Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Macquarium Inc. provides compiler-related services to its clients. Its two primary services are a pts to cam a 20 percent annual return on the assets

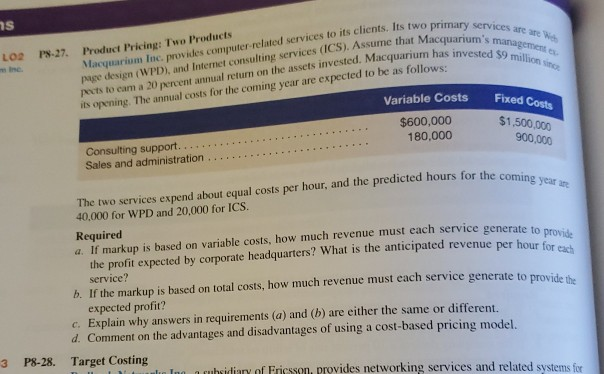

Macquarium Inc. provides compiler-related services to its clients. Its two primary services are a pts to cam a 20 percent annual return on the assets invested. Macquarium has invested $9 million page design (WPD), and Internet consulting services (ICS). Assume that Macquarium's management Product Pricing: Two Products its opening. The annual costs for the coming year are expected to be as follows: Fixed Costs $1,500,000 900,000 The two services expend about equal costs per hour, and the predicted hours for the coming year LOR PS-27. Variable Costs $600,000 Consulting support... 180,000 Sales and administration 40,000 for WPD and 20,000 for ICS. Required a. If markup is based on variable costs, how much revenue must each service generate to provide the profit expected by corporate headquarters? What is the anticipated revenue per hour for et b. If the markup is based on total costs, how much revenue must each service generate to provide the expected profit? c. Explain why answers in requirements (a) and (b) are either the same or different. d. Comment on the advantages and disadvantages of using a cost-based pricing model. P8-28. Target Costing subsidiary of Fricsson, provides networking services and related systems for 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started