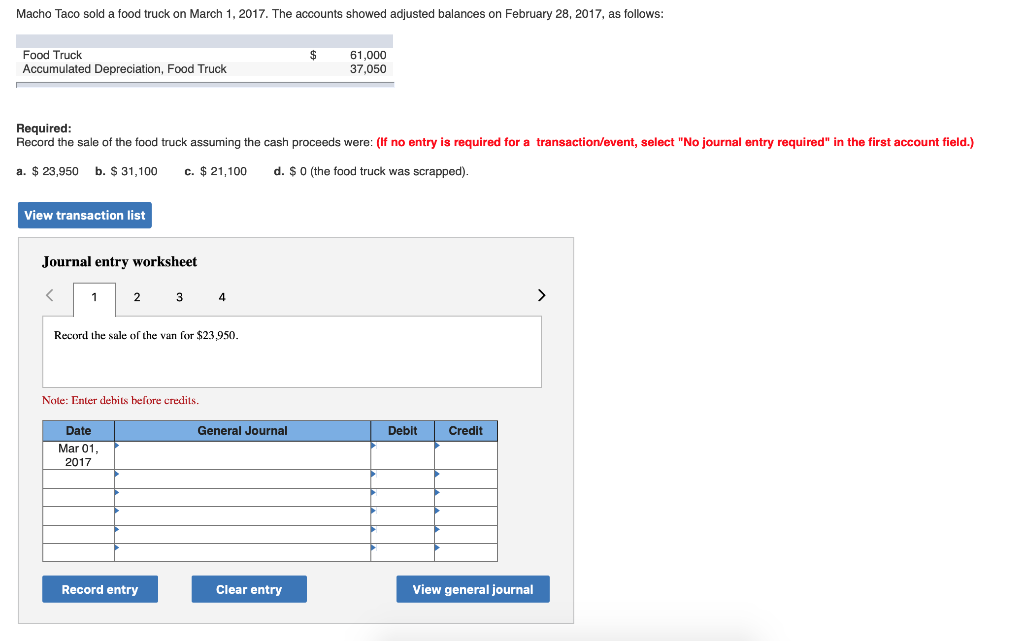

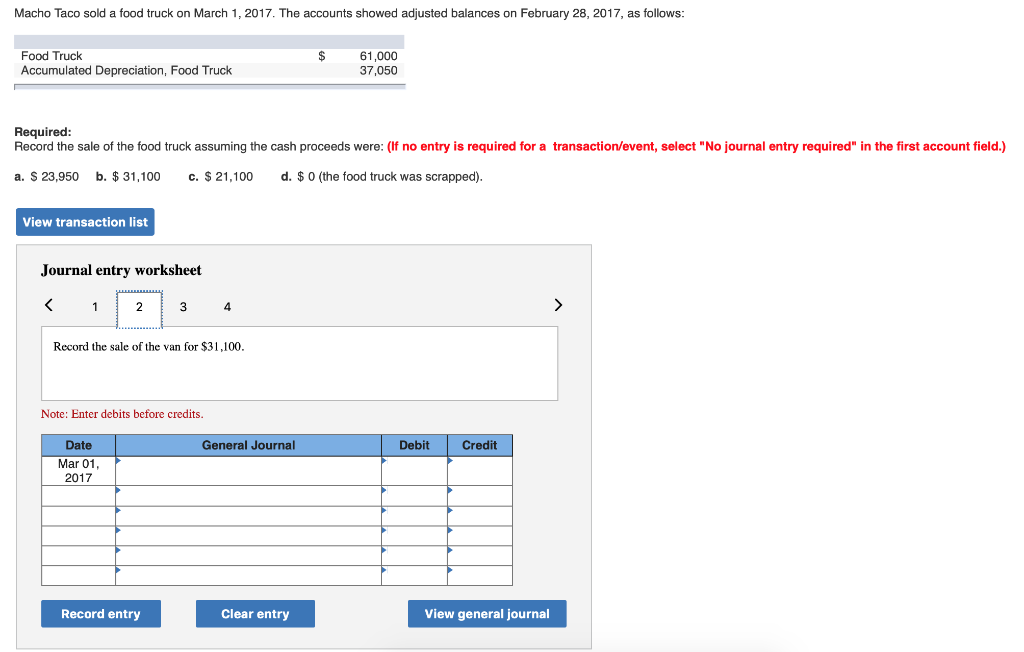

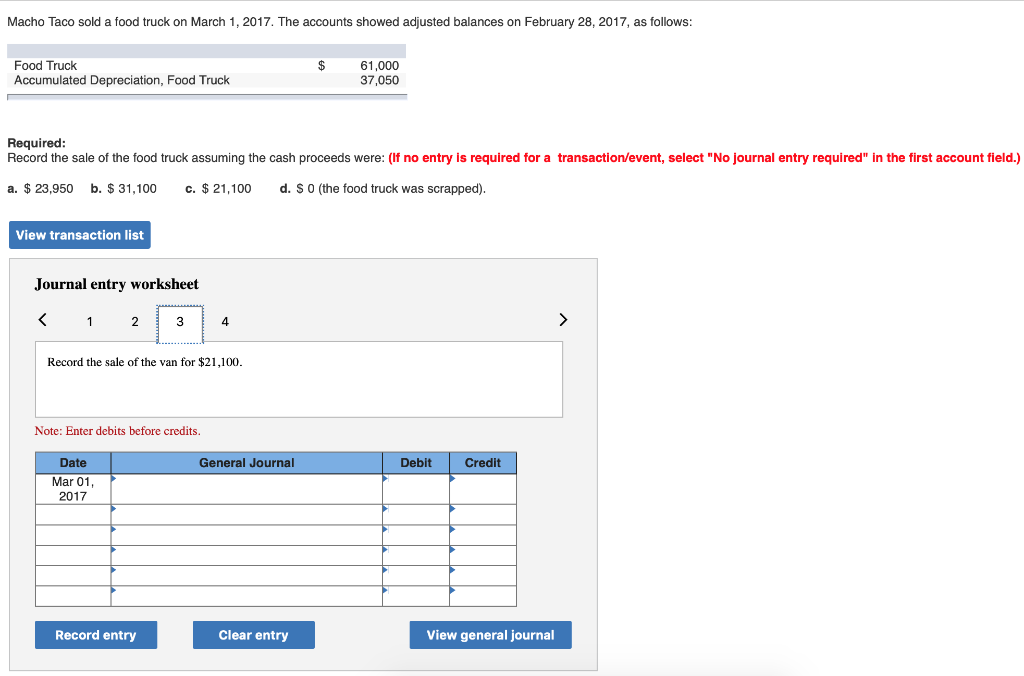

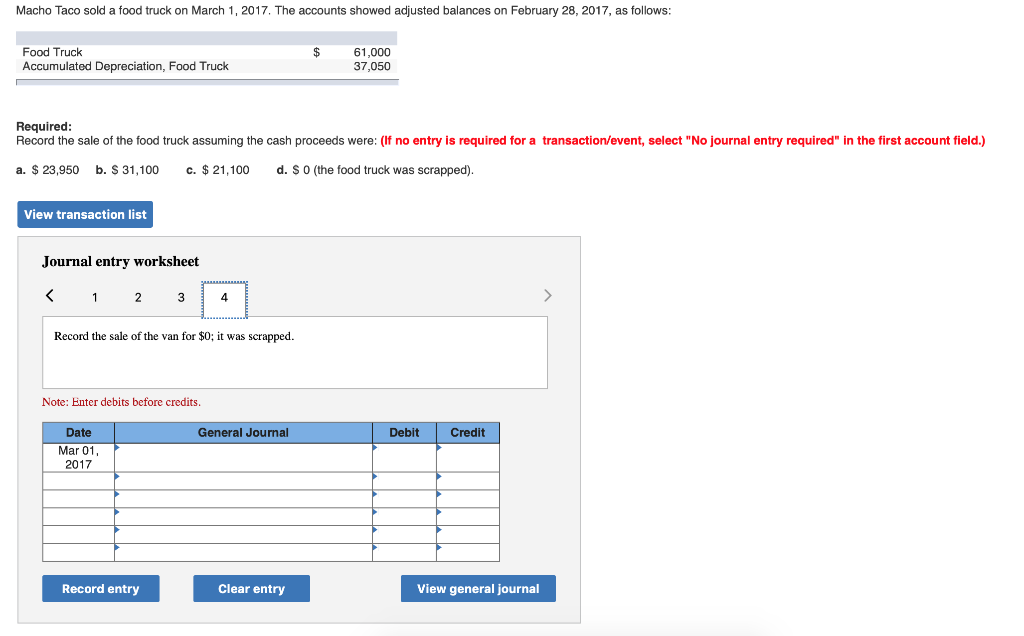

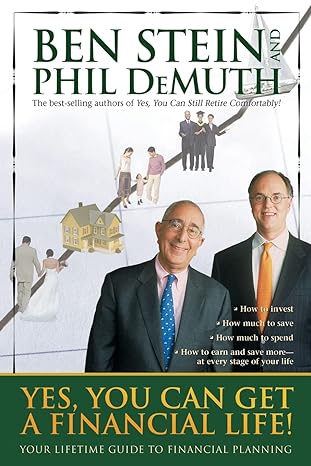

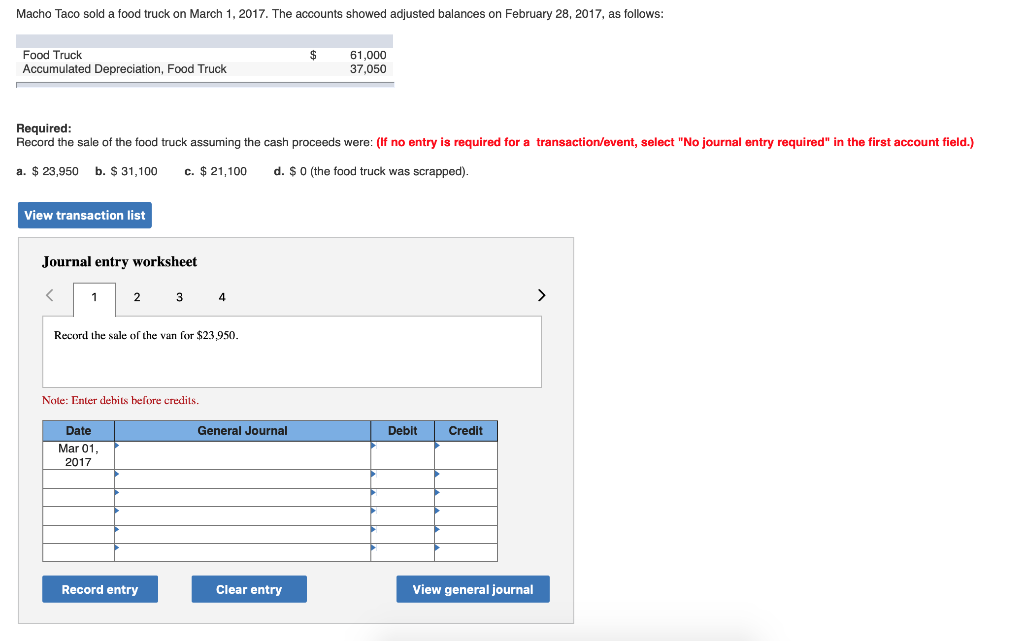

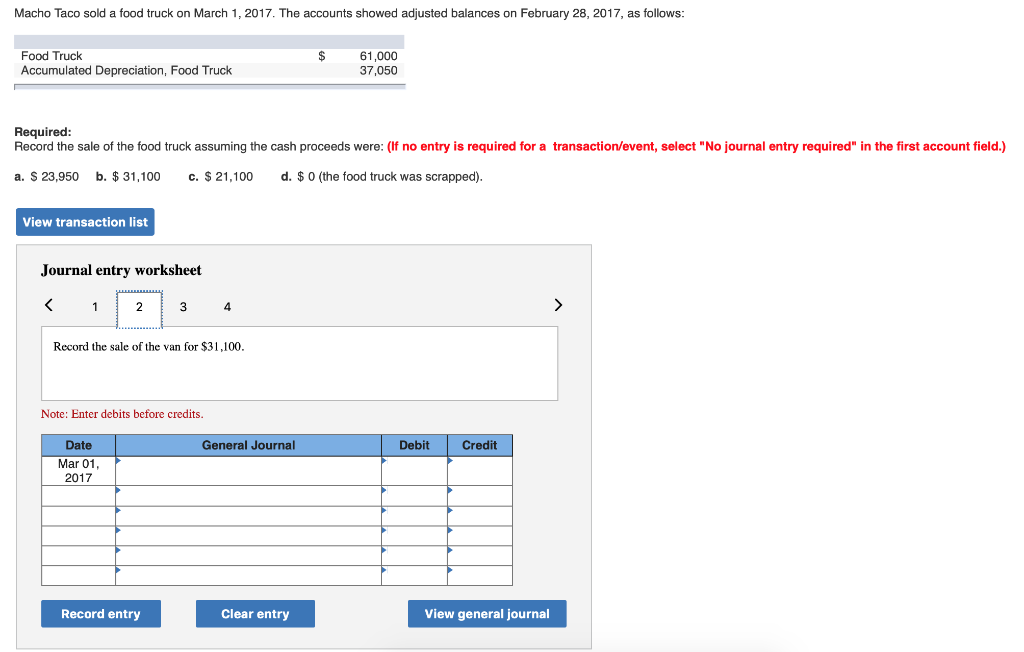

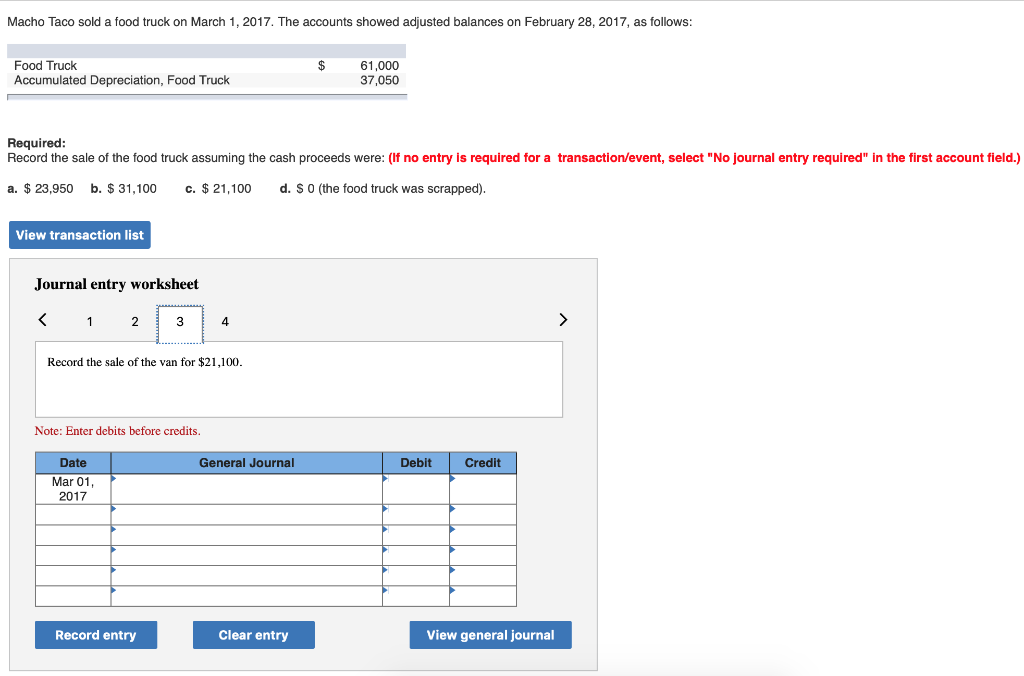

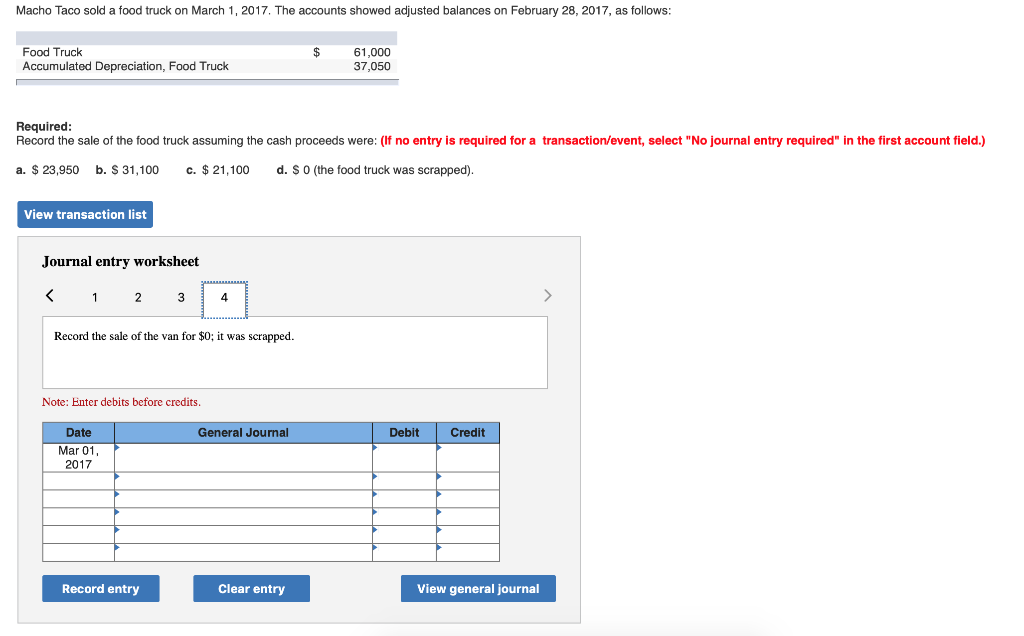

Macho Taco sold a food truck on March 1, 2017. The accounts showed adjusted balances on February 28, 2017, as follows: Food Truck Accumulated Depreciation, Food Truck 61,000 