Question

Macro Company owns five machines that it uses in its manufacturing operations. Each of the machines was purchased four years ago at a cost of

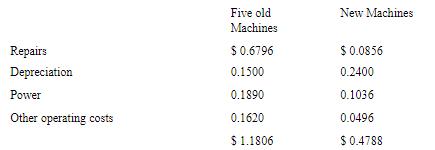

Macro Company owns five machines that it uses in its manufacturing operations. Each of the machines was purchased four years ago at a cost of $120,000. Each machine has an estimated life of 10 years with no expected salvage value. A new machine has become available. One new machine has the same productive capacity as the five old machines combined; it can produce 800,000 units each year. The new machine will cost $648,000, is estimated to last six years, and will have a salvage value of $72,000. A trade-in allowance of $24,000 is available for each of the old machines. These are the operating costs per unit:

Ignore federal income taxes. Use the payback period method for (a) and (b).

a. Do you recommend replacing the old machines? Support your answer with computations. Disregard all factors except those reflected in the data just given.

b. If the old machines were already fully depreciated, would your answer be different? Why?

c. Using the net present value method with a discount rate of 20%, present a schedule showing whether or not the new machine should be acquired.

Repairs Depreciation Power Other operating costs Five old Machines $ 0.6796 0.1500 0.1890 0.1620 $ 1.1806 New Machines $ 0.0856 0.2400 0.1036 0.0496 $ 0.4788

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

2 D TL Initial A S 6 Year 1 2 3 old Savings In machines Outflow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started