Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mace Ltd is planning its capital budget for 2015 and 2016. The company's directors have reduced their of projects to five, the expected cash flows

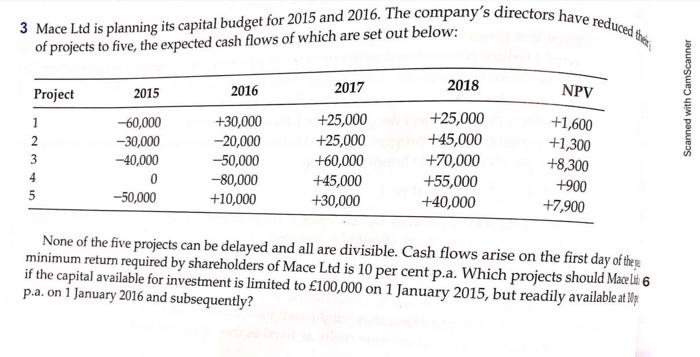

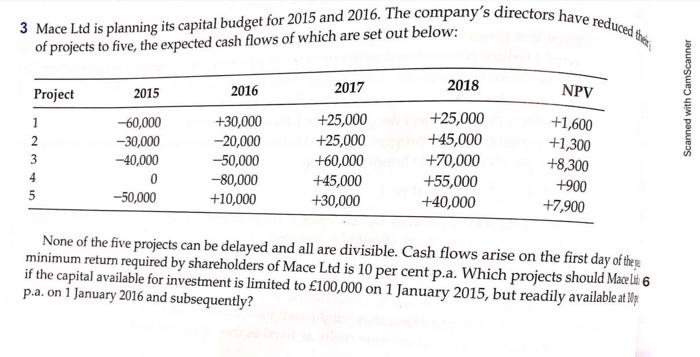

Mace Ltd is planning its capital budget for 2015 and 2016. The company's directors have reduced their of projects to five, the expected cash flows of which are set out below: 1 of 1 2018 2017 NPV 2016 2015 Project +25,000 +25,000 +1,600 +30,000 -60,000 1 +45,000 +25,000 -20,000 2 +1,300 -30,000 +70,000 +60,000 3 -40,000 -50,000 Scanned with CamScanner +8,300 4 +55,000 +45,000 0 -80,000 +900 5 -50,000 +30,000 +10,000 +40,000 +7,900 None of the five projects can be delayed and all are divisible. Cash flows arise on the first day of the ye minimum return required by shareholders of Mace Ltd is 10 per cent p.a. Which projects should MaceL6 if the capital available for investment is limited to 100,000 on 1 January 2015, but readily available at 10 p.a. on 1 January 2016 and subsequently

3 Mace Ltd is planning its capital budget for 2015 and 2016. The company's directors have reduced the of projects to five, the expected cash flows of which are set out below: 2017 2018 2016 NPV Project 2015 +25,000 -60,000 +25,000 1 +30,000 +1,600 2 -30,000 -20,000 +25,000 +45,000 +1,300 -40,000 -50,000 +60,000 +70,000 +8,300 4 0 -80,000 +45,000 +55,000 +900 5 -50,000 +10,000 +30,000 +40,000 +7,900 None of the five projects can be delayed and all are divisible. Cash flows arise on the first day of the re minimum return required by shareholders of Mace Ltd is 10 per cent p.a. Which projects should Maceliti 6 if the capital available for investment is limited to 100,000 on 1 January 2015, but readily available at My p.a. on 1 January 2016 and subsequently? 23 Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started