37,050 Required: Record the sale of the food truck assuming the cash proceeds were: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) d. $ 0 (the food truck was scrapped). a. b. $ 31,100 c. $ 21,100 23,950 View transaction list Journal entry worksheet 1 2 3 4 Record the sale of the van for $23.950 Note: Enter dehits before credits Date General Journal Debit Credit Mar 01 2017 View general journal Record entry Clear entry Macho Taco sold a food truck on March 1, 2017. The accounts showed adjusted balances on February 28, 2017, as follows: Food Truck Accumulated Depreciation, Food Truck 61,000 37,050 Required: Record the sale of the food truck assuming the cash proceeds were: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) d. 0 (the food truck was scrapped) b. $31,100 c. 21,100 23,950 a. View transaction list Journal entry worksheet 1 2 3 4 Record the sale of the van for $31.100 Note: Enter debits before credits. Date General Journal Debit Credit Mar 01, 2017 Record entry Clear entry View general journal Macho Taco sold a food truck on March 1, 2017. The accounts showed adjusted balances on February 28, 2017, as follows: Food Truck Accumulated Depreciation, Food Truck 7,050 Required: Record the sale of the food truck assuming the cash proceeds were: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) d. S 0 (the food truck was scrapped). a. $ 23,950 b. 31,100 c. $ 21,100 View transaction list Journal entry worksheet 1 2 3 Record the sale of the van for $21,100. Note: Enter debits before credits Date Gene urnal Credit Mar 01, 2017 Record entry Clear entry View general journal Macho Taco sold a food truck on March 1, 2017. The accounts showed adjusted balances on February 28, 2017, as follows: Food Truck 61,000 37,050 Accumulated Depreciation, Food Truck Required: Record the sale of the food truck assuming the cash proceeds were: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) c. 21,100 d. S 0 (the food truck was scrapped). a. $ 23,950 b. $ 31,100 View transaction list Journal entry worksheet 2 3 Record the sale of the van for $0; it was scrapped. Note: Enter debits before credits. Debit Credit Date General Journal M 2017 Record entry Clear entry View general journal