Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Macho Tool Company is going public at $43 net per share to the company. There also are founding shareholders that are selling part of their

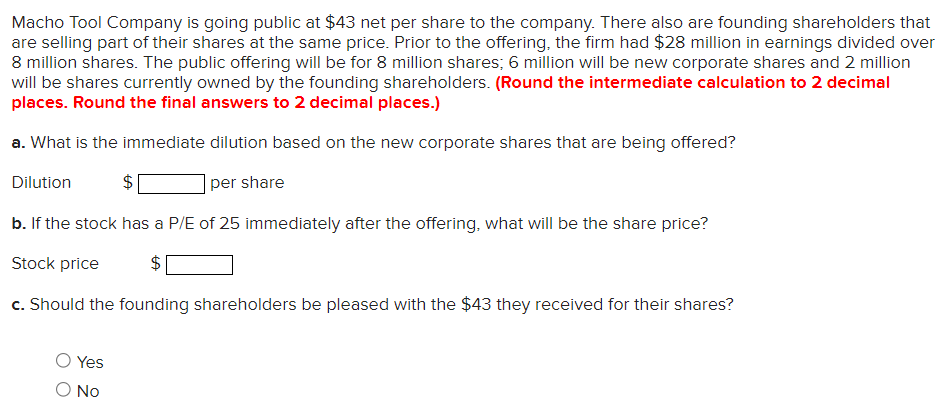

Macho Tool Company is going public at $43 net per share to the company. There also are founding shareholders that are selling part of their shares at the same price. Prior to the offering, the firm had $28 million in earnings divided over 8 million shares. The public offering will be for 8 million shares; 6 million will be new corporate shares and 2 million will be shares currently owned by the founding shareholders. (Round the intermediate calculation to 2 decimal places. Round the final answers to 2 decimal places.) a. What is the immediate dilution based on the new corporate shares that are being offered? Dilution $ per share b. If the stock has a P/E of 25 immediately after the offering, what will be the share price? Stock price $ c. Should the founding shareholders be pleased with the $43 they received for their shares? Yes No

Macho Tool Company is going public at $43 net per share to the company. There also are founding shareholders that are selling part of their shares at the same price. Prior to the offering, the firm had $28 million in earnings divided over 8 million shares. The public offering will be for 8 million shares; 6 million will be new corporate shares and 2 million will be shares currently owned by the founding shareholders. (Round the intermediate calculation to 2 decimal places. Round the final answers to 2 decimal places.) a. What is the immediate dilution based on the new corporate shares that are being offered? Dilution $ per share b. If the stock has a P/E of 25 immediately after the offering, what will be the share price? Stock price $ c. Should the founding shareholders be pleased with the $43 they received for their shares? Yes No Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started