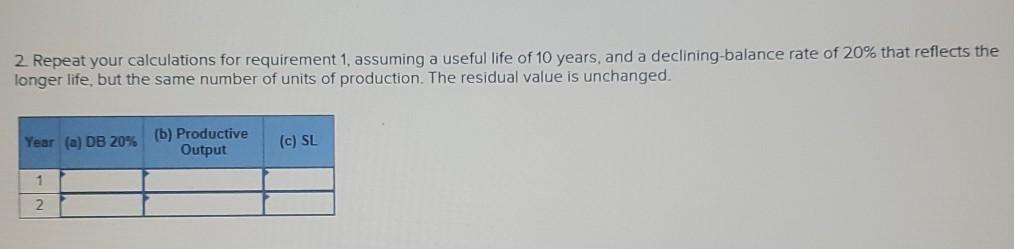

Mace Company acquired equipment that cost $66,000, which will be depreciated on the assumption that the equipment will last six years and have a $4,300 residual value. Component parts are not significant and need not be recognized and depreciated separately. Several possible methods of depreciation are under consideration Required: 1. Prepare a schedule that shows annual depreciation expense for the first two years, assuming the following (Round your answer to nearest whole dollar.): a. Declining-balance method, using a rate of 30%. b. Productive-output method. Estimated output is a total of 210,000 units, of which 24,000 will be produced the first year, 36,000 in each of the next two years: 30,000 the fourth year, and 42,000 the fifth and sixth years. c. Straight-line method. a. Declining-balance method, using a rate of 30%. b. Productive-output method. Estimated output is a total of 210,000 units, of which 24,000 will be produced the first year, 36,000 in each of the next two years: 30,000 the fourth year, and 42,000 the fifth and sixth years. c Straight-line method. Year (a)DB 30% (b) Productive (C) SL Output 1 2 2 Repeat your calculations for requirement 1, assuming a useful life of 10 years, and a declining-balance rate of 20% that reflects the longer life, but the same number of units of production. The residual value is unchanged. Year (a) DB 20% (b) Productive Output (c) SL 1 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started