Question

Macrinez Company assembled the following information in completing its July bank reconciliation: balance per bank $22,920; outstanding checks $4,650; deposits in transit $7,500; NSF

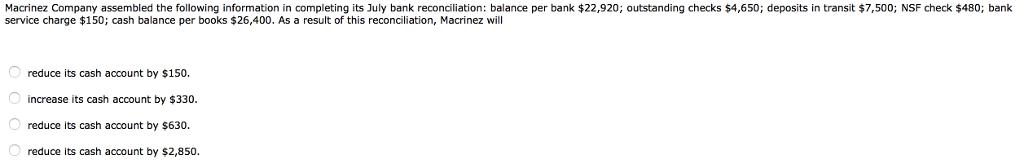

Macrinez Company assembled the following information in completing its July bank reconciliation: balance per bank $22,920; outstanding checks $4,650; deposits in transit $7,500; NSF check $480; bank service charge $150; cash balance per books $26,400. As a result of this reconciliation, Macrinez will O reduce its cash account by $150. O increase its cash account by $330. O reduce its cash account by $630. O reduce its cash account by $2,850.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Unadjusted Balance as per bank 22920 Add Deposit in transit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App