Answered step by step

Verified Expert Solution

Question

1 Approved Answer

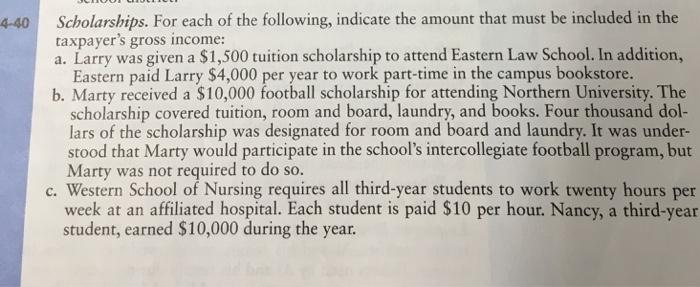

4-40 Scholarships. For each of the following, indicate the amount that must be included in the taxpayer's gross income: a. Larry was given a

4-40 Scholarships. For each of the following, indicate the amount that must be included in the taxpayer's gross income: a. Larry was given a $1,500 tuition scholarship to attend Eastern Law School. In addition, Eastern paid Larry $4,000 per year to work part-time in the campus bookstore. b. Marty received a $10,000 football scholarship for attending Northern University. The scholarship covered tuition, room and board, laundry, and books. Four thousand dol- lars of the scholarship was designated for room and board and laundry. It was under- stood that Marty would participate in the school's intercollegiate football program, but Marty was not required to do so. c. Western School of Nursing requires all third-year students to work twenty hours per week at an affiliated hospital. Each student is paid $10 per hour. Nancy, a third-year student, earned $10,000 during the year.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution a The amount that must be included in the tax payers gross income is 4000 Explanation The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started