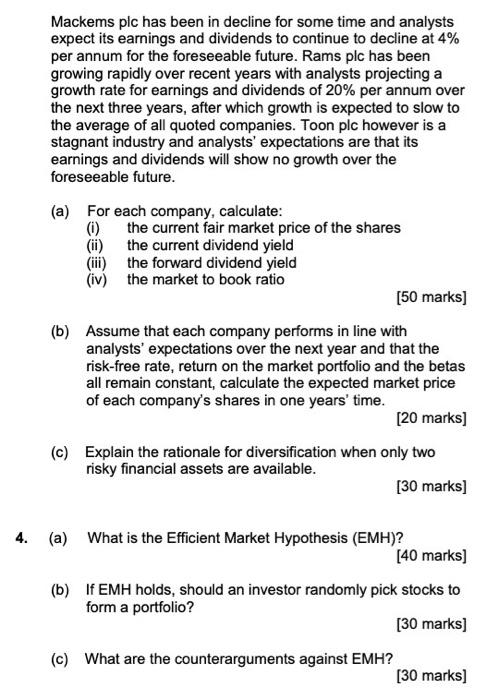

Mackems plc has been in decline for some time and analysts expect its earnings and dividends to continue to decline at 4% per annum for the foreseeable future. Rams plc has been growing rapidly over recent years with analysts projecting a growth rate for earnings and dividends of 20% per annum over the next three years, after which growth is expected to slow to the average of all quoted companies. Toon pic however is a stagnant industry and analysts' expectations are that its earnings and dividends will show no growth over the foreseeable future. (a) For each company, calculate: (1) the current fair market price of the shares (ii) the current dividend yield (ii) the forward dividend yield (iv) the market to book ratio [50 marks] (b) Assume that each company performs in line with analysts' expectations over the next year and that the risk-free rate, return on the market portfolio and the betas all remain constant, calculate the expected market price of each company's shares in one years' time. [20 marks) (c) Explain the rationale for diversification when only two risky financial assets are available. [30 marks) 4. (a) What is the Efficient Market Hypothesis (EMH)? [40 marks) (b) If EMH holds, should an investor randomly pick stocks to form a portfolio? [30 marks) (c) What are the counterarguments against EMH? [30 marks) Mackems plc has been in decline for some time and analysts expect its earnings and dividends to continue to decline at 4% per annum for the foreseeable future. Rams plc has been growing rapidly over recent years with analysts projecting a growth rate for earnings and dividends of 20% per annum over the next three years, after which growth is expected to slow to the average of all quoted companies. Toon pic however is a stagnant industry and analysts' expectations are that its earnings and dividends will show no growth over the foreseeable future. (a) For each company, calculate: (1) the current fair market price of the shares (ii) the current dividend yield (ii) the forward dividend yield (iv) the market to book ratio [50 marks] (b) Assume that each company performs in line with analysts' expectations over the next year and that the risk-free rate, return on the market portfolio and the betas all remain constant, calculate the expected market price of each company's shares in one years' time. [20 marks) (c) Explain the rationale for diversification when only two risky financial assets are available. [30 marks) 4. (a) What is the Efficient Market Hypothesis (EMH)? [40 marks) (b) If EMH holds, should an investor randomly pick stocks to form a portfolio? [30 marks) (c) What are the counterarguments against EMH? [30 marks)