Answered step by step

Verified Expert Solution

Question

1 Approved Answer

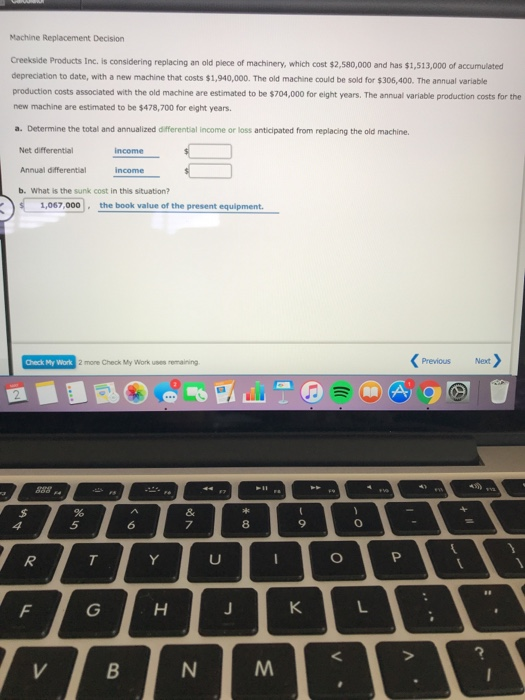

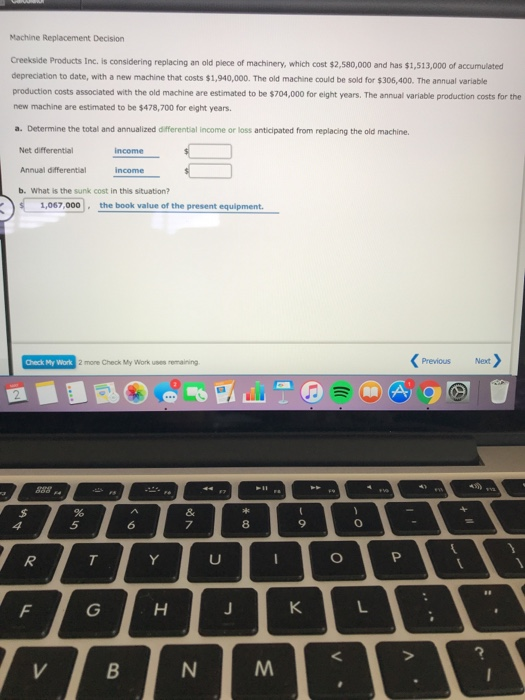

Machine Replacement Decision Machine Replacement Decision Creekside Products Inc. is considering replacing an old plece of machinery, which cost $2,580,000 and has $1,513,000 of accumulated

Machine Replacement Decision

Machine Replacement Decision Creekside Products Inc. is considering replacing an old plece of machinery, which cost $2,580,000 and has $1,513,000 of accumulated depreciation to date, with a new machine that costs $1,940,000. The old machine could be sold for $306,400. The annual variable production costs associated with the old machine are estimated to be $704,000 for eight years. The annual variable production costs for the new machine are estimated to be $478,700 for eight years a. Determine the total and annualized differential income or loss anticipated from replacing the old machine. Net differential Annual dfferential b. What is the sunk cost in this situation? $ 1,067,000 the book value of the present equipment. Previous Next Check My Work 2 more Check My Work uses remaining 8a8 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